CaptainFIs financial and personal update for Quarter 3, 2022

OK so its been six months since I wrote a net wealth update, so I figure I will have a crack at a ‘post FIRE’ update. I plan to write these every 3 months as quarterly updates on the portfolio and what I have been up to in my Early Retirement!

Key takeaways;

- Six months of FIRE, 12 months of not flying.

- Have been in ‘Resting / Healing mode’ – focusing on physical and mental health, and time with family.

- Not tracking Net Wealth figure anymore.

- My dog Angel passed away.

- We got a puppy.

- I met a partner, and we did some traveling to NSW and QLD, as well as within SA.

- Have moved in with my Mum to be here full-time carer (is this a full-time unpaid job? Yes – I Think it is!)

- FIRE ETF portfolio tips $800K.

- Investment property completed ($190K equity) and ready to be tenanted.

- The website portfolio goes gangbusters, producing more revenue than I used to earn flying with a whopping $1M valuation. I decide to sell some of the websites to focus on my core 7 websites.

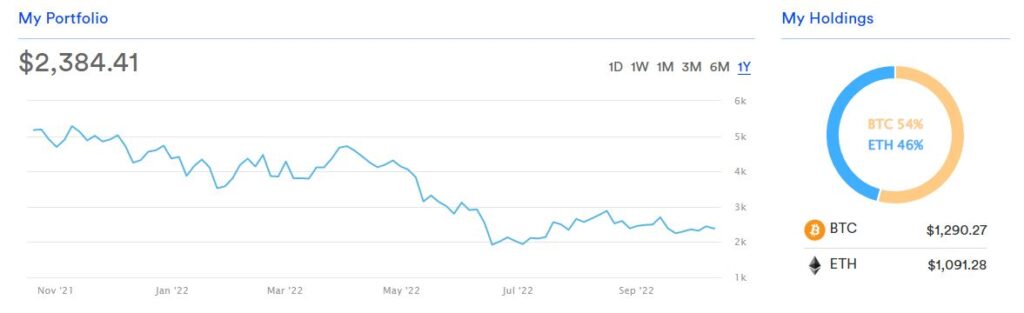

- Cryptocurrency portfolio slumps to a 60% loss.

- Angel investment in Pearler grows (but I don’t know exactly how much).

- I get down to my last $100 in cash and vow to bring my cash buffer back up to $30K… OOPS!

Read the full article below

Captain FI is not a financial advisor, does not hold an AFSL and this article is not financial advice. This website is reader-supported, which means we may be paid when you visit links to partner or featured sites, or by advertising on the site. For more information please read my Privacy Policy, Terms of Use, and Financial Disclaimer

CaptainFI personal update

First up, the obvious elephant in the room is I am no longer working or flying full-time. I actually haven’t flown an aircraft for over a year because I took so much leave at the end of my career – a combination of just feeling totally burnt out plus having extreme family health emergencies I needed to attend to. I haven’t bothered to stay current, but I will eventually do a flight review and sort out my medical situation so I can get back into the air. I’d love to take friends for joyrides, and potentially get back into instructing.

Well, those six months of Early Retirement have just flown by! I am shifting away from a ‘Net worth update’ style of quarterly update – partly because the numbers are irrelevant now, and partly because I have been working on decoupling the idea that net wealth = self worth. This has been to help reduce some of my worries about money. So I will no longer be tallying my total investments against liabilities to produce a net wealth figure. More on this further down.

I spent the first 5 months of my retirement just kind of, not really doing much at all! I think I was de-stressing from all the chronic stress and anxiety I had built up over my career.

I saw a surgeon and got my chronic neck and back pain looked at (whiplash events and general wear and tear from flying) and started a proper regime with a physiotherapist to strengthen these areas, and even saw a podiatrist and got some orthotics (it’s all interconnected somehow). Coupled with both parents having terminal cancer, I have had very little brain space for productivity or writing or podcasting. It has been both a relief and challenging to talk to a psychologist about this, which ultimately led to a very healing and transformational experience with the use of psychedelics (psilocybin)

One of my breakthrough moments during my journey was decoupling my self worth from my net wealth, and relaxing when it comes to finances. I discovered that whilst personal finances are important, it is not everything and it was starting to occupy far too much of my consciousness. I have a great foundation and self discipline, and I needed to trust my instincts and let go of using finance to regain a sense of control over my life. Whilst debriefing with the psych, we discussed that it would be helpful to stop keeping close tabs on my finances – to stop calculating a net wealth figure, and to spend freely (but responsibly) on my family things I enjoy such as nice food.

I met an amazing girl about 6 months ago, who I am now very lucky to be able to call my girlfriend. We spent a lot of time getting to know each other and hanging out with my best mate Angel in my city penthouse garden, as well as getting to know the newest addition to our family – Baby ‘Soot’ the English Cockerspaniel.

Unfortunately, Angel got really sick. She began limping which I assumed was arthritis from old age as she was ten and a half years old. Our awesome vet hooked us up with some Metacam pain relief and anti-inflammatories. It initially helped, but after a week she worsened. I took her in for scans, which revealed an osteosarcoma in her leg. I can’t believe how quickly cancer took her. Within two weeks from the initial diagnosis, she had told me she was ready.

She died peacefully in my arms at home, cuddled together in her favorite warm spot on the balcony, thanks to the grace of Peaceful Paws.

She is buried at ‘Angels Rest’, on top of a huge hill in the Adelaide foothills. Over the next few months I plan to build a small sign, table, chairs, small water tank and dog bowl as a memorial to her. It will be great for when I take Soot walking up there, as well as for hikers to be able to rest and catch their breath with an amazing view.

After Angel passed, my girlfriend and I went on a bit of a holiday up to NSW and QLD (Sydney to Brisbane), to just get out of the apartment and for a change of scenery. We flew across from Adelaide and rented a Jucy camper van, as we wanted to visit lots of friends on the road, and also test out a bit of Van life. So it was much cheaper than renting a car and then paying for accomodation seperately. Plus, we were doing research for our travel blog, writing articles about Van Life and reviewing Jucy which made it a cheeky business expense. We mainly explored the mountains and hinterland, avoiding well built up areas (except we did stop into the Gold Coast as my gf hadn’t been there before).

We took a cruise out to Moreton island and spend some time at Tangalooma resort (Which was pretty cool). We got to do Whale and Dolphin watching, snorkle at ship wrecks, and drink cocktails on the beach. They also had Parasailing, Kayaking, Helicopter rides, Quad biking, Massage places and more. They were also filming a movie on the beach which was pretty interesting to see, they had huge sets, cameras and cranes in place on the beach (someone said it was filming for King Kong), and there were hundreds of staff and extras all ferreting around dressed in all black looking seriously under the pump walking around very fast. I did chuckle a bit thinking I didn’t have a timeline or a boss to answer to and felt a bit sorry for them!

We loved the experience so much that we ended up buying a rooftop tent, a car fridge, a dual battery set up with an inverter and a solar panel. We have gone on a few weekend camping getaways and are enjoying the freedom that we can go anywhere, and that we don’t have to pay for accommodation. We are planning a round Australia trip in 2023 and currently contemplating whether we upgrade the Foresters suspension, or bite the bullet and swap it out for something like a Prado or a Pajero which has a bit more range, space and clearance.

After we got back from our holiday, my Mum asked me to move in with her. As many of you will know, my Mum is very special to me, and she has been fighting a battle with ovarian cancer that has unfortunately metastasized and progressed to be terminal. As cancer spreads, she can progressively do less and less, so I have assumed a full-time caring role for her. It’s very important to me that someone is looking after her well-being, and is there to advocate for her, manage her medications and run the household (shopping, cooking, cleaning, gardening, looking after the dog etc). Unfortunately, both of my siblings have kids already, so being the only childless one it has fallen to me. It was a shame to move out of the apartment in the city, but it was the right thing to do.

We are working closely with the palliative care team who have been very helpfull, and are hoping to have an NDIS assessment done so that we can get a little help around running the household.

I applied for Carers Allowance through Centrelink, which so far has taken about 3 full days of time paperwork and admin chasing things around. It is definitley not very user friendly and the system is deliberately hostile to make you not use it. I am not eligible for carers payment due to the share portfolio (it is asset tested), but I am eligible for carers allowance as it is income tested (you must earn below $250,000). Whilst the $144 per fortnight definitely helps, the main reason we were told to apply for it is the 61 days of respite care that you become eligible for. This means that my partner and I may be able to get away for a weekend and not have to worry about Mum not getting looked after as she can get an in home carer to come and stay the night to keep an eye on her and look after things.

Well, I am sure I have missed out heaps of things, so if you want to see more of my day-to-day life, click on any of the links below to follow me on your preferred social media platform. I am pretty active on posting, and I try to answer peoples messages and emails where I can. I am also quite active on the facebook groups if you cant get me through email or message.

Captain FI’s Investments

My investments (outside super) are split between a few different areas. I’m not going to include my super since I can’t access them for a long time (but I discuss them in my transition to retirement article), so for these updates I just focus on the ones I have the most control over;

- FIRE Portfolio’ (Global, US and AUS Index fund ETFs)

- Real Estate (Investment property)

- Website Portfolio (Online businesses)

- Angel Investing

- Cryptocurrency

Since March, I have divested in the RoboAdvisors and Managed fund, and rolled that money into my property development as we had some unforeseen expenses to get us over the line.

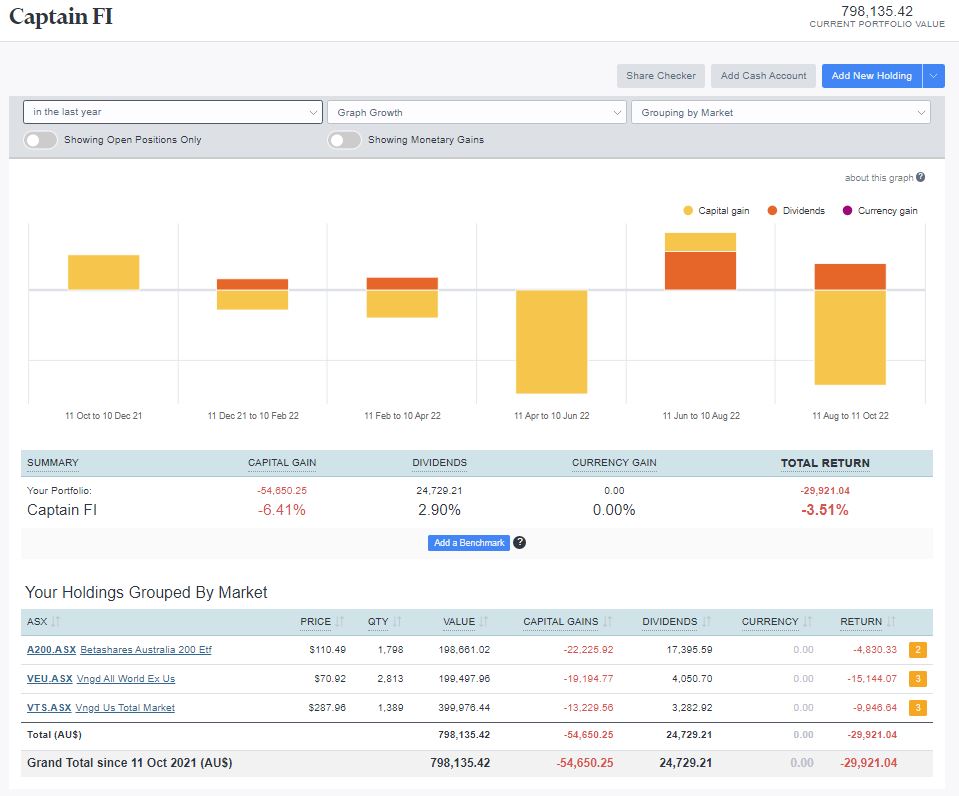

‘FIRE’ Portfolio (Exchange Traded Index Funds)

My Financial Independence Retire Early ETF Portfolio is a simple, low-fee passive portfolio split between three index-tracking Exchanged Traded Index Funds (ETFs)

- I now have this portfolio fully automated through Pearler – the Financial Independence long term investing platform.

- I track my share portfolio using Sharesight, which means my accounting is also completely hands free using the Pearler API plugin.

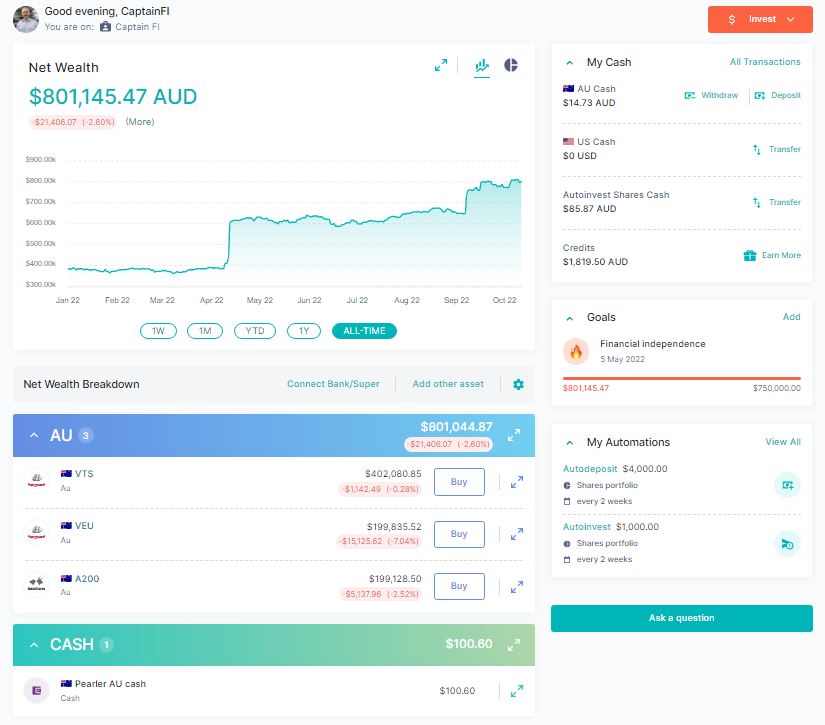

Pearler Dashboard

The Pearler dashboard shows the value of the portfolio tipped over $800,000 recently to reach an all time high. The graph does show there has been volatility in the market, and the sudden jumps indicate when I have made lump sum investments into the portfolio recently (1 x $100,000 and 2 x $50,000) from consolidating my investments as well as distributions from my website portfolio.

The rolling 12 month performance shows the FIRE portfolio is down in total return by 3.5% this year. Hopefully it recovers a bit over the next quarter.

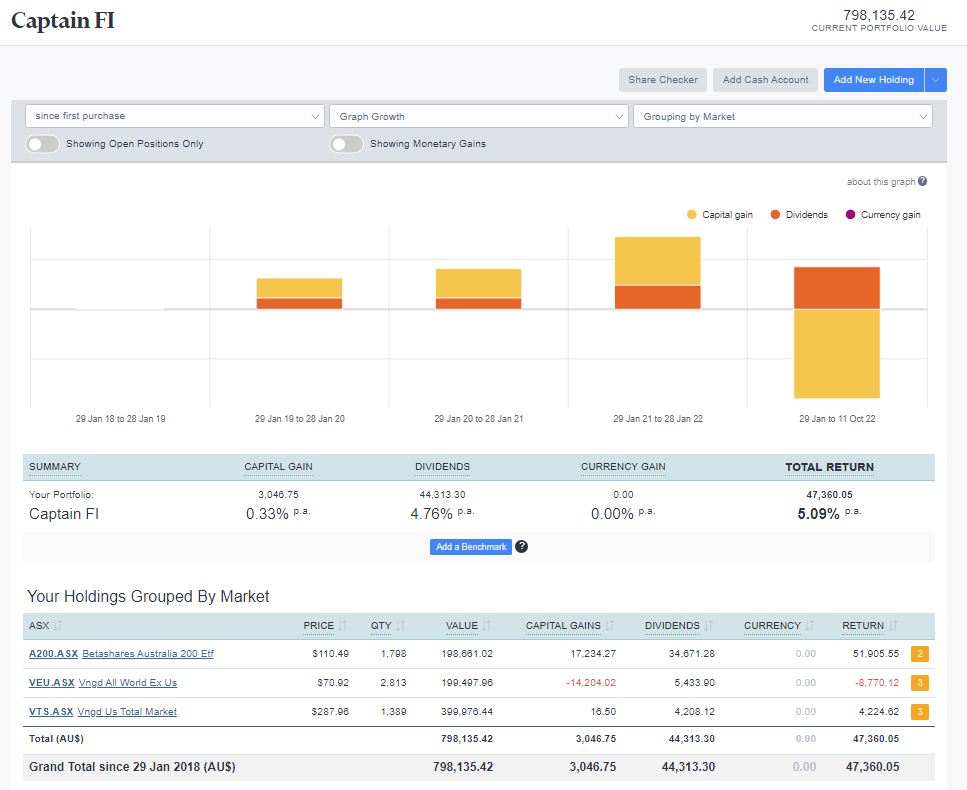

Total long-term performance sitting at 5.1% p.a. Some big capital losses in 2022 so far (around 8%) offset by growth in previous years as well as dividend returns, so overall not a bad spot to be in. If the shares do go up to record highs again, I will likely harvest some towards paying for a hobby farm.

Investment property

I have built a duplex as a joint venture development with a close friend. It is a small dwelling, approximately 10km from a major East Coast city.

- Property estimated Value = $560,000

- Mortgage outstanding = $370,000

- Mortgage terms = 30 years @ 4% Variable (Principle + Interest)

- Rental income = $575 per week

- Holding costs = $535 per week (Mortgage repayments $410, property maintenance $40, other costs $85)

- Cash flow = +$40 per week (Cash flow positive – for now!)

The project is finally finished (almost) and we will be ready to move a tenant into each dwelling shortly. Unfortunately, it’s gone on a little late with delays due to COVID and a shoddy builder which has well and truly eaten into the profit margin, but it is still not a total loss and it will still be a good little investment and provide a bit of cash flow.

I was quite disappointed in the builders at the state of the property when they tried to hand it over – many aspects were not up to code, and the property was very messy with builders’ rubbish and debris. I was very glad we had a property inspector who wrote a very scathing report which we took to the project manager and mortgage broker to have rectified.

I’m still going off the bank’s original valuation of $560K – there was apparently a property ‘boom’ and ‘bust’ over the time we were building (with one upper estimate of $650K), so it will be interesting to see what the new valuation will be on completion. With a mortgage of $370K, this leaves me with about $190K of planned equity in the build, meaning we have made about $60k of ‘manufactured equity’ with an investment of $130K over 3.5 years (not all of the cash was required upfront). This is an approximate projected annualized return of about 11% – which has significantly outperformed my shares over this time period.

Because the delays have been over 12 months from the original schedule, they have cost me in excess of $30,000 worth of lost rental income. Thankfully we had withheld some of the progress payments until milestones had been completed, which meant the bank was not charging us the total level of interest applicable on the full $370K, which did help to offset some of the losses.

I have been very grateful to my close friends who have handled a lot of the contract admin and negotiations – thankfully this is not their first development so they know what they are doing (I am just along for the ride, so to speak!).

Online Business (website portfolio)

I run a small online business which is a website portfolio of 18 content sites that make money from display Advertising through managed ad networks such as Adsense, Ezoic and Mediavine, and affiliate programs such as Amazon Associates and other direct affiliate deals.

I think I ‘bit off more than I can chew’ given my current family situation by launching the most recent 12, but I am thankful they don’t really take that much time at all and I can effectively outsource pretty much the whole content plan and management of staff and contractors to my ops manager. I enjoy doing a bit of SEO in terms of keyword research, market analysis and article optimization, but outsource the ‘heavy lifting’ and some of the more repetitive tasks.

I very much enjoy writing and podcasting for CaptainFI.com and my specialist pilot site though and don’t see that changing any time soon.

Overall, the portfolio of websites now produces more revenue than I used to earn in my full-time job, and I am choosing to reinvest nearly all of this into growing the size and traffic of the website by producing large amounts of quality, engaging content that has been KW researched and SEO optimized. Conservatively, the website portfolio was recently valued at just shy of a cool one Million, which absolutely amazed me. I had not really thought about the possibility of ‘selling out’ before, but have decided to sell off some of the smaller sites to provide additional revenue and improve cash flow and profits.

I learned these skills through the eBusiness institute over the past 4 years – I have done a pretty comprehensive review of the eBusiness institute as well as interviewed Matt and Liz Raad about this on the podcast about online business and websites if you want to learn more about this lucrative side hustle. They provide a free introductory course for CaptainFI readers. I have also recently interviewed Liz Raad again on the pod about entrepreneurship, which is live now, and have recorded a recent update with Matt which will be published shortly.

I have decided to scale back and sell some of the ones I have built up over the past few years, and just keep my ‘core sites’ (instead of running 20!). This is because it’s difficult to do the required networking and to give each site the attention they deserve when you have a very large portfolio of sites, and I need to focus on caring for my Mum as the priority.

As a result I have a few sites I am open to selling to anyone who wants to get started with this side hustle with their first starter or established content site. They range from 1 to 3 years old, with various backlink profiles, number of published articles and traffic.

What’s included;

- Domain name (some are very valuable)

- Backlink profile (and other off page SEO)

- Live site (set up as per eBusiness institute guidelines)

- Home page with 3+ core purpose pages

- Privacy policy, contact us, terms and conditions

- Logo, design and graphics

- WordPress theme with category widgets (themegrill)

- WordPress plugins

- AAWP and Advanced Ads Pro premium plugins installed and set up (these will cost approx $50 per year to update)

- Core purpose articles published (full on page SEO completed as an example of what to do for further articles)

- Rights to use any paid images used on the site from a paid stock database (majority used are royalty free)

- Pseudonym author with story and unique images (headshots)

- 12+ months Content plan (not written)

- Keyword research spreadsheet (completed – plus a quick tutorial from me on how to do it and evaluate the keywords).

- Facebook page

- Twitter account

- Instagram account

- Gmail account

- Google drive (with relevant documents)

- Traffic: up to 1000/mo* (NB most starter sites are around 50)

- Income: up to $100/mo (mainly Amazon/Adsense) *

- Some guidance / coaching from me on getting it up and running

*no guarantees, depends on site, some affiliate networks you will need to apply for

You’d need to:

- Get the domains transferred into your name (I will provide the transfer keys – your hosting provider will walk you through this)

- Get a hosting service (I recommend either BlueHost or VentraIP)

- Transfer the website files to your hosting service so you can host the website files on the domain name (I will provide a .ZIP file of the backup on day of purchase)

- Switch out my Google AdSense and Amazon affiliates account to your accounts (not that they are making much money if any, as these are starter sites – but with consistent article posting and social media engagement they will grow over the next 12-24 months).

- Get subscriptions for the premium plugins when they expire in 12 months (AAWP and Advanced Ads Pro – approx $50 a year

- Write articles or hire a writer on upwork, format and publish them on the site

- Interact and build a social media community, share articles from the sites or get a social media scheduling tool subscription

- Find a techie on upwork to help you run the technical stuff (like updating plugins, fixing/troubleshooting, helping you get your google analytics and adsense connected)

Niches covered include;

(Starter – 1 year old)

- Beekeeping (pending purchase)

- Worm farms (pending purchase)

- Bicycles

- Motorbikes

- Barbecues

- HomeBrewing

- Survivalist / prepping

- Pools

- Beds / sleep / mattress

- Aged care

- Fitness

- Four wheel driving*

(Established – 3+ years old)

- Fatherhood

- Van life and camping

- Permaculture

- Pets

- Weddings (pending purchase)

- Vegan recipes (pending purchase)

- Crossbows (pending purchase)

*Prices (USD): Starter site: $5,000, Established site: $10,000 (The four-wheel driving site is $10k due to a very desirable and hence valuable domain name).

Sales would be subject to an NDA as there’s a fair bit of communication and information exchange in the handover, and I’d be happy to give you some pointers setting it all up and ongoing guidance but of course, that’s no guarantee of success.

Would recommend only eBusiness institute students or those highly motivated to learn take an interest as there’s a bit to wrap your head around initially.

Once you get it sorted out and automate your shit, it’s a great side hustle that has potential to grow into a full on ‘semi-passive’ business over a few years (for example I’m making more revenue now than when I was flying).

Whilst these are professionally set up starter affiliate marketing content sites from an eBusiness champion graduate, word of warning, it’s not easy in the beginning and you need to persevere for it to succeed, it will likely to take a year or longer to see decent results. Buyer beware!

Send me an email through the contact form or get in touch via the socials if you are;

1. Interested in online business

2. Have read my articles on content websites and making money online. < https://captainfi.com/make-money-online >

3. Have listened to my podcast interviews with eBusiness institute < https://captainfi.com/matt-and-liz-raad >

4. Have read my review of the eBusiness Institute or are a current student of Matt and Liz’s

Finally… please don’t message if you are ‘just curious’. This is a great opportunity to get started with your own online businesses, I’ve posted at length about my experience running websites, if you are curious please go back over my posts and ask questions in the facebook group. Basically, my loss from overcommitting myself is your gain.

cheers,

Capt. FI

Angel Investing

I have a small ‘Angel Investment’ in the Financial Independence brokerage platform Pearler. This was the maximum allowable private investment of $10,000 (AUD) which was made in July 2021 with the total number of ‘private equity’ shares based on their June company valuation. This was all documented, recorded and disclosed as per ASIC requirements. I also disclosed it in my NW updates and my Pearler review.

I am not tracking the exact company valuations for Pearler, but I know the company has had its valuation more than triple and has raised over $10m through VC rounds, so I assume the shares are worth a lot more now. How much exactly though? I am not sure.

Cryptocurrency Portfolio

Nothing exciting here, made a small purchase of BTC, giving me an even split of Bitcoin and Ethereum. Overall I have invested $6,000 and have a current crypto portfolio value of $2,384 which means I am down a total of 60% on my crypto speculation. Hmmmmmmmmmmmmmmmm…. HODL? Its not a loss unless you sell, LOL!

I am glad I did not jump onto the NFT bandwagon, as I have seen a lot worse returns (such as – 99.9%!). I personally get the vibe that a lot of this Web3/NFT stuff is to do with circumventing sanctions and money laundering legislation.

I do think though, when it comes to Bitcoin and Ethereum, that whilst the downside risk is I lose another 40% of my capital as it goes to zero, the upside potential is limitless really. I am happy to continue holding and making small contributions to the portfolio to see where it goes.

Cash – Mojo and emergency fund

Cash reserves is ridiculously low as I type this – I actually got down to a minimum of $140 haha. Which is quite irresponsible really, I just had more than expected expenses with the property build and less income.

I am very much waiting for the next round of dividends which I will keep as cash reserves, and begin to pump up my mortgage offset account (Mojo) back up to the planned balance of $30,000 (plus $2,000 in my savings account). This is approximately six months of my living expenses, plus six months worth of rental income for the investment property.

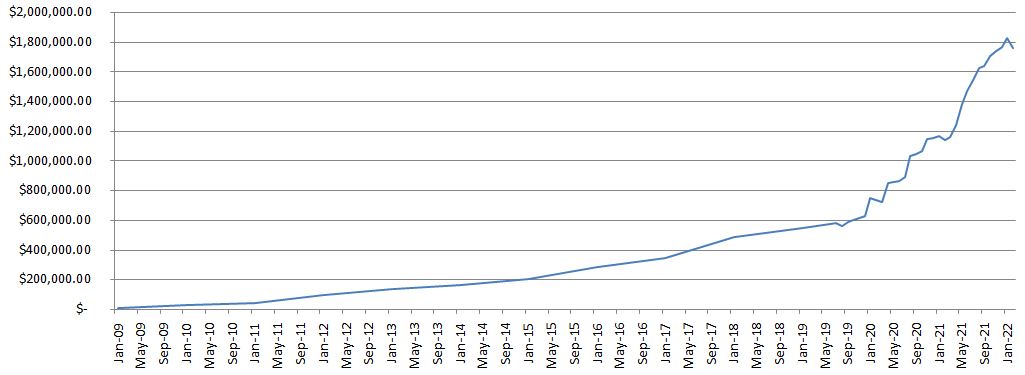

Captain FI net Wealth progression

I kept track of my net wealth progression via monthly updates and a graph which was rather crudely constructed in Excel. It demonstrates the ‘somewhat exponential’ journey over the past 14 years. You can access the archives for my Net Worth updates here to see how its gone over time. Check out the graph and all the updates below to see how it has gone since the beginning.

| Date | Net worth | Difference | Saving Rate | Notes | |

| Jan 09 | $5,000.00 | ? | Estimate NW based on historical Super, Bank statements and assets at the time | LINK | |

| Jan 10 | $24,000 | +$19,000 | ? | Estimate NW | LINK |

| Jan 11 | $40,000 | +$16,000 | ? | Estimate NW | LINK |

| Jan 12 | $92,000 | +$50,000 | ? | Estimate NW | LINK |

| Jan 13 | $130,000.00 | +$38,000 | ? | Estimate NW | LINK |

| Jan 14 | $161,000.00 | +$31,000 | ? | Estimate NW | LINK |

| Jan 15 | $200,000.00 | +$39,000 | ? | Estimate NW | LINK |

| Jan 16 | $281,000.00 | +$81,000 | ? | Estimate NW | LINK |

| Jan 17 | $340,000.00 | +$59,000 | ? | Estimate NW | LINK |

| Jan 18 | $482,000.00 | +$142,000 | ? | Estimate NW | LINK |

| Jan 19 | $542,000.00 | +$60,000 | ? | Estimate NW | LINK |

| Jul 19 | $578,900.00 | +$36,900 | 84% | Finally began tracking NW this like a proper adult. | |

| Aug 19 | $560,100.00 | -$18,800.00 (-3.2%) | 78% | Share market slight correction, Ok savings. | |

| Sep 19 | $584,744.88 | $24,644.88 | 72% | Share market rebound, savings rate not so good. | LINK |

| Oct 19 | $600,386.00 | $15,641.12 | 84% | Good saving this month. Normal salary, plus allowances, dividends from index funds, tax refund, eBay selling and was working abroad in asia where things are cheap. | LINK |

| Nov 19 | $612,917.21 | $12,531.21 | 76% | Falling short of my savings goal of 80%. Mostly domestic legs this month with higher costs. Also invested in hydroponics. | LINK |

| Dec 19 | $625,350.00 | $12,432.79 | 76% | Good savings of cash (for development) and investment, however higher spending due to Christmas period (Travel and Gifting). | LINK |

| Jan 20 | $865,212.00 | $239,862.00 | 55% | Super settlement was a HUGE boost to NW. $9K growth from stock market. Expensive month lots with lots of unexpected bills – weddings, travel, Booking flights, fines etc. | LINK |

| Feb 20 | $851,802.0 | -$16,592 (-1.9%) | 52% | Large increase in spending on myself this month, still managed to tuck away $5K to put into shares and property. Corona Virus market scare resulted in a correction and gave NW a small negative trend. Time in the market not Timing the market! Became Single again. | LINK |

| Mar 20 | $819, 354.6 | -$31,806.95 (-3.7%) | 80% | Another small step backwards in the NW due to the ‘corona crash’ in full swing. FIRE Portfolio of ETF/LICs down about 15% this month, however due to high savings rate and structure of my superannuation annuity the NW is only down 3.7%. Savings rate good at 80%, higher than usual income (with some slightly higher spending, too). Picking up shares on discount – this is the best outcome for someone in the accumulation phase with good income! | LINK |

| Apr 20 | $847,023 | +$27,668 | 85% | $11,000 in rebound of stock market capital prices alone (up 6%), plus first quarter dividends paid (heavily reduced due to banks withholding dividends). Great savings rate due to COVID-19 lock-down = no spend. Increased entrepreneurial efforts and selling down of physical possessions provided side hustle income. Two standard paychecks from flying activity; domestic day trips only so no allowances. All cash unfortunately had to go into the property development due to contract timing, I am chomping at the bit to buy some more index funds before they go back up in price too much – hence why I am selling most of my toys! | LINK |

| May 20 | $857,859 | +$10,836 | 92% | Some Great sales as I let go of my Super Sport Motorcycle, Some gym gear, expensive flying equipment and a few other various bits and bobs and invested this money. Flying still reduced, but increasing from April. The share market grew as I continued to make my fortnightly investments. I also wrote down the ‘value’ of some of my possessions (liabilities) such as my car, tools and furniture by around $10K to align them to market price (“tell him hes dreaming…!”). | LINK |

| June 20 | $858,650 | +$791 | 90% | Small Net Worth gain as I continue to declutter and simplify my life, despite being off work due to a family emergency. Share market not doing much. | LINK |

| July 20 | $888,218 | +$29,568 | 68% | Majority gain due to share market going back up, low spending due to being on the family farm and at home because of lock down. | LINK |

| Aug 20 | $1,029,293 | +$141,075 | 74% | Became a millionaire. Achieved this massive milestone I set out for myself in Dec 2019. Included unrealised gains in my property development as well as website business. Good savings rate due to not much spending, invested in Aus and total world shares. Investing in my web business. Starting to shift focus away from $$$ and more into looking after my mental health. | LINK |

| Sep 20 | S1,045,486 | +$16,193 | 60% | Officially took time off work for the rest of the year to be close and look after family during major operations. Continued to sell down physical possessions and work on digital business while at home. NW gain mainly due to valuation of websites. | LINK |

| Oct 20 | $1,064,399 | +$18,913 | 80% | Base income (retainer) and leave loading, dividend and websites provided income, as well as raiding my P2P lending capital. Significant bill for property due to design not meeting standards which effectively lowers my equity position, as well as fence being stolen. | LINK |

| Nov 20 | $1,143,433 | +$80,394 | 82% | Big gains came from share market growth (influencing both the Financial Independence share portfolio and Invested superannuation), Business gains (due to increased earnings) and a $30K boost to my annuity thanks to me logging in and checking the fine-print on the accumulation stats. I only invested around $7K. Insane that in one month, I accumulated nearly more net worth than I did in four years from 2009-2012 | LINK |

| Dec 20 | $1,152,920 | + $9,487.32 | 84% | Share market slight drop, Earnings from Business, Contract work, Selling possessions. No share market investments this month (oops! I forgot and money was tight). Invested a lot into the website business this month (way more than planned) and it is still running at a decent loss (plans to turn it cash flow positive in 3 months). | LINK |

| Jan 21 | $1,165,678 | +$12,757 | 79% | Great returns from the share market. Earnings from Business, Dividends, Flying wage, flipping items on consignment. Regular share contribution, investing in micro investing platforms, P2P lending, Investment property and big reinvestment into the business (still running at a loss) | LINK |

| Feb 21 | $1,135,272 | -$30,406 | 76% | Significant write down on property development due to council DA rejection and redesign requiring more money and creating less equity. Offset by small increase to Business value and investments. Simplified my investments and switched over to Pearler. | LINK |

| Mar 21 | $1,155,594 | +$20,322 | 71% | Continued investment into the portfolio as well as growth of investments and business. Gave my notice at work and looking for part time job at home for ‘Barista FI’ | LINK |

| Apr 21 | $1,242,220 | +$86,727 | 74% | Property development back on track | LINK |

| May 21 | $1,379,469 | +$137,248 | 72% | Massive gains in the website portfolio due to revaluation based on recent business income, big growth of superannuation due to annuity increasing (salary increment) and shares generally went up. Crypto went down by about 40% or so. | LINK |

| June 21 | $1,469,989 | +$89,757 | 41% | Quit flying role and moved to Adelaide. Great month for investments, websites producing serious income so accordingly they are valued higher. Spent a lot on furnishing the new apartment and on enjoying some more luxuries. Seeing a therapist to help deal with anxiety from leaving work. | LINK |

| July 21 | $1,543,959 | +$74,732 | ??? | Set myself up in Adelaide. Did basically nothing for the whole month except spent time with family, relax, sleep and go to doctors appointments. Massive boost to website portfolio AdSense and affiliate incomes, as well as general share market performance. | LINK |

| Aug 21 | $1,624,116 | +$70,156 | ??? | Relaxed again, focused on mental and physical health, and spending time with family and my partner. Big increases to spending (too afraid to calculate a ‘savings rate’) but also big increases to NW through website portfolio income growth. Finally got the slab poured on the investment property (foundation). | LINK |

| Sep 21 | 1,640,663.85 | +$16,547 | ??? | Stocks, super etc went down, but business income from websites increased, plus business valuation increased. Property build. got to frame stage, and I also got a dog! Expenses for vet surgery well worth it. Moved into a nicer apartment | LINK |

| Oct 21 | $1,705,907 | +$65,243 | 30% | Big boost from website valuation due to securing new affiliate contracts for recurring income, shares went up nicely. No massive changes to this month. Calculated a savings rate and found myself pretty low due to spending a lot on my garden and going out quite a lot – I don’t think I will calculate this savings rate figure any more. | LINK |

| Nov 21 | $1,739,144.23 | +$33,236 | N.A. | Great month. Relaxing (somewhat). Spent a lot of money doing ‘fun’ things like winery tours, a fine dining experience and self education. Shares moved sideways (well slightly down) but everything else went up. Building got to enclosed stage (roof, walls, windows and doors) but have had some issues with build quality and weather / covid delays. Put a $1000 deposit on the puppy. | LINK |

| Dec 21 | $1,764,516 | +25,372 | N.A. | Spent nearly the whole month with family, did some work on the website portfolio. Traffic recovered from google algorithm changes. Invested $10K into Stockspot and Sixpark, $1K into ACDC, $100 into Comsec pocket and $100 into Bamboo, $260 into BTC, $4K into ETFs through pearler. Paid the $3000 balance for the puppy. | LINK |

| Jan 22 | $1,826,633 | +$62,117 | N.A | Stock market slightly down, Massive boost to website traffic (overall its more than doubled). Invested $10K VTS, 2K VEU through pearler, Paid for Angels cancer surgery, bought more BTC and ETH, bought a parcel of ETHI on commsec pocket. | LINK |

| Feb 22 | $1,757,210.57 | -$69,422.93 | N.A | Stock market down, Website business revenues down and additional spending on content and staff for business, Additional property development bills, some unexpected expenses, Wrote down the value of some of my personal property (and gave stuff away). |

Captain FI is a Retired Pilot who lives in Adelaide, South Australia. He is passionate about Financial Independence and writes about Personal Finance and his journey to reach FI at 29, allowing him to retire at 30.