Well, this is probably the latest update I have ever pushed, so thanks for bearing with me. There has been a lot happening in the Captain FI household recently, which, if you follow on social media, you might be aware of which grew by one this month! Lots of exciting news, moving, life changes, and studies happening, so read on for all the details…

CaptainFI is reader supported, which means we may be paid when you visit links to partner or featured sites

Monthly Question from the Captain;

Do you ride an Electric scooter to save transport costs? I recently bought one only to find out they are actually illegal to ride here in Adelaide!

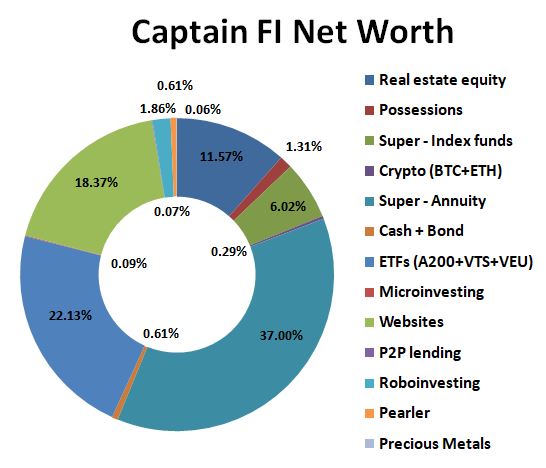

CaptainFI Total Net Worth

CaptainFI Financial progression

CaptainFI personal update: Early Retirement?

This month had a lot of stuff going on. I realised some of which is best not to talk about on here (like relationship stuff) as discretion is the better part of valour, but I certainly want to talk about how my family grew by one (and four legs!).

Angel is a wonderfully natured and snuggly 9 year old Rotty, who came to me through a friend of a friend. She needed to be rehomed, and the thought of her going to a shelter made me really sad. We had a couple of short meetings over the past few months and really hit it off (one of the nights she snuggled with me all night) so it was a great match, and she came home with me.

After a stop at Pet barn for some essentials, she needed a couple of quick checks at the vet, some vaccinations and boosters and then finally the big one – desexing surgery. It was higher risk because of her age, but my friend who is a vet surgeon gave it to me straight and explained why it needed to be done for her wellbeing. She is sitting beside me feeling rather flat, but it is for the best and this massively reduces her risk of Pyo and other health complications at end of life stage. I know she is an older dog, but she is wonderful and playful and I am very happy to have given her a safe, stable and comfy home for her Golden years, and she is wonderful company for me. Especially now that I am effectively ‘Retired’ and don’t have to go galivanting off around the world anymore.

She loves snuggling up to me on the couch, and well, the ‘no dogs in the bed rule’ lasted all of one night so she curls up in a ball on the end of the bed with me each night, and I wake up to a beautiful smile burrowing into my arm pit and pillows. While she recovers and been on her pain meds we have been watching all the dog movies (A dogs journey, a dogs purpose, Marley and Me, Red Dog, Oddball, Beethoven – you name it – and she loves it!) on the new 90″ big screen that came fitted to the new apartment.

Speaking of homes – I actually moved again! I was having a lot of maintenance issues with my ‘new’ apartment, and after something like the 20th tradesperson visit in 3 months, I threw in the towel. I first approached them with a reasonable offer (one months notice, professional clean on vacate and I would allow all inspections and repairs for them to get it fixed up and a new tenant), which they declined, so I had to lodge an official complaint, numerous section 68 maintenance orders and then finally submit a case to the tribunal to have the contract ended.

My ‘new’ place is freaking awesome – I am renting it off a friend, and it is actually way bigger, more modern, and actually even cheaper than the last apartment. I also have a much much bigger balcony space, which means I can buy more plants! He is a caterer, so it has a professional grade commercial kitchen with a double oven and six burners, and a huge fridge freezer set up, with all of the appliances you can think of (as well as these cool block out electric blinds, an even more massive TV than my old apartment. I figure my electric bills will be going up by living here haha, but I can’t wait to get stuck into some serious cooking and dinner parties with all this space. Is this lifestyle inflation?

Our family had some awesome news regarding my Mums immunotherapy – it was showing signs of becoming ineffective and she was getting quite sick with lots of UTI’s, but after an aggressive few rounds of antibiotics she is feeling much better and her tumours have even shrunk by another 3mm on the MRI scans! We are celebrating by booking some first class tickets on the Ghan from Adelaide to Darwin for a 3 day luxury rail journey to go and visit family, and then flying home back to Adelaide. Fingers crossed the borders remain open.

I have also been working heaps behind the scenes on Podcasting, and have recorded a BUNCH of awesome episodes, including one on online business with the CEO of a highly successful digital marketing agency, and also one with Pat from SixPark (a veteran investor and CEO of multi million dollar company with over 3 decades in the finance and investing industry under his belt). I am working with the team here at CaptainFI.com to get them all edited and cued up to come out over the rest of the year which is really exciting. I know I have been a bit slack in terms of continuity, but I am still having fun and doing it behind the scenes, and can’t wait to get them all polished and out for you.

I have also started doing the eBusiness Institute Champions course – this was a massive step up for me after doing WebDev, Digital Investors and the Words of Wealth mindset program. It is a huge time commitment too – one of the reasons I have been so busy this month. I am learning how to build my portfolio of sites, grow traffic faster, and monetise more effectively. Champions is basically a 1:1 mentoring package with Matt and Liz Raad (link to podcast interview), and after I got to interview them, learn the basics on DI and then see some great results from that, I am doubling down and going all out.

It has me reflecting on ‘is this actually early retirement or have I just changed jobs?’, however I am building a business that provides a stream of semi-passive and time leveraged income. Outsourcing and working smarter, means I will be able to buy my dream farm in a few years and smash off the mortgage ASAP, all whilst having time for rest, relaxation, recreation and family.

I really miss flying and my old life, but have been working through this with my therapist and GP. I’m slowly weening off the anti-depressants and am off the anti-anxiety meds, which is great. I still am taking some pain killers for my neck/back but with regular physio and some upcoming surgery this should be sorted by the end of the year and I should be pain free! I am thinking about starting Gliding again next year for sport, as well as getting back into a little bit of ad-hoc flying instructing to keep my finger in the pie so to speak (it really is such a fun hobby, especially down over the beaches on a lovely spring day).

This month I did a lot of personal growing, and I found a lot of closure in writing letters to three of my ex-partners (I have only really had a three other serious relationships) basically accepting, forgiving, explaining and apologising for what happened (and in a nutshell, what happened was I prioritised my career and drove them away). I have been offered by my Doctor to spend some time at a therapy facility / wellness retreat to help overcome some past traumas, which I am seriously considering but am a little hesitant about just because of now having the dog as well as all my plants etc – may end up needing a house sitter.

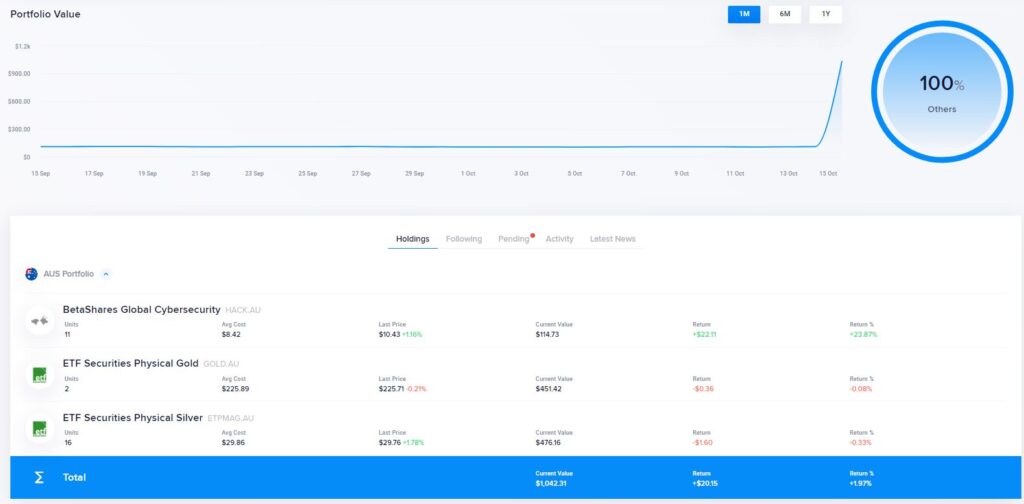

This month I also bought some direct shares in Gold and Silver ETFs to track their performance against the other asset classes in the portfolio.

For more information on how I am planning for Early Retirement you can read my dedicated transition to retirement financial planning process article. Although to be honest, with the success of the website portfolio, I may need to revisit this.

Captain FI Investments

My investments are split between nine investment ‘areas’. I decided to start reporting on the progression and performance of each of my investments separately so we can find the best way to Financial Independence once and for all.

- ETF ‘FIRE’ Portfolio (Global, US and AUS Index fund ETFs)

- Hands-free Automated Investing (Roboadvisors)

- Cryptocurrency (BTC and ETH)

- Microinvesting (including Stock picking)

- Real Estate

- Peer to Peer lending

- Website Portfolio (Online businesses)

- Angel Investing (Pearler)

- Precious Metals (Gold and Silver)

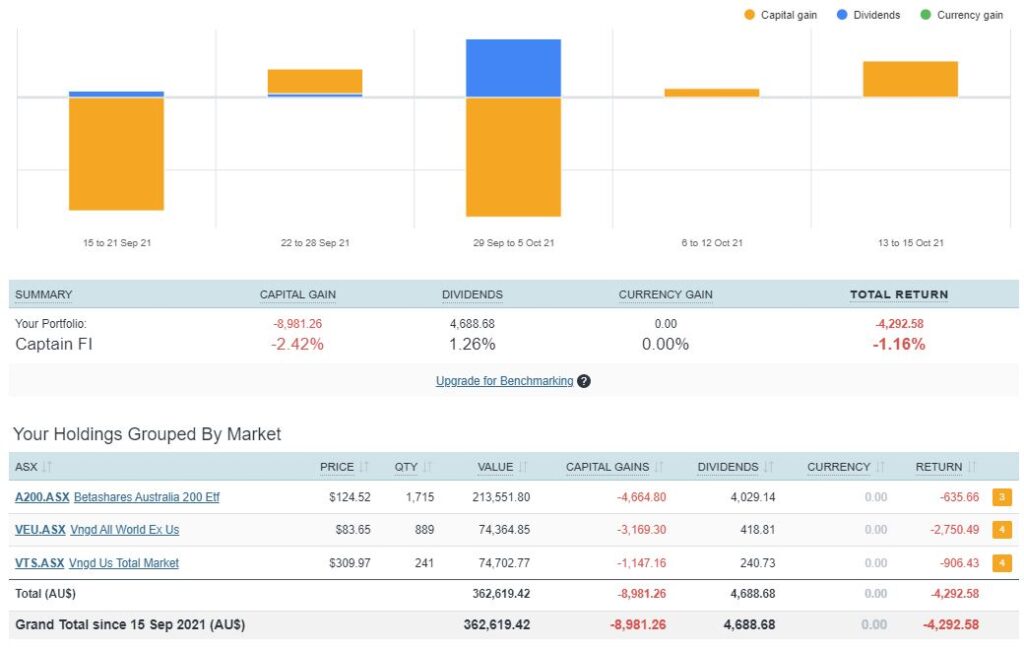

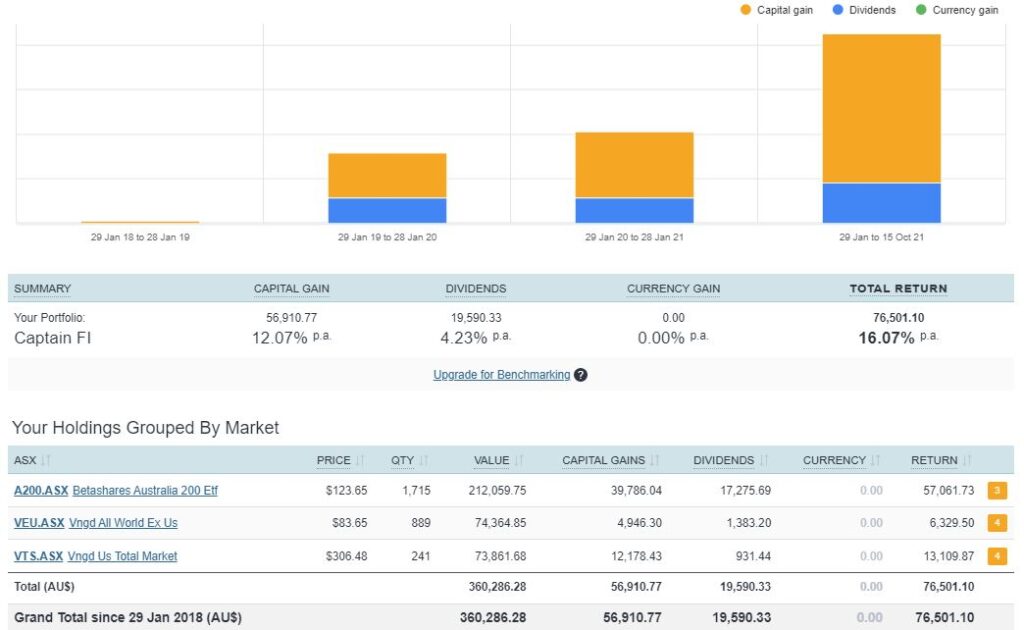

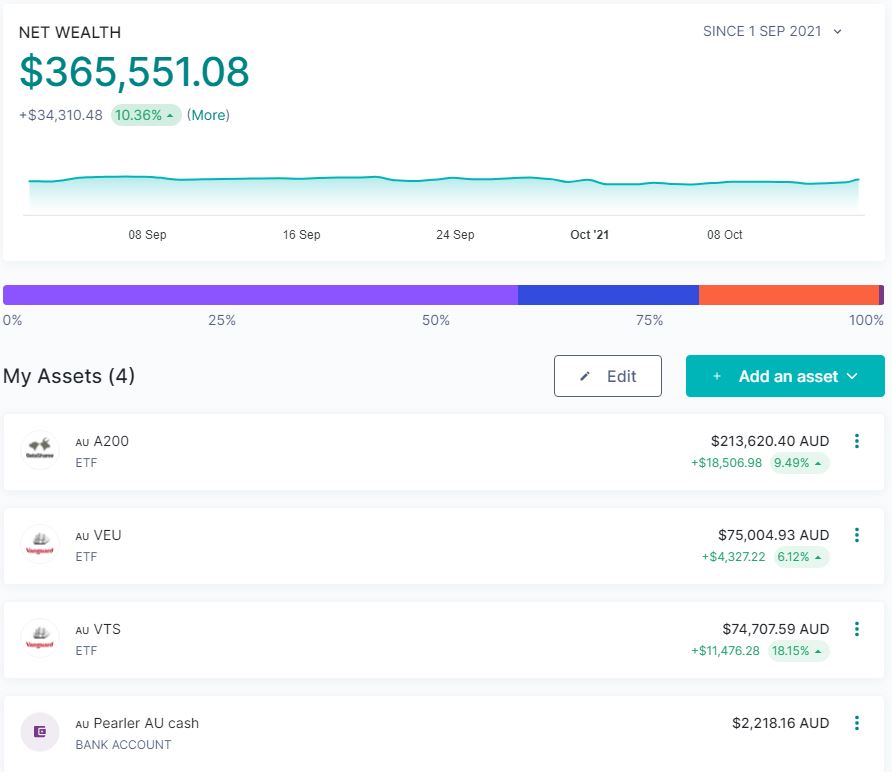

ETF ‘FIRE’ Portfolio

My Financial Independence ETF Portfolio is a simple, low-fee passive portfolio which is split between three index tracking Exchanged Traded Index Funds (ETFs):

- I now have this portfolio fully automated through Pearler which has been a huge gamechanger for me and a massive weight off my mind

- I track my share portfolio using Sharesight, which means my accounting is also completely hands free using the Pearler API plugin.

- This means I pretty much only need to log in to confirm all the trades and dividends over the year when needed for my tax return, however I also choose to log in each month to produce these monthly updates for you guys.

- I have had questions about the tax efficiency of VTS and VEU due to the double tax or withholding tax drag because they are US domiciled funds. This is something I will be looking into. My limited understanding at the moment is that this tax drag creates an ‘effective MER’ of closer to 0.5% which might mean there may be a lower cost alternative that is better than these ETFs – something I will be investigating.

Portfolio vs Target – Pearler chart

I am still heavy on Australian shares through the A200 fund because I was chasing the franked dividend yields for a baseline level of income stability for Financial Independence. I am now working to balance this home bias concentration risk by an automated purchasing of VTS and VEU through Pearler.

I have also made a $10,000 ‘Angel Investment’ into Pearler. This is a private equity investment into the actual brokerage tech company itself.

Hands-free Automated Investing Portfolio

The Hands-free Automated Investing Portfolio is a combination of the two largest Online investment advisors in Australia – Stockspot and SixPark. I think they are both pretty damn good, and to stay accountable I wanted to hedge my bets with an investment in both. This way I can analyse the performance of each against one another – comparing the results of asset allocation, and Chris Brycki’s choice to diversify with gold, against Pat Garratts’ choice to diversify with property and infrastructure.

This month, Sixpark is in the lead which dropped in value by less than how much Stockspot dropped.

I’m pretty excited to say I was able to record a pod episode with Chris from Stockspot recently and I am working to get it edited and released for you all ASAP. I have also been chatting to Pat from SixPark who turns out is a really good bloke and very switched on financially, and we also recorded a podcast which I will release soon too.

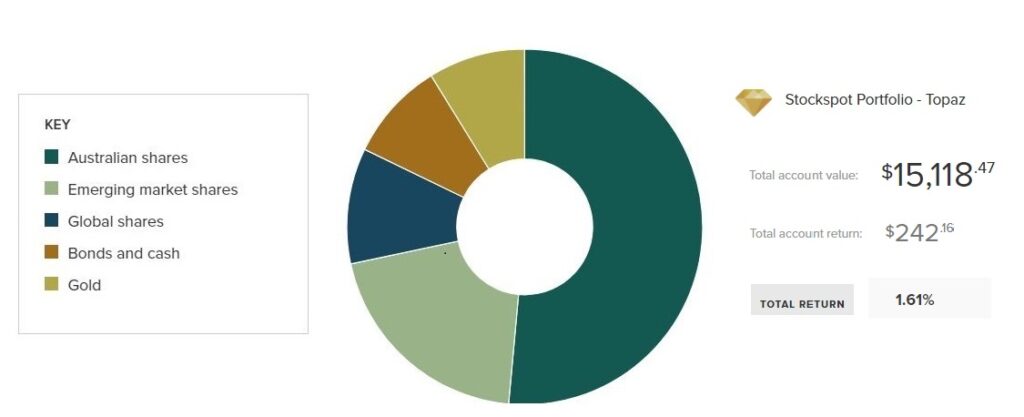

Stockspot

After a successful trial with the Stockspot roboadvisor platform where they allocated me the Topaz portfolio (which is their most aggressive portfolio), I have increased the balance to $10K and am letting it compound away. After realising some great gains in the website portfolio, I am ready to make another $5K investment into Stockspot (and will do the same into SixPark to keep it even for the comparison) – however I need to sort out the tax owed on the website income and set that aside first.

If you want to learn more about Stockspot, check out the dedicated review I did on Stockspot – which I will be keeping updated with all the lessons from my personal use trial.

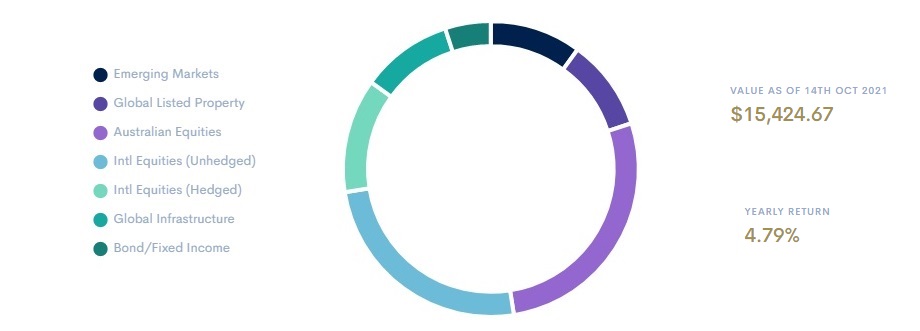

SixPark

The Six Park online investment is going well too, slightly out performing Stockspot this month. I will add another $5K to this portfolio shortly, too. This month I recorded an awesome podcast with Pat Garrett, CEO of SixPark (and someone with some INSANE financial credentials after over 3 decades dominating the industry).

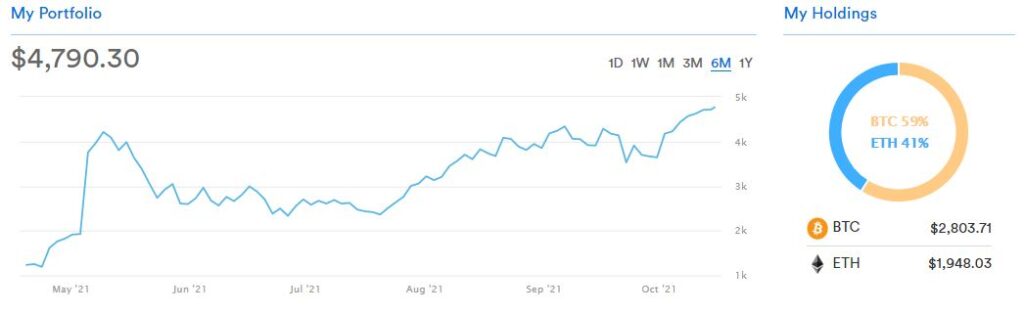

Cryptocurrency Portfolio

Crypto seems to back on a small bull run, I didn’t add anything this month because I forgot. I need to set up an automatic transfer from my bank into coinspot which will make it easier to stick to my goal of DCA into Bitcoin and Ether.

I did a podcast episode on Bitcoin with Stephan Livera if you are interested to learn more about it, and also did an interview with Andrew Fenton from the CoinTelegraph where we talked a lot about crypto and its application on the Financial Independence Journey

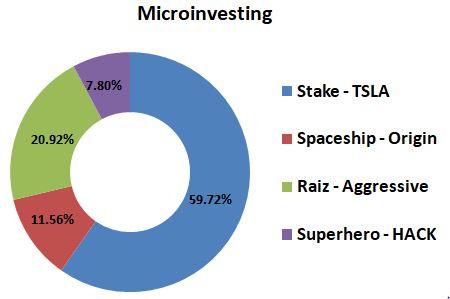

Micro-investing Portfolio

I have been playing with four of the biggest microinvesting platforms mainly just as research for the blog, because I want to see how they all stack up against each other, and against the other portfolio’s in terms of % gains.

Its not strictly speaking a true comparison though because they don’t even hold the same investments at all. Really it is just a bit of fun stuffing around with them, including a bit of speculative stock picking, and really gives me some more background knowledge and familiarity for my reviews and when people ask me about how to get started investing using microinvesting platforms.

Its not a huge amount of money, but has grown to $1500 which I think shows the power of small amounts adding up over time.

I will soon be adding Commsec pocket to the mix – let me know which of the 7 ETFs you’d like me to try.

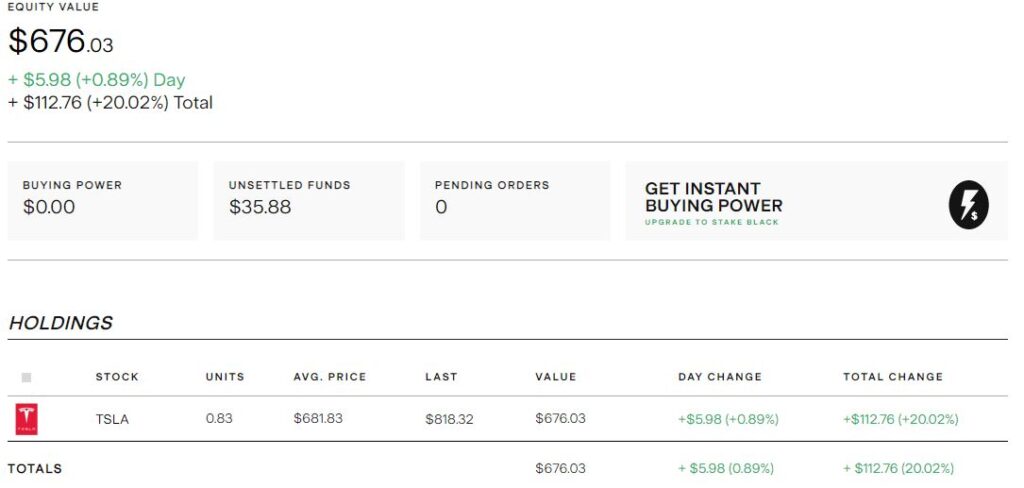

Stake Invest

I just decided to go all in on Tesla (Elon Musk’s electric car company) through Stake. Its interesting as this is on the US stock market, so the currency fluctuation affects the value of the investment in Australian dollars, so its kind of a fun way to learn about currency risk and hedging. Some strong performance recently making it dominate the microinvesting portfolio

Raiz Invest

Raiz aggressive portfolio – good split of ETFs, and a cheap option for small-ish balances at only $3.50 per month. To be honest the fee’s are more than my investment return, but the round ups from spending and the occasional affiliate click sign up bonus usually more than covers any fees, making it a weird pseudo-investment-pseudo-savings kind of account.

Superhero Trading

I didn’t do any trading on Superhero this month, just left my HACK shares to do their thing. I might have a look at some ethical ETFs on superhero over the next few months, but the HACK ETF has gone up by 24% since I bought it. I bought the Gold and Silver ETFs, and will be looking to add some other more speculative picks like ‘gold miners’ and ‘lithium stocks’ etc in here to see how they fair.

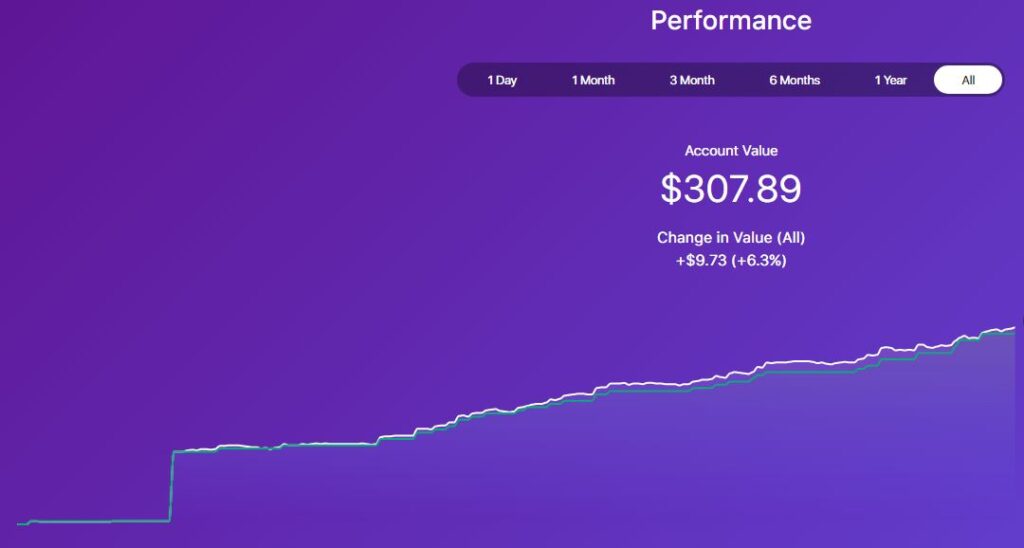

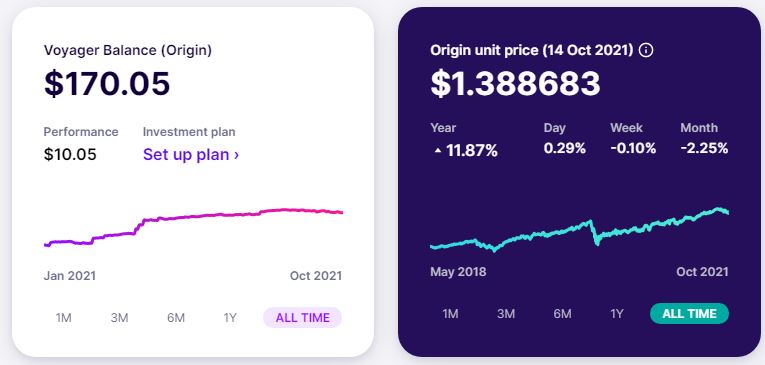

Spaceship Voyager Invest

Spaceship Origin portfolio: Top 100 Global Blue chip ETF. This seems to be going alright but If I am honest, for a speculative punt I should have probably gone for the Universe portfolio which seems to be having insanely high gains – I am hoping the origin portfolio might be more stable though. Latest screenshot below.

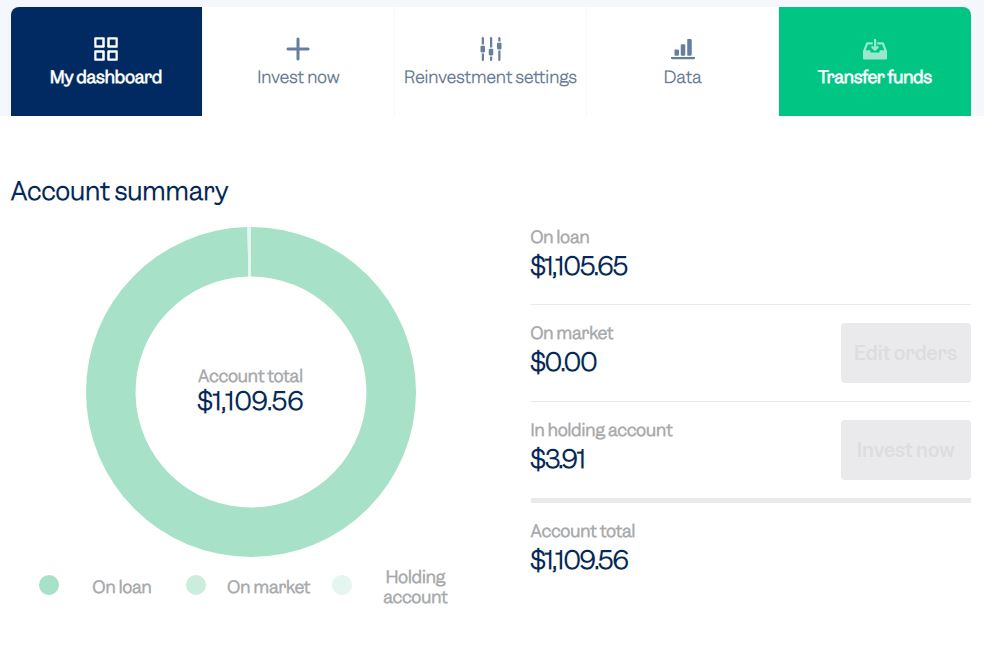

Plenti P2P lending

Plenti Peer to Peer lending account. I have it all set to auto reinvest and over time it should slowly grow, but it is good to know that I can either switch the auto invest off and have that drop into my account within a month, or I can just forfeit monthly interest and do an early withdrawal of whatever is on loan in case I ever need to quickly access the cash. This forms part of my emergency fund (the rest is in the bank).

Investment property

Once the slab was done, progress has been much quicker. The frame is up and we are hoping to have it clad and roofed soon so that it is water tight. Unfortunately the builder has stated there will be a six month project slide, so it is not looking like this will be completed until at least mid 2022, meaning tenants won’t be until the second half of the year (the flow on effect being not being able to refinance until after then, and so wont be able to get the farm till at *least* 2023 – but that is probably not the worst thing, as it makes me sit on my hands and research much better next time)

It has taken a long time to get to this point, and boy have we made some embarrassing mistakes; including but not limited to…

- Thinking we could save money by NOT using an architect on a house and land package we bought from a developer *WITHOUT DA* from council

- Falling for the oldest trick in the book re: portable fencing hire (the fencing hire company stole the fences back and then tried to charge us for having them stolen)

- Endless delays by not having DA and needing to relodge with council three times meant we were one of the last blocks to be built on, and hence became the neighbourhood ‘free rubbish dumping ground’ which we then had to pay to get the rubbish removed and pay tip fees for (A big fuck you to any dodgy builders reading this who have ever engaged in this practice)

- COVID-19 delays and supply restrictions and union activity meant the builder essentially got a free pass to break contract schedule, putting us back by an extra six months with no penalty, compensation or damages payable – this further took money away from the ‘bottom line’ and made the build less profitable (would have been better to stick money into index funds)

I have not changed any of the valuations, still going off the banks final completed estimation of $560K, and with the mortgage the way it is leaves me with about $190K of equity in the build. This will come in handy after completion and tenancy as I will likely be able to access some of this equity during a refinance towards buying the dream farm in the Adelaide Hills.

Online Business (websites)

My websites continued to amaze me with September being my biggest month yet. Of course, this fluctuates depending on traffic, affiliate sales and downloads but holy shit, this thing is insane.

As I mentioned above, I am doing the Champions course now, with the aim to really double down and cement my website business income through portfolio sites, as well as diversify into more websites, as well as through more affiliate programs. It sort of worries me that most of my sites are monetised through Google and Amazon as this seems like a business risk if either of those two companies boot me off the programs, so I will be endeavouring to partner with as many more individual income sources and partners as possible.

My goal is to purchase a completely new website later this year, and renovate it to keep for income. Which I am looking forward to doing through the champions course with Matt and Liz’s close guidance. Otherwise, I will continue to ramp up content production across the portfolio in order to keep the views going up, and positive trends on google and on business income.

I have done a pretty comprehensive review of the eBusiness institute as well as interviewed Matt and Liz Raad about this on the podcast about online business and websites if you want to learn more about this lucrative side hustle. They provide a free introductory course for CaptainFI readers. I have also recently interviewed Liz Raad again on the pod about entrepreneurship, which is live now.

Angel Investing

Currently I have made an ‘Angel Investment’ in the Financial Independence brokerage company Pearler. This was the maximum allowable private investment of $10,000 (AUD) made in July 2021 with the number of ‘private equity’ shares based on their June company valuation.

This helps to fund Pearler’s capital investment pool and lets them grow and build their business – which is great for me since I have nearly $400K invested through them and I trust them to automate my investing for me.

As Pearler grows and builds its revenue, it will get an increasingly higher company valuation and my private equity will grow accordingly (i.e. it is not a free $10,000 loan, it is a $10,000 investment where I am buying a slice of the company).

Whilst this doesn’t align with my general investing philosophy of index investing and diversification, I feel I have a unique insight into Pearlers organisational and company structure and build a great rapport and trust with their executives, and I believe in this company and its genuine intentions to help people reach financial independence.

Also realise that while $10,000 does sound like a lot of money, but this is a small overall percentage of my total investments so my personal risk is actually quite low, and I would not encourage anyone to go out and make $10,000 Angel investments into tech startups. It is generally quite high risk (high risk = high reward). Make sure you don’t compare your financial ‘race’ with others (just think of it like a time trial where you are only competing with yourself)

Precious Metals

Precious Metals is a new area for this month. I split $1000 into half Gold (ASX:GOLD) and half silver (ASX:ETPMAG) ETF’s. Lets see how they go! Just to keep them separate from my other investments I have actually done this through Superhero, although this may somewhat undermine (pun intended) the point of holding precious metals. The main reason I did this is to simply force myself to pay attention and track the Gold and Silver prices through these popular Gold and Silver ETFs – so I can then compare them to the performance of the other parts of the portfolio.

There is also an ulterior motive which is to force myself to keep a little bit of “dry powder” in case there seems to be another big market correction, my plan is to watch these metal ETFs go to the moon, then sell them and use the money to buy stock market ETFs. I wonder if it will work out or if it will be a big flaming pile of poo – only time will tell!

Cash / emergency fund

Had no deliberate plans to hold this much cash this month, but found myself sitting on around $10K. Mostly because I was too busy / lazy to actually do anything with it so just let it sit there. Should also be getting my bond refund and rental refund for my old apartment too, which will be nice. My plan will just be to throw any surplus cash into a mix of Stockspot and SixPark, as well as a few other little speculative investments, and I will begin to ‘beef’ up the mortgage offset account since I am now paying interest as the construction loan is being drawn out, and I want to have a nice little buffer before it is finished and tenanted just in case of emergencies. I am thinking $20K would be a solid amount for the offset – along with appropriate insurances – what do you think?

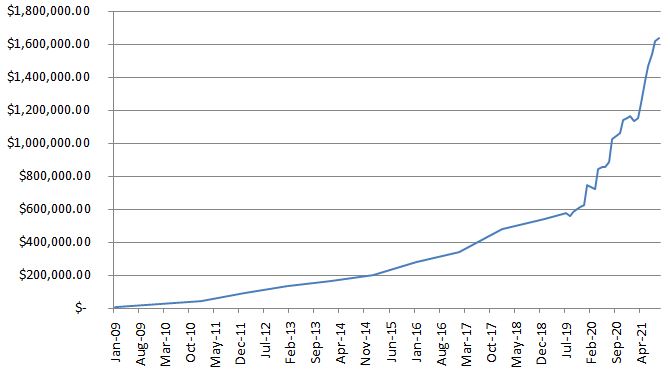

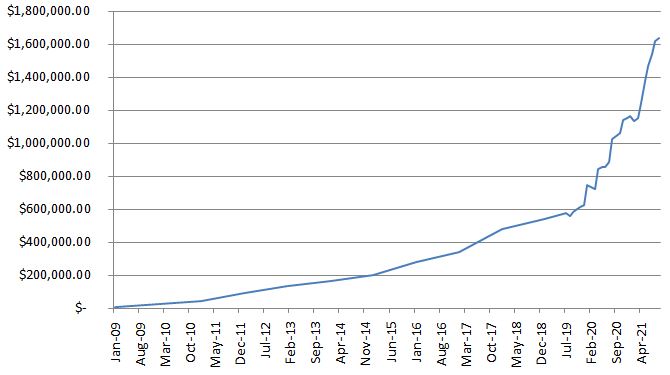

Captain FI net worth progression

The net worth progression graph is rather crudely constructed in Excel, but still demonstrates the ‘somewhat exponential’ journey over the past 13 years. You can access the archives for my Net Worth updates here to see how its gone over time.

| Date | Net worth | Difference | Saving Rate | Notes | |

| Jan 09 | $5,000.00 | ? | Estimate NW based on historical Super, Bank statements and assets at the time | LINK | |

| Jan 10 | $24,000 | +$19,000 | ? | Estimate NW | LINK |

| Jan 11 | $40,000 | +$16,000 | ? | Estimate NW | LINK |

| Jan 12 | $92,000 | +$50,000 | ? | Estimate NW | LINK |

| Jan 13 | $130,000.00 | +$38,000 | ? | Estimate NW | LINK |

| Jan 14 | $161,000.00 | +$31,000 | ? | Estimate NW | LINK |

| Jan 15 | $200,000.00 | +$39,000 | ? | Estimate NW | LINK |

| Jan 16 | $281,000.00 | +$81,000 | ? | Estimate NW | LINK |

| Jan 17 | $340,000.00 | +$59,000 | ? | Estimate NW | LINK |

| Jan 18 | $482,000.00 | +$142,000 | ? | Estimate NW | LINK |

| Jan 19 | $542,000.00 | +$60,000 | ? | Estimate NW | LINK |

| Jul 19 | $578,900.00 | +$36,900 | 84% | Finally began tracking NW this like a proper adult. | |

| Aug 19 | $560,100.00 | -$18,800.00 (-3.2%) | 78% | Share market slight correction, Ok savings. | |

| Sep 19 | $584,744.88 | $24,644.88 | 72% | Share market rebound, savings rate not so good. | LINK |

| Oct 19 | $600,386.00 | $15,641.12 | 84% | Good saving this month. Normal salary, plus allowances, dividends from index funds, tax refund, eBay selling and was working abroad in asia where things are cheap. | LINK |

| Nov 19 | $612,917.21 | $12,531.21 | 76% | Falling short of my savings goal of 80%. Mostly domestic legs this month with higher costs. Also invested in hydroponics. | LINK |

| Dec 19 | $625,350.00 | $12,432.79 | 76% | Good savings of cash (for development) and investment, however higher spending due to Christmas period (Travel and Gifting). | LINK |

| Jan 20 | $865,212.00 | $239,862.00 | 55% | Super settlement was a HUGE boost to NW. $9K growth from stock market. Expensive month lots with lots of unexpected bills – weddings, travel, Booking flights, fines etc. | LINK |

| Feb 20 | $851,802.0 | -$16,592 (-1.9%) | 52% | Large increase in spending on myself this month, still managed to tuck away $5K to put into shares and property. Corona Virus market scare resulted in a correction and gave NW a small negative trend. Time in the market not Timing the market! Became Single again. | LINK |

| Mar 20 | $819, 354.6 | -$31,806.95 (-3.7%) | 80% | Another small step backwards in the NW due to the ‘corona crash’ in full swing. FIRE Portfolio of ETF/LICs down about 15% this month, however due to high savings rate and structure of my superannuation annuity the NW is only down 3.7%. Savings rate good at 80%, higher than usual income (with some slightly higher spending, too). Picking up shares on discount – this is the best outcome for someone in the accumulation phase with good income! | LINK |

| Apr 20 | $847,023 | +$27,668 | 85% | $11,000 in rebound of stock market capital prices alone (up 6%), plus first quarter dividends paid (heavily reduced due to banks withholding dividends). Great savings rate due to COVID-19 lock-down = no spend. Increased entrepreneurial efforts and selling down of physical possessions provided side hustle income. Two standard paychecks from flying activity; domestic day trips only so no allowances. All cash unfortunately had to go into the property development due to contract timing, I am chomping at the bit to buy some more index funds before they go back up in price too much – hence why I am selling most of my toys! | LINK |

| May 20 | $857,859 | +$10,836 | 92% | Some Great sales as I let go of my Super Sport Motorcycle, Some gym gear, expensive flying equipment and a few other various bits and bobs and invested this money. Flying still reduced, but increasing from April. The share market grew as I continued to make my fortnightly investments. I also wrote down the ‘value’ of some of my possessions (liabilities) such as my car, tools and furniture by around $10K to align them to market price (“tell him hes dreaming…!”). | LINK |

| June 20 | $858,650 | +$791 | 90% | Small Net Worth gain as I continue to declutter and simplify my life, despite being off work due to a family emergency. Share market not doing much. | LINK |

| July 20 | $888,218 | +$29,568 | 68% | Majority gain due to share market going back up, low spending due to being on the family farm and at home because of lock down. | LINK |

| Aug 20 | $1,029,293 | +$141,075 | 74% | Became a millionaire. Achieved this massive milestone I set out for myself in Dec 2019. Included unrealised gains in my property development as well as website business. Good savings rate due to not much spending, invested in Aus and total world shares. Investing in my web business. Starting to shift focus away from $$$ and more into looking after my mental health. | LINK |

| Sep 20 | S1,045,486 | +$16,193 | 60% | Officially took time off work for the rest of the year to be close and look after family during major operations. Continued to sell down physical possessions and work on digital business while at home. NW gain mainly due to valuation of websites. | LINK |

| Oct 20 | $1,064,399 | +$18,913 | 80% | Base income (retainer) and leave loading, dividend and websites provided income, as well as raiding my P2P lending capital. Significant bill for property due to design not meeting standards which effectively lowers my equity position, as well as fence being stolen. | LINK |

| Nov 20 | $1,143,433 | +$80,394 | 82% | Big gains came from share market growth (influencing both the Financial Independence share portfolio and Invested superannuation), Business gains (due to increased earnings) and a $30K boost to my annuity thanks to me logging in and checking the fine-print on the accumulation stats. I only invested around $7K. Insane that in one month, I accumulated nearly more net worth than I did in four years from 2009-2012 | LINK |

| Dec 20 | $1,152,920 | + $9,487.32 | 84% | Share market slight drop, Earnings from Business, Contract work, Selling possessions. No share market investments this month (oops! I forgot and money was tight). Invested a lot into the website business this month (way more than planned) and it is still running at a decent loss (plans to turn it cash flow positive in 3 months). | LINK |

| Jan 21 | $1,165,678 | +$12,757 | 79% | Great returns from the share market. Earnings from Business, Dividends, Flying wage, flipping items on consignment. Regular share contribution, investing in micro investing platforms, P2P lending, Investment property and big reinvestment into the business (still running at a loss) | LINK |

| Feb 21 | $1,135,272 | -$30,406 | 76% | Significant write down on property development due to council DA rejection and redesign requiring more money and creating less equity. Offset by small increase to Business value and investments. Simplified my investments and switched over to Pearler. | LINK |

| Mar 21 | $1,155,594 | +$20,322 | 71% | Continued investment into the portfolio as well as growth of investments and business. Gave my notice at work and looking for part time job at home for ‘Barista FI’ | LINK |

| Apr 21 | $1,242,220 | +$86,727 | 74% | Property development back on track | LINK |

| May 21 | $1,379,469 | +$137,248 | 72% | Massive gains in the website portfolio due to revaluation based on recent business income, big growth of superannuation due to annuity increasing (salary increment) and shares generally went up. Crypto went down by about 40% or so. | LINK |

| June 21 | $1,469,989 | +$89,757 | 41% | Quit flying role and moved to Adelaide. Great month for investments, websites producing serious income so accordingly they are valued higher. Spent a lot on furnishing the new apartment and on enjoying some more luxuries. Seeing a therapist to help deal with anxiety from leaving work. | LINK |

| July 21 | $1,543,959 | +$74,732 | ??? | Set myself up in Adelaide. Did basically nothing for the whole month except spent time with family, relax, sleep and go to doctors appointments. Massive boost to website portfolio AdSense and affiliate incomes, as well as general share market performance. | LINK |

| Aug 21 | $1,624,116 | +$70,156 | ??? | Relaxed again, focused on mental and physical health, and spending time with family and my partner. Big increases to spending (too afraid to calculate a ‘savings rate’) but also big increases to NW through website portfolio income growth. Finally got the slab poured on the investment property (foundation). | LINK |

| Sep 21 | 1,640,663.85 | +$16,547 | ??? | Stocks, super etc went down, but business income from websites increased, plus business valuation increased. Property build. got to frame stage, and I also got a dog! Expenses for vet surgery well worth it. Moved into a nicer apartment |

Captain FI is a Retired Pilot who lives in Adelaide, South Australia. He is passionate about Financial Independence and writes about Personal Finance and his journey to reach FI at 29, allowing him to retire at 30.

Hi captain, congrats. Yes I have bought a scooter in Radelaide also and am riding sensibly with helmet and giving way to pedestrians for transport. I was not aware that they are illegal officer. There are lots around the cbd be beach paths. I did not know they had to be registered, insured, licenced as the retailer did not inform me. Good luck

Thanks mate. Yeah I was a bit blown away by the scooter laws. The policeman did say they target people riding dangerously (such as two people on one scooter, or not wearing helmets) so I think if you do the right thing you can sneak under the radar, but then if there is an accident you could be legally liable for medical bills and property damage. I have written to my MP and reckon you should do the same, they should just be treated the same as ebikes really.

Hey captain, well done again! I don’t know what it is but there is something addictive to watching someone else’s net worth progress over time. The 6 month delay is no doubt frustrating – I believe builders have experienced some sharp price increases on materials of late. A lot of them are losing money on contracts they signed a year before due to the increases. As always, I enjoyed the update. Keep it up!

Thanks Sam, I too am guilty of stalking all the other people publishing their NW updates. The FI Explorer is one of my favourites https://www.thefiexplorer.com/