CaptainFIs February 2022 financial and personal update for the end of March 2022

OK so I’m gonna call it – this is my last Net Worth update.

I have been talking for some time about ending them and really simplifying my blog to remove some of the superfluous stuff and that includes stopping these monthly updates. Realistically, they had served as a way for me to stay accountable and transparent on my journey to FI and to of course track my progress. It was also a cool way to be transparent and share what was going on in my life, the challenges I faced on my journey to FI, and what I was doing to overcome them.

I hope they have helped you as much as they had helped me stay motivated over the years, and also that they proved I wasn’t full of crap and actually did put my money where my mouth was on the journey to FIRE and knew a little bit about what I was doing. Alas, all good things must come to an end, and it’s probably good timing given the current media circus. Realistically, I just don’t know what more value I can add to this blog by continuing to put detailed monthly updates out now that well… I’ve sort of done it and retired early.

So there it is. One million, Seven hundred and one thousand, four hundred and ten dollars. This portfolio of assets, alongside my current insurance, is what I am planning on taking into battle for financial support for the rest of my life. I really hope it works out or else I might have to… get a job again?

Captain FI is not a financial advisor, does not hold an AFSL and this article is not financial advice. This website is reader-supported, which means we may be paid when you visit links to partner or featured sites, or by advertising on the site. For more information please read my Privacy Policy, Terms of Use, and Financial Disclaimer

CaptainFI March 2022 update

I have been talking for some time about really simplifying my blog, and removing these monthly updates. Realistically, they had served as a way for me to stay accountable and transparent on my journey to FI and to of course track my progress. It was also a cool way to share what was going on in my life, challenges I faced on my journey to FI, and what I was doing to over come them.

I hope they have helped you as much as they had helped me in putting them together, and also that they proved I wasn’t full of crap and actually did put my money where my mouth was on the journey to FIRE and my regular investing plan. Alas, all good things must come to an end, and its probably good timing given the current media circus.

I worry though, that I probably got sucked into hyper-performance capitalism culture, you know, hustle culture that your net worth was your self worth and all that crap. I definitely put too much emphasis on my investments and I think I used them as a bit of a crutch to gain a sense of security that I felt I didn’t have, to try and quash any sense of anxiety or uncertainty about the future. As a method to regain control of my life. I don’t regret what I did, and it has certainly afforded me a lifestyle change now which is much more sustainable, but I think I put a lot of pressure on myself and if I had another crack at it, I would probably tell myself to 1. Start Earlier and 2. Dont go so hard. The fact that I could have started earlier by definition would have meant I wouldn’t have to go hard, so, that’s probably two ways of saying the same thing.

Anyway, now that I have transitioned out of full time work and am living a much slower life, I don’t really feel the personal need to put out a monthly update tracking every single investment and piece of noise out there. I feel like the ‘intense’ journey to FI is complete, and now I can just take some time for a deep breath, and to take stock of my life and think about what I want to do going forward.

Somewhere along the way, this blog which started being all about my learning and my accountability, morphed its way into a resource for people to learn about financial independence. And I took that seriously and only wanted to publish good stuff that actually helped people. From a viewer point of view, I don’t really know what me rabbiting on each month about tiny fluctuations in my investment portfolio would even give you, it certainly sounds repetitive and I think holistically, it is actually counter to the whole concept of Financial Independence and lazy index investing – which is to not bother with the day to day noise or month to month minutia, and to simply zoom out and look at the years and decades.

Once we triage our finances and follow the ‘basic steps to financial independence’ (you know, sorting out a budget, earning more, being adequately insured, working out how index funds work and all that – Money Smart is a great free resource to help with some of this) we sort of enter this boring autopilot phase where our money stuff isnt actually that important in our day to day lives.

So anyway, there is going to be some changes. Firstly, I am going to switch to either Quarterly or Yearly updates with respect to my finances and investments. I’m not too sure yet, but its probably going to be yearly at this stage because I don’t want to go too over board on the investing stuff (the mindset and behaviour is wayyy more important), but I also do want to maintain transparency and keep everyone updated on how the finances are tracking post-FI. That way I can also try to include fun stuff like my total yearly expenditure against what I’ve earned in passive income – putting my money where my mouth is about “RE” so to speak (whilst I have retired from conventional full time flying, I am still ‘working’ on little passion projects and side hobbies and interests, some of which make money). What was that article I wrote a few years back, RE standing for ‘Redirect Employment’ or ‘Recreation Enjoyment’ or something like that??

Historically, I haven’t really directly published a lot of my earning or spending data (although indirectly if you read between the lines you can calculate it, given I mention how much I have invested / saved and I also provided a savings rate, and the fact that we are all on the same marginal tax brackets).

ASIC and ‘Finfluencers’

This month we had some clarification from ASIC regarding what is and isn’t appropriate when discussing Financial Independence online (and on social media), and I actually sought clarification from my lawyer about this. Basically, if you haven’t been following along, the regulator ASIC has had some issues dealing with dodgy people online. There are a number of people online all too happy to deceive, lie and steal from people – doing things like spruiking investments which they run or have a vested interest in (i.e. big shareholders, or run by family or friends) and even giving out unlicensed and potentially misleading and dangerous financial advice – think meme stocks and crypto hype.

Unfortunately, ASIC has a pretty hard job in front of them. The evolution of social media and the digital landscape makes it incredibly difficult for them to maintain oversight of what’s going on in order to monitor and flag people conducting criminal activity. Especially with things like Instagram stories which disappear after 24 hours (or can be deleted immediately once a prospective victim is baited and hooked).

But, it’s not just these blatant criminals and scam artists in the spotlight, ASIC have cast the net far and wide and has an easy target of ‘Finfluencers’ set within their crosshairs.

A Finfluencer is someone with Financial Influence

This is in response to a new ‘industry’ of unlicensed ‘financial influencers’ discussing their experience with financial products online on platforms like Tik Tok, YouTube and Instagram – some of which amassing huge followings, which has stemmed from a huge boom in interest in retail investing post-COVID-19. From my limited experience on social media, I actually thought most of these Finfluencers did a pretty good job at general education and bringing the topic of financial independence to the forefront of people’s minds. I’ve learned some cool money hacks – but if we are honest – a lot of these reels and videos are shit, and some of them are blatantly wrong and misleading (although not always deliberately so).

It’s gotten so bad to the point where sometimes, people will say or do anything to try and get your attention, grow their influence and then monetize their content and followers. Affiliate marketing, advertising and sponsored content are some of the ways influencers can monetize their content (and actually I have done all three of these things on my website portfolio myself, too!). These are in of themselves, legitimate ways for businesses and content creators to be paid for producing their content – whether that is writing articles, books, producing youtube videos, podcast episodes, audio books, social media copy, reels and so on.

The reason the Finfluencer industry even exists highlights is probably the horrific state of the financial advice industry in Australia at the moment, as highlighted by Alex Vikovich in his Article in the financial Review – Finfluencer crackdown highlights ludicrous advice laws

Real advice out of reach

Over the past two years, the costs of obtaining professional financial advice have skyrocketed by a third to a median annual fee of $5000, according to the Financial Services Council.

Overwhelmingly, this unfortunate scenario – in which an important social need is unable to be met by the only industry legally able to provide it – is the result of a decade of new rules and regulations introduced before and since the damning Hayne royal commission.

The paperwork involved in giving formal investment advice to a client is so mountainous that most licensed providers have decided it is simply too difficult and costly to service all but the very wealthy (and about 10,000 of them have quit the profession altogether).

Alex Vikovich, Australian Financial Review

The issue really comes down to conflicts of interest, where people can be misleading about the accuracy of reviews, or their followers simply blindly follow their recommendations thinking it is financial advice because they trust them. For example, if an influencer is paid to promote a variety of investment products, then they kinda have a financial incentive to promote the particular investment product or trading platform that pays the highest commission or payment – that is a conflict of interest.

Conflicts of interest are nothing new – we see this every day across all forms of media, from Radio stations and Talk shows, Morning breakfast television shows.

ASIC have released info sheet 269 to try to clarify the laws regarding financial influencers and manage these conflicts of interest

“This information sheet (INFO 269) is for social media influencers who discuss financial products and services online. It sets out how financial services laws apply to you – it is your responsibility to ensure that any content you post complies with the law. INFO 269 is also for Australian financial services (AFS) licensees who use an influencer. You should be aware of your obligations as you may also be liable for any misconduct by the influencer.”

ASIC, INFO 269

Basically, to try and protect Australian retail investors (consumers) from the harm from misleading information, ASIC has produced this sheet to try and clarify extant laws. To be clear, no laws have actually changed, and providing unlicensed financial advice was always illegal, but ASIC are now just highlighting the issue with the plethora of influencers providing what could be interpreted as general financial advice without having an Australian Financial Services Licence (AFSL)

“An Australian Financial Services Licence (AFSL) is a legal licence provided by the Australian Securities and Investments Commission (ASIC) enabling the operation and activities of Australian financial services businesses.”

Wikipedia

ASIC are encouraging influencers to either stop talking about investments or to become licenced (or at least, to pay to become a Corporate Authorised Representative (CAR) of an AFSL holder). This is because there is then some ‘checks and balances’ in place to manage the conflicts of interest.

Again, lets be clear, conflicts of interest are not new. There are literally countless examples of conflicts of interest – remember how Elon Musk got banned by the SEC from tweeting about stocks for market manipulation (and then he switched to tweeting about crypto which was unregulated)? Remember the Barefoot effect when Scott Pape recommended stocks in his stock tipping newsletter and the prices surged as all his subscribers piled in as soon as the markets opened? Remember when Kim Kardashian, Floyd Mayweather and Paul Pierce got paid to use their celebrity status to advertise a little-known cryptocurrency called EthereumMax as part of a larger pump and dump scheme to defraud investors and had a lawsuit filed against them? Matt Damon, Reece Witherspoon, Gweneth Paltrow, DJ Khaled and T.I. are also named as celebrities facing backlash (or worse) for touting crypto in an article by Business of Business

Celebrity endorsements have been a thing since time immemorial. Especially for athletes, actors or reality TV stars with poor money skills, who, when they retire from sport/acting/fake drama find themselves in a bit of a pinch so they are more than happy to endorse the multivitamins that they *totally* took their whole lives and that was *totally* responsible for their fame. They have influence, and advertisers buy it from them. Its always been so. The person that often gets screwed is the retail customer. At least when it comes to ASIC, there is an AFSL number attached to the people doing the spruiking, and so they can be taken to court if enough people complain. With Finfluencers – its harder to track them down I suppose.

So ASICs deliberations are not a bad thing, because they are aimed at protecting the public, but they do seem a bit heavy-handed and restrictive.

As a result, I won’t be drastically changing what I do on this blog since I was never breaking any rules to start with (and I have legal advice to back that up), but I guess this ties in a bit when it comes to my Net Worth updates and made it an easier decision to stop publishing new ones. It was really time to stop them anyway since I have left flying work.

Fundamentally, this blog has been about my journey to financial independence. It has been about me learning, and sharing the gems that I have picked up. I have never professed to be an expert, and perhaps bar a few clickbaity article titles I have used for SEO purposes to try to attract attention (and that I am reconsidering using in the first place), I don’t claim that anything I do is the best strategy, financial advice or a ‘one size fits all’ option.

The reality is though that some people may potentially read my articles and interpret them as gospel financial advice – which is not the intent. So I am working to be absolutely crystal clear on this with my readers – I am not providing financial advice. I am providing an account of my own financial journey, and I provide clear and unbiased review content – not just about investing, but about all things financial independence – innovative ways to earn more, side hustle and progress your career, savvy ways to be frugal, save money and be efficient, and of course the most simplest piece of the puzzle – How I personally invest my surplus. I do this because I am sharing my research and time, something I was going to put into the area anyway, so its no skin off my nose to share that with the world. Actually, it kinda seems like a dick move to hoard the information to myself, right?

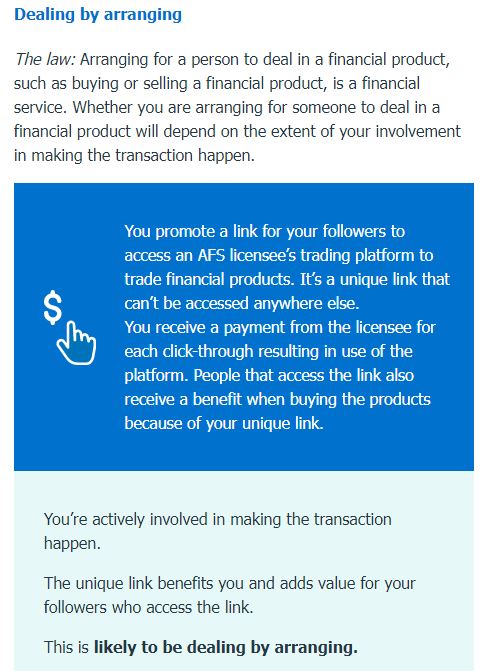

I just have to be really careful now that when I talk about my investments that I am not ‘influencing’ anyone to go out and do the same, or dealing by arranging with affiliate links to investment products. Funnily enough, a few years ago I actually got expert legal advice which cost me thousands of dollars that said that affiliate links to share trading platforms was completely kosher, aka completely within the remit of the law, because it was a means to buy an investment and not an investment itself. I mean, otherwise why would these AFSL holders even be ALLOWED to offer affiliate programs in the first place, right?

Anyway, ASIC has backflipped and now said that affiliate links to brokers or share trading platforms is *likely* to be dealing by arranging (note the word likely), and accordingly, I have removed affiliate links to investing products. I will also be ceasing my discussion around my use of many things like micro-investing tools and peer to peer lending (which, if I am honest, aren’t all that relevant to my stage in the financial journey anyway) and of course as I mentioned earlier, stopping the net worth updates and publishing what I invest in so as to not be seen as influencing anyones financial decisions.

At this stage I am not removing my historical Net Worth updates or ETF reviews, but pending legal advice and how this all unfolds I may have my hands tied. For now at least, I have gone through and done some editing and making disclaimers a bit more obvious, but If you find anything on the website that you think looks a bit suss after ASICs clarification, as always get in touch or drop a comment to let me know. I’m confident everything is good to go and above board, but doesn’t help to have an extra set of eyes.

For more discussion on this topic, check out Daves article about it over on Strong Money Australia.

What I have been up to

So with that out of the way, Lifestyle wise, March has been amazing. Mad March, some people in Adelaide call it. We have had the worlds largest arts festival pretty much all month, set up just down the road from where live, and it has been, epic.

I went out and saw a record number of Fringe shows across Gluttony, the Garden of Unearthly Delights, and various other small venues across town. It was sad to see that a few of the regular hosts like the Royal Croquet Club did not make an appearance this year, so hopefully they will be back in 2023. Regardless, there was number of pop up bars, eateries and night markets and the atmosphere was just really buzzing.

I’m loving the cooler change to the weather, crisp mornings make for a nice cosy sleep ins, and in the city here it means less noise as people don’t go out as much when its cooler or rainy. Sounding like a bit of a grinch here arent I? haha! I’m definitely a winter person, so looking forward to having my block in the hills and drizzly, cold days to spend inside by the fire.

My Mum is doing much better after some changes to her chemotherapy, she has been switched from a PARP inhibitor to a monthly IV based treatment, as well as a switching of her pain management. Which initially was quite funny because she was clearly high off her tits on the new oxycontin until they tailored her dosage down to a more sustainable level. I do feel really empathetic for my poor old mum, but honestly I can’t really imagine just how bad it would be to have a failing body, horrible cancer and chronic pain. I am very glad I am here in Adelaide to be close to her and support her where I can.

I feel like I have made some good progress myself in terms of my own physio/rehab and focusing on my mental health. I still have my ups and downs, but starting a new round of medication has been helpful for pain management but also my own headspace.

I actually did a monologue episode on the podcast recently – This is your Captain speaking #3 – Early Retirement Update where I had a chat about everything that has been going on in my life.

I enjoyed getting back into blogging and podcasting in CaptainFI, having a crack at the new Pearler Micro for a review, and also going in to revisit my Pearler review and make sure it was all up to date. I also posted a review of my experience using NAB for my investment property, a review of Finder.com and looked into investing options for kids. Here are the articles I posted;

- Friday, April 1 | NAB Bank Review – is a ‘Big 4’ bank better?

- Tuesday, March 29 | This is your Captain speaking #3 – Early Retirement Update

- Friday, March 25 | Investing for kids; What are the Options?

- Thursday, March 24 | Pearler automatic share trading review: March 2022

- Friday, March 18 | Podcast | Digital Marketing with Richard

- Thursday, March 17 | Pearler Micro review – the best way to start your investing journey?

- Friday, March 11 | Finder Review: Is it safe to use?

If you want to see more of my day-to-day life, click on any of the links below to follow me on your preferred social media platform as I am pretty active on all of them these days. I share experiences from my day to day life, things I am interested in, as well as my journey to financial independence and links to some of the best articles and podcasts regarding Investing, Business and Financial Independence (and of course all the latest and the best articles and podcasts from CaptainFI.com). Growing the followership means I can help spread the Financial Independence message and reach more people, so I’d love to have you on-board to help spread the good word.

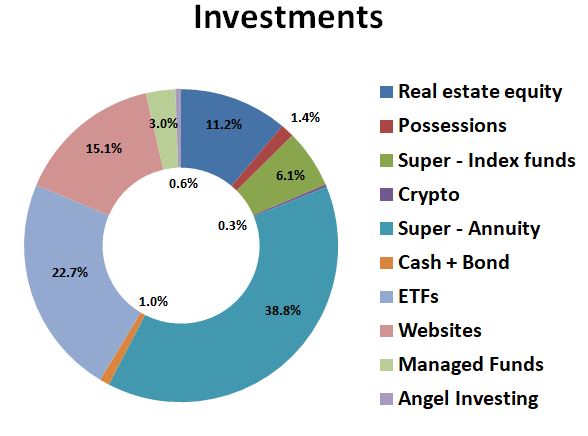

Captain FI Investments

My investments (outside super) are split between a few different areas. I don’t regularly talk much about my super (index funds and annuity) since I can’t access them for a long time (but I discuss them in my transition to retirement article), so for these updates I just focus on the ones I have the most control over;

- ‘FIRE Portfolio’ (Global, US and AUS Index fund ETFs)

- Real Estate (Investment property duplex)

- Website Portfolio (Online businesses)

- ‘Outsourced’ Portfolio (2 x Roboadvisors and 1 x Actively managed fund)

- Angel Investing

- Cryptocurrency

You will note that this has changed a bit since last month. I’ve basically just placed all the ‘sell’ and ‘withdraw’ orders on all my various smaller and more obscure investments and then will be closing these accounts, because the time hassle was just too much. They were interesting for a while, I got enough data to properly understand and review them, but really I am just wanting to simplify my life going forward. I will just be rolling some of these funds into one of the managed funds and then putting the rest into my emergency fund since I probably need to be keeping a larger one anyway without a regular income stream.

‘FIRE’ Portfolio (Exchange Traded Index Funds)

My Financial Independence ETF Portfolio is a simple, low-fee passive portfolio that is split between three index-tracking Exchanged Traded Index Funds (ETFs):

- I now have this portfolio fully automated through Pearler

- I track my share portfolio using Sharesight, which means my accounting is also completely hands free using the Pearler API plugin.

This means I pretty much only need to log in to confirm all the trades and dividends over the year when needed for my tax return. My portfolio splits aren’t at my targets because I initially

The rolling 12 month performance shows that whilst 2022 got off to a shaky start, the market is probably doing on average what we expect it to do. Which is good. Although a year is also a pretty short timeframe to consider when we are talking about investments.

Would you look at that, looks much nicer when you zoom out and look at the longer-term performance. Who would have thought? Doesn’t take an AFSL holder to point that out, does it?

‘Outsourced’ Investing Portfolio

The Hands-free Automated Investing Portfolio is a combination of the two larger Online investment advisors (roboadvisors) in Australia – plus an actively managed fund through a financial advisor which I get charged a fixed yearly rate for. I am interested to see as an experiment which ones perform better, whether they outperform my purely stocks ETF portfolio. I know its obviously not ideal to be paying three sets of management fee’s, but, tbh for me personally it is worth it for the experiment.

So the new kid on the block, I have made a $10,000 investment into a managed fund which I will be explaining all about in due course. Basically I have been to a financial advisor and paid for a statement of advice, and they recommended this particular fund that they run would suit my investing risk tolerances and time frame. It’s no surprise that it is very similar portfolio construction to the ones provided to me by the RoboAdvisors, but once I get my head wrapped around how it all works for reporting etc I will report what happens here, as well as do up a review article specifically on the financial advisor I went through and how the process went.

I also intent to contribute another $10,000 to it in due course so that all three of the different funds have at least had the same amount of starting capital. Now strictly speaking it isnt a *true control* because the investments were made at different times and so the effect of market timing will have an effect early on, but in the long term I would imagine them to all even out. There hasn’t really been that much of a difference between them all anyway.

Cryptocurrency Portfolio

Nothing exciting here, made a small purchase of BTC, it seems to have rebounded a bit.

Investment property

Starting to look around to refinance for when the building is complete, which could be an issue given I have left my PAYG job… AWKWARD! I am hoping they will let me service the loan initially against income from my business, shares, and of course the rent the tenant will pay. If not then hmm, I may have to sell either the property, or parcels of shares to get the deal across the line. Either way I am not too fussed as I have a pretty good Mortgage Broker who will sort it out.

I will be starting to do some research into good property management firms. I will be outsourcing this as I could not be stuffed dealing with a tenant and all the bullshit that it entails. Hopefully the building will be completed in a couple of months and it all gets sorted out. Luckily I am doing this with a mate and will hope to leech off his research into property managers (don’t worry, we have been copying off each other ever since first-year engineering maths class nearly 15 years ago!)

I’m currently paying $1000 a month for an interest-only mortgage, which is slightly more than it actually costs and the surplus is going into an offset which is being managed by my mate in the JV account (we both pay that, and at the end we will both get one property to rent out and split whatever is left in the offset).

Rolling lessons learned:

It has taken a long time to get to this point, and boy have we made some embarrassing mistakes. Rolling lessons learned include but are not limited to…

- Thinking we could save money by NOT using an architect on a house and land package we bought from a developer *WITHOUT DA from council*

- Falling for the oldest trick in the book re: portable fencing hire (the fencing hire company stole the fences back and then tried to charge us for having them stolen)

- Endless delays by not having DA and needing to relodge with council three times meant we were one of the last blocks to be built on, and hence became the neighbourhood ‘free rubbish dumping ground’ when the fence was “stolen” (we then had to pay to get the rubbish removed and pay tip fees for – a big fuck you to any dodgy builders reading this who have ever engaged in this practice)

- Because we were the last to build, the ‘new neighbours’ objected to our build being two story due to shadowing – and we were forced to build single story instead at a reduced profit margin. Despite us being relatively early on the land release!

- COVID-19 delays, subsequent supply restrictions and union activity meant the builder essentially got a free pass to break contract schedule, putting us back by an extra six months+ with no penalty, compensation or damages payable (they even billed us for this extension!!) – this further took money away from the ‘bottom line’ as we had to pay more interest, had capital tied up, and was not earning rental income – all making the build less profitable.s)

- Lots of small (but not insignificant) expenses such as council fees, independent inspection fees and rates (even though the house isn’t built yet apparently you still have to pay rates…) add up to significant amounts over the project lifetime. I was amazed to see just how everyone gouges you for things you don’t even think about, and brokers / builders don’t mention these costs so you just have to cop them when they arrive.

- Independent inspections and checks are worth their weight in gold. I am talking design and plan reviews, soil tests, site inspections, construction and building inspections etc. Do not cheap out or try to skip these, and don’t trust anyone or any builder – they are very cheap insurance and great piece of mind and give you (legal) leverage over the builder, especially if someone is trying to pull the wool over your eyes.

- Pay a lawyer or legal professional to read the contract. You think you can read through it yourself and spot everything but you can’t. The builders legit make it their BUSINESS to know how to weasel their way out of things as well as suck more money out of you.

- Builders can blackmail you and threaten to walk off site after you release large payment milestones, because you have less leverage. They are banking on you not wanting to go to court because of the cost and time expense. Be judicious about approving large payment milestones, and its better to only release small progress payments frequently, which keeps the money in your account and power in your control.

- Be careful if there is a project manager appointed by the lender or the builder. Because they are actually not working for you, they are working for the builder. Fairly self evident how important that last bit is, as they will put the other parties interest ahead of yours (i.e. you pay more, and project gets delayed more).

I have not changed any of the valuations, still going off the banks final completed estimation of $560K, and with the mortgage the way it is at $370K leaves me with about $190K of equity in the build, meaning we currently make just under $70k of ‘manufactured equity’ with an investment of $120K over two and a bit years (not all of the cash was required upfront). This is an approximate projected annualized return of about 11%.

This will come in handy after completion and tenancy as I will be trying to access some of this equity during a refinance towards buying the dream farm in the Adelaide Hills. Not sure how refinancing is going to go given I am not getting a full time flying wage anymore (but hopefully may be able to finance based off website income). When the build is finished and tenanted I will do a full article explaining everything and try to calculate the total costs and profit.

With the general upward trend of property values in the area, I am hoping we can get it revalued on completion at higher than $560K (I believe some similar properties in the area have been going for $600K+) which would be awesome and would offset some of the stress of building.

I will release an article once everything is finalised and try to calculate a final yield and overall review, but its hard to quantify the amount of anxiety it has caused me (which isnt really anyones fault, it just has been poor timing).

Online Business (websites)

I had a lot of fun getting new logos and graphic designs done up for all the new sites, which is one of the fun creative parts of running online businesses.

Now I get to go through and individually build out some more aspects of each site, and put together mass writers briefs for the hundreds of articles I will require for my content plan. I keep reminding myself… one step at a time… one website at a time… one article a time! Its pretty easy to get really wrapped up in it and get bogged down in the weeds and start doing everything myself, so I am trying to lean more on my team of outsourcers.

It was a mammoth effort, but I also did the KW research for all 19 sites, updating workflows and building out content plans for 2022-2023. At one article a week for 19 websites, factoring in a little extra to build up a cue that’s 100 articles a month. Whilst I can write about my experiences with FIRE and Aviation, Matt keeps reminding me that it is impossible for me to write for every site. So I am working with a team of awesome writers and editors to get articles produced and posted onto the websites, but I just cant help writing a few here or there (especially if its a guest post for someone else’s website!).

I grew my team a lot and its been so exciting to watch it grow, especially on the days when I am just feeling really overwhelmed with everything, its awesome to know that the team are working on it.

Its really cool because now there are all these different niches, and they are mostly all things I find very interesting, so my hobby of reading and researching has actually like become a little part time business for me. I knew reading all those FI books would be good for something – the inspiration for this coming partly from Tim Ferriss and the Four Hour Work Week.

It’s been nice having a project to focus on, and I’m hoping that going forward I can continue to leverage this for semi passive income which then increases my wealth and safety buffer for FI. Its great because it means I don’t have to pull the trigger on ending the accumulation phase and start selling down my shares that traditionally comes with FIRE, and in the future I can even look at doing things like finance and even potentially leveraging this income towards a loan for a block of land rather than say, having to look at selling the IP or any shares or websites.

I learned these skills through the eBusiness institute – I have done a pretty comprehensive review of the eBusiness institute as well as interviewed Matt and Liz Raad about this on the podcast about online business and websites if you want to learn more about this lucrative side hustle. They provide a free introductory course for CaptainFI readers. I have also recently interviewed Liz Raad again on the pod about entrepreneurship, which is live now.

Angel Investing

I have an ‘Angel Investment’ in the Financial Independence brokerage company Pearler. This was the maximum allowable private investment of $10,000 (AUD) made in July 2021 with the total number of ‘private equity’ shares based on their June company valuation. This was all documented, recorded and disclosed as per ASIC requirements. I also disclosed it in my NW updates and my Pearler review.

I don’t actually know their financials or how many shares were issued, so this was more of a ‘speccy punt’ in technical terms. I invested because I believed in the pitched business model and thought the company had a future, so I figured the risk of losing my money would be pretty low. If Pearler continues to grow and builds its revenues and profits as a company, it will hopefully get an increasingly higher valuation and my little equity stake will grow (i.e. it is not a free $10,000 loan, it is a $10,000 investment where I am buying a slice of the company and its future valuations).

Whilst this doesn’t align with my general investing philosophy of index investing and diversification, I feel I had a unique insight into Pearler after meeting the team and using the platform early on after its release, so when I was offered to be an angel investor I took it up.

Some people have called this a conflict of interest regarding me even having a review of Pearler on the blog, or because that I have worked with Pearler – I previously had an affiliate link people could use to sign up and get free trades – and in exchange pearler paid me an affiliate commission. This has since been removed after clarification from ASIC and the release of their fact sheet saying that it wasn’t definitely, but that it was ‘Likely’ Dealing by arranging – I certainly didn’t want to risk not complying with ASIC and financial regulations.

I actually approached Pearler this month regarding this potential conflict of interest and asked whether I could sell my current (fraction of a percent) stake in the company because to be honest I was so sick of it coming up. So, its likely that I will be selling that at some point in the near future just so I can clean the slate and make sure there is no perceived bias.

Also realise that while $10,000 does sound like a lot of money, this is a small overall percentage of my total investments so my personal risk is actually quite low, and I would not encourage anyone to go out and make $10,000 Angel investments into tech startups. It is generally quite high risk (high risk = high reward). It is kind of like when multi Billionaires go on twitter and say they are buying $1M of crypto or paid $500K for an NFT or something. Make sure you don’t compare your financial ‘race’ with others.

Cash / emergency fund

Sitting on a total of about $17K in the Emergency Fund across the various bank accounts. I have got my final payout from work coming which is kinda scary but also exciting at the same time, as well as somehow my accountant managed to score me a few thousand dollars for my tax return from 2020-2021 financial year which was well overdue. Because I did some selling of shares to fund the property development last year it wasn’t as straight forward this year, but glad its sorted and Sharesight made it a bit easier. I’m guessing I will probably end up trying to keep around $30k in cash or close enough to a years living expenses, which I will initially just keep in an offset on the investment property. I also need to think a bit harder about how much I need to cover anything bad happening in the IP, but I will have insurance and its a new building so I think my risk is fairly low, but I may allocate a bit more cash to that just in case.

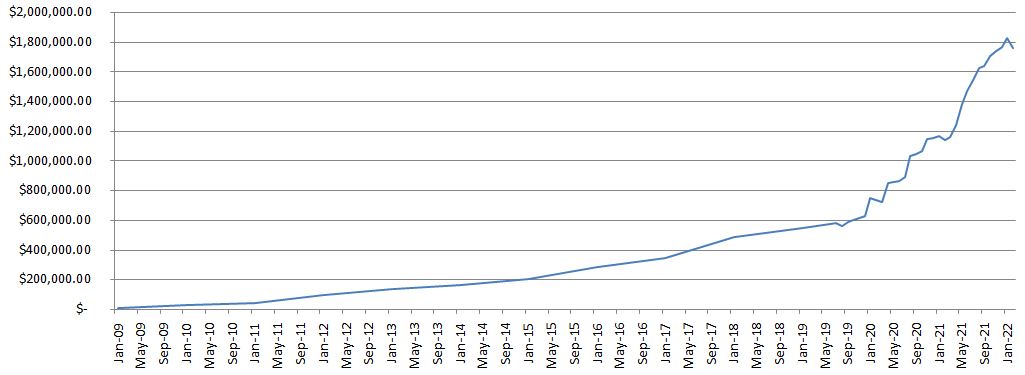

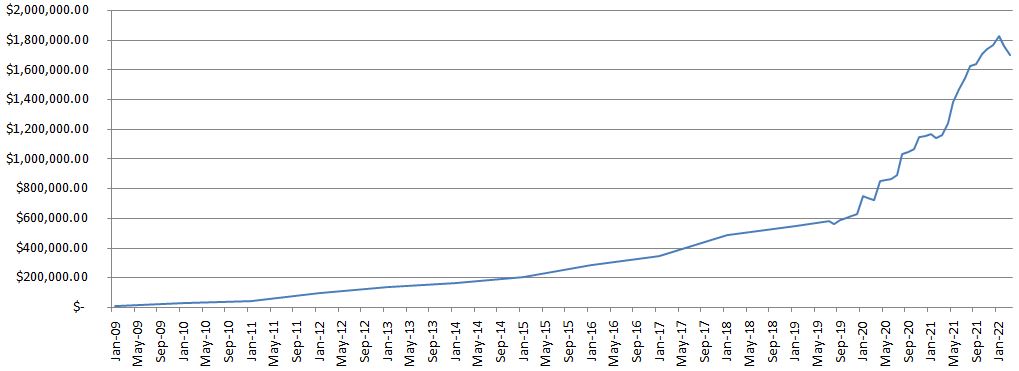

Captain FI net worth progression

The net worth progression graph is rather crudely constructed in Excel, but still demonstrates the ‘somewhat exponential’ journey over the past 14 years. You can access the archives for my Net Worth updates here to see how its gone over time.

Again I feel incredibly privileged that this started from ZERO, rather than from a negative. Unfortunately, a lot of people need to overcome a negative net worth whether that is due to student loans for their education or perhaps poor decisions with credit cards etc. This is a huge testament to how amazing my mum is and all of the sacrifices she made to support our family and prioritise our education, which allowed me to achieve so well during my final years of high school and ultimately score a scholarship at university (I got paid to study!).

Check out the graph and all the updates below to see how it has gone since the beginning.

| Date | Net worth | Difference | Saving Rate | Notes | |

| Jan 09 | $5,000.00 | ? | Estimate NW based on historical Super, Bank statements and assets at the time | LINK | |

| Jan 10 | $24,000 | +$19,000 | ? | Estimate NW | LINK |

| Jan 11 | $40,000 | +$16,000 | ? | Estimate NW | LINK |

| Jan 12 | $92,000 | +$50,000 | ? | Estimate NW | LINK |

| Jan 13 | $130,000.00 | +$38,000 | ? | Estimate NW | LINK |

| Jan 14 | $161,000.00 | +$31,000 | ? | Estimate NW | LINK |

| Jan 15 | $200,000.00 | +$39,000 | ? | Estimate NW | LINK |

| Jan 16 | $281,000.00 | +$81,000 | ? | Estimate NW | LINK |

| Jan 17 | $340,000.00 | +$59,000 | ? | Estimate NW | LINK |

| Jan 18 | $482,000.00 | +$142,000 | ? | Estimate NW | LINK |

| Jan 19 | $542,000.00 | +$60,000 | ? | Estimate NW | LINK |

| Jul 19 | $578,900.00 | +$36,900 | 84% | Finally began tracking NW this like a proper adult. | |

| Aug 19 | $560,100.00 | -$18,800.00 (-3.2%) | 78% | Share market slight correction, Ok savings. | |

| Sep 19 | $584,744.88 | $24,644.88 | 72% | Share market rebound, savings rate not so good. | LINK |

| Oct 19 | $600,386.00 | $15,641.12 | 84% | Good saving this month. Normal salary, plus allowances, dividends from index funds, tax refund, eBay selling and was working abroad in asia where things are cheap. | LINK |

| Nov 19 | $612,917.21 | $12,531.21 | 76% | Falling short of my savings goal of 80%. Mostly domestic legs this month with higher costs. Also invested in hydroponics. | LINK |

| Dec 19 | $625,350.00 | $12,432.79 | 76% | Good savings of cash (for development) and investment, however higher spending due to Christmas period (Travel and Gifting). | LINK |

| Jan 20 | $865,212.00 | $239,862.00 | 55% | Super settlement was a HUGE boost to NW. $9K growth from stock market. Expensive month lots with lots of unexpected bills – weddings, travel, Booking flights, fines etc. | LINK |

| Feb 20 | $851,802.0 | -$16,592 (-1.9%) | 52% | Large increase in spending on myself this month, still managed to tuck away $5K to put into shares and property. Corona Virus market scare resulted in a correction and gave NW a small negative trend. Time in the market not Timing the market! Became Single again. | LINK |

| Mar 20 | $819, 354.6 | -$31,806.95 (-3.7%) | 80% | Another small step backwards in the NW due to the ‘corona crash’ in full swing. FIRE Portfolio of ETF/LICs down about 15% this month, however due to high savings rate and structure of my superannuation annuity the NW is only down 3.7%. Savings rate good at 80%, higher than usual income (with some slightly higher spending, too). Picking up shares on discount – this is the best outcome for someone in the accumulation phase with good income! | LINK |

| Apr 20 | $847,023 | +$27,668 | 85% | $11,000 in rebound of stock market capital prices alone (up 6%), plus first quarter dividends paid (heavily reduced due to banks withholding dividends). Great savings rate due to COVID-19 lock-down = no spend. Increased entrepreneurial efforts and selling down of physical possessions provided side hustle income. Two standard paychecks from flying activity; domestic day trips only so no allowances. All cash unfortunately had to go into the property development due to contract timing, I am chomping at the bit to buy some more index funds before they go back up in price too much – hence why I am selling most of my toys! | LINK |

| May 20 | $857,859 | +$10,836 | 92% | Some Great sales as I let go of my Super Sport Motorcycle, Some gym gear, expensive flying equipment and a few other various bits and bobs and invested this money. Flying still reduced, but increasing from April. The share market grew as I continued to make my fortnightly investments. I also wrote down the ‘value’ of some of my possessions (liabilities) such as my car, tools and furniture by around $10K to align them to market price (“tell him hes dreaming…!”). | LINK |

| June 20 | $858,650 | +$791 | 90% | Small Net Worth gain as I continue to declutter and simplify my life, despite being off work due to a family emergency. Share market not doing much. | LINK |

| July 20 | $888,218 | +$29,568 | 68% | Majority gain due to share market going back up, low spending due to being on the family farm and at home because of lock down. | LINK |

| Aug 20 | $1,029,293 | +$141,075 | 74% | Became a millionaire. Achieved this massive milestone I set out for myself in Dec 2019. Included unrealised gains in my property development as well as website business. Good savings rate due to not much spending, invested in Aus and total world shares. Investing in my web business. Starting to shift focus away from $$$ and more into looking after my mental health. | LINK |

| Sep 20 | S1,045,486 | +$16,193 | 60% | Officially took time off work for the rest of the year to be close and look after family during major operations. Continued to sell down physical possessions and work on digital business while at home. NW gain mainly due to valuation of websites. | LINK |

| Oct 20 | $1,064,399 | +$18,913 | 80% | Base income (retainer) and leave loading, dividend and websites provided income, as well as raiding my P2P lending capital. Significant bill for property due to design not meeting standards which effectively lowers my equity position, as well as fence being stolen. | LINK |

| Nov 20 | $1,143,433 | +$80,394 | 82% | Big gains came from share market growth (influencing both the Financial Independence share portfolio and Invested superannuation), Business gains (due to increased earnings) and a $30K boost to my annuity thanks to me logging in and checking the fine-print on the accumulation stats. I only invested around $7K. Insane that in one month, I accumulated nearly more net worth than I did in four years from 2009-2012 | LINK |

| Dec 20 | $1,152,920 | + $9,487.32 | 84% | Share market slight drop, Earnings from Business, Contract work, Selling possessions. No share market investments this month (oops! I forgot and money was tight). Invested a lot into the website business this month (way more than planned) and it is still running at a decent loss (plans to turn it cash flow positive in 3 months). | LINK |

| Jan 21 | $1,165,678 | +$12,757 | 79% | Great returns from the share market. Earnings from Business, Dividends, Flying wage, flipping items on consignment. Regular share contribution, investing in micro investing platforms, P2P lending, Investment property and big reinvestment into the business (still running at a loss) | LINK |

| Feb 21 | $1,135,272 | -$30,406 | 76% | Significant write down on property development due to council DA rejection and redesign requiring more money and creating less equity. Offset by small increase to Business value and investments. Simplified my investments and switched over to Pearler. | LINK |

| Mar 21 | $1,155,594 | +$20,322 | 71% | Continued investment into the portfolio as well as growth of investments and business. Gave my notice at work and looking for part time job at home for ‘Barista FI’ | LINK |

| Apr 21 | $1,242,220 | +$86,727 | 74% | Property development back on track | LINK |

| May 21 | $1,379,469 | +$137,248 | 72% | Massive gains in the website portfolio due to revaluation based on recent business income, big growth of superannuation due to annuity increasing (salary increment) and shares generally went up. Crypto went down by about 40% or so. | LINK |

| June 21 | $1,469,989 | +$89,757 | 41% | Quit flying role and moved to Adelaide. Great month for investments, websites producing serious income so accordingly they are valued higher. Spent a lot on furnishing the new apartment and on enjoying some more luxuries. Seeing a therapist to help deal with anxiety from leaving work. | LINK |

| July 21 | $1,543,959 | +$74,732 | ??? | Set myself up in Adelaide. Did basically nothing for the whole month except spent time with family, relax, sleep and go to doctors appointments. Massive boost to website portfolio AdSense and affiliate incomes, as well as general share market performance. | LINK |

| Aug 21 | $1,624,116 | +$70,156 | ??? | Relaxed again, focused on mental and physical health, and spending time with family and my partner. Big increases to spending (too afraid to calculate a ‘savings rate’) but also big increases to NW through website portfolio income growth. Finally got the slab poured on the investment property (foundation). | LINK |

| Sep 21 | 1,640,663.85 | +$16,547 | ??? | Stocks, super etc went down, but business income from websites increased, plus business valuation increased. Property build. got to frame stage, and I also got a dog! Expenses for vet surgery well worth it. Moved into a nicer apartment | LINK |

| Oct 21 | $1,705,907 | +$65,243 | 30% | Big boost from website valuation due to securing new affiliate contracts for recurring income, shares went up nicely. No massive changes to this month. Calculated a savings rate and found myself pretty low due to spending a lot on my garden and going out quite a lot – I don’t think I will calculate this savings rate figure any more. | LINK |

| Nov 21 | $1,739,144.23 | +$33,236 | N.A. | Great month. Relaxing (somewhat). Spent a lot of money doing ‘fun’ things like winery tours, a fine dining experience and self education. Shares moved sideways (well slightly down) but everything else went up. Building got to enclosed stage (roof, walls, windows and doors) but have had some issues with build quality and weather / covid delays. Put a $1000 deposit on the puppy. | LINK |

| Dec 21 | $1,764,516 | +25,372 | N.A. | Spent nearly the whole month with family, did some work on the website portfolio. Traffic recovered from google algorithm changes. Invested $10K into Stockspot and Sixpark, $1K into ACDC, $100 into Comsec pocket and $100 into Bamboo, $260 into BTC, $4K into ETFs through pearler. Paid the $3000 balance for the puppy. | LINK |

| Jan 22 | $1,826,633 | +$62,117 | N.A | Stock market slightly down, Massive boost to website traffic (overall its more than doubled). Invested $10K VTS, 2K VEU through pearler, Paid for Angels cancer surgery, bought more BTC and ETH, bought a parcel of ETHI on commsec pocket. | LINK |

| Feb 22 | $1,757,210.57 | -$69,422.93 | N.A | Stock market down, Website business revenues down and additional spending on content and staff for business, Additional property development bills, some unexpected expenses, Wrote down the value of some of my personal property (and gave stuff away). |

Captain FI is a Retired Pilot who lives in Adelaide, South Australia. He is passionate about Financial Independence and writes about Personal Finance and his journey to reach FI at 29, allowing him to retire at 30.