Woolworths Pet Insurance can be a way of protecting your pet’s health while protecting your bank balance against bill shock from unexpected vet bills. But is it really worth it? Read on for my full Woolworths pet insurance review..

Woolworths Pet Insurance, (now called Everyday Insurance) is one of a growing number of players in the pet insurance space. Woolworth Pet Insurance has a range of options under Woolworth’s Everyday Insurance brand.

The following Woolworths Pet Insurance review looks at the products on offer and weighs up the pros and cons of investing in pet insurance, to help keep your fur baby, and wallet, healthy.

The Good

- Competition in the pet insurance market means premiums are becoming competitive

- Peace of mind that the bulk of some unexpected bills will be covered

- Affordable premiums, in the early years

- Extra services such as VetAssist and GapOnly payment options

- Option to claim on well-being services such as vaccines and dental

- Lifetime cover

- They have a pet insurance info hub with heaps of helpful articles

- Winner of Canstar’s Outstanding value awards

The Bad

- Premiums get more expensive the older your pet gets, and when they are likely to need it most

- Premiums go up every year and if you make a claim, they can become expensive

Verdict: If you do choose to go with a pet insurer, Woolworths is a good option, with competitive premiums, but in my opinion, a large Emergency Fund is the best option.

CaptainFI is not a Financial Advisor and the information below is factual review information, not financial advice. This website is reader-supported, which means we may be paid by advertising on the site, or when you visit links to partner or featured sites. For more information please read my Privacy Policy, Terms of Use, and Financial Disclaimer.

Introduction

As with any insurance product, pet insurance helps protect against what might happen in the future. For some people, this offers peace of mind and guards against bill shock from unexpected vet bills due to illness or accident. Building a large Emergency fund can also help protect against unexpected bills of any sort, so it’s up to you to decide whether any pet insurance is worth it for you or not. You can read my article on Barefoot Investor buckets HERE which details where I put my Emergency fund and the Barefoot Bucket strategy for money management.

What does Woolworths Pet Insurance cover?

Woolworths Pet Insurance1 offers a number of options when it comes to health insurance for your pet, from the Everyday Insurance brand.

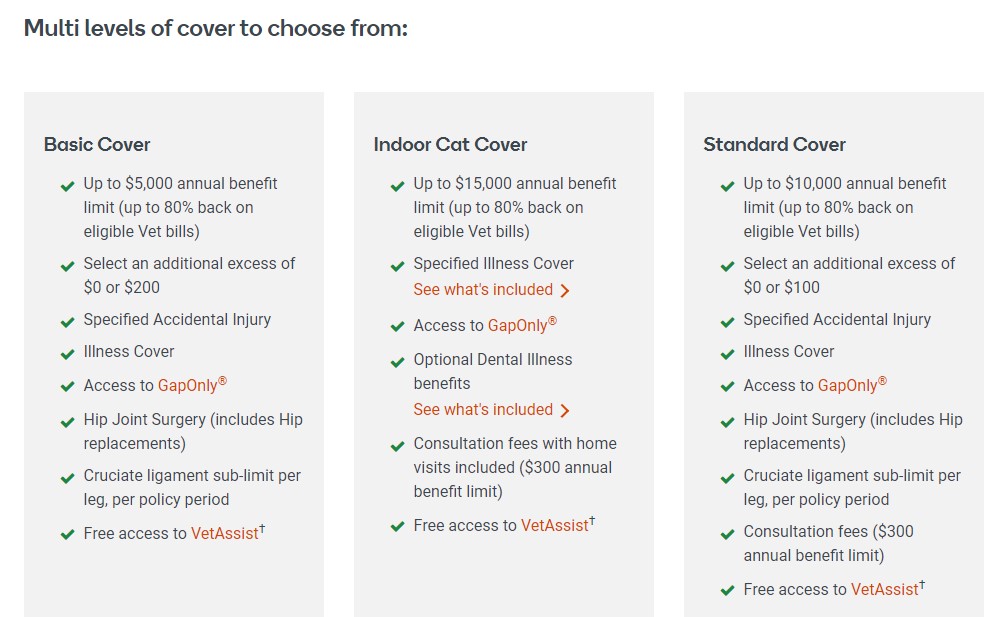

- Basic cover – up to an annual benefit limit of $5000, up to 80% back on eligible vet bills, choice of excess from $0 to $200 to lower your premium, access to a vet 24/7 through VetAssist for chat or video online, access to GapOnly so you only pay the gap, plus illness cover, specified accidental injury, and a limited number of surgeries such as hip joint and cruciate ligament procedures.

- Standard cover – the benefits of Basic cover with a few differences, such as up to an annual benefit limit of $10 000, option for an additional excess from $0 – $100 and claim on consultation fees up to $300 per year.

- Comprehensive cover – the benefits of Standard cover, but up to $24 000 per year of benefits and optional routine care benefits such as vaccinations.

- Comprehensive Plus cover – the benefits of Comprehensive cover, but with up to $30 000

- Pet-specific Woolworths Pet Insurance, such as Indoor Cat Cover

Keep in mind, your insurance premium will go up every year as your pet ages.

How does Woolworths Pet Insurance work?

Woolworths Pet Insurance works by assisting in covering costs in relation to eligible vet care when it comes to injury or unexpected illness. You pay a premium for the level of cover you want and then can claim back some of the cost of the bills.

Woolworths Pet Insurance comes with a gap only payment option, where some vets will let you pay just the gap and they get the rest from the insurer. This means you don’t have to find all the money up front to pay the bill, in order to make the claim.

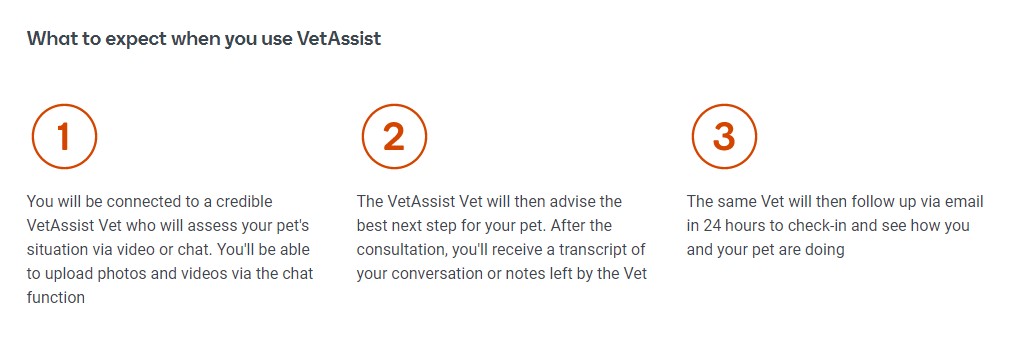

Woolworths Pet Insurance also offers VetAssist, with video and chat, giving you 24/7 access to vet advice online.

You can read the AVA (Australian Vet Association)’s guide to Pet Insurance HERE2.

How much is Woolworths Pet Insurance?

Woolworths Pet Insurance premiums depend on a number of factors, such as type of pet, age of pet, range of cover and whether you pay an excess.

For example, for a 6 month old Labrador puppy, the annual premiums with no excess are: Basic $712, Standard $876, Comprehensive $929 and Comprehensive Plus $938. There are options to pay yearly, monthly or fortnightly. The top excess option in each category reduces annual premiums to: Basic $416, Standard $654, Comprehensive $692 and Comprehensive Plus $404.

You can read my article HERE on the Real Cost of Dog Ownership.

Options get more sparse and expensive, the older your pet is. That puppy at 10yrs old would only be eligible for Basic cover, with an annual premium with no excess of $3 480, or $2 213 a year with a $200 excess. Again, payment options are yearly, monthly or fortnightly.

Is there a waiting period with Woolworths pet insurance?

Yes, there are waiting periods for different conditions such as 30 days for conditions in the Illness or Specified Illness clauses, 6 months for cruciate ligament conditions and other waiting periods depending on cover.

Who is Woolworths Pet Insurance underwritten by?

Woolworths Pet Insurance is underwritten by Hollard Insurance. Hollard is a privately owned insurance company that was founded in South Africa in 1980. Hollard offers insurance products in life insurance and short-term insurance, such as pet insurance.

Where are they based?

While Woolworths Pet Insurance is underwritten by the South African Hollard insurance company, its Australian offices are listed as being in Chatswood, New South Wales.

Advantages of Woolworths Pet Insurance

- Competition in the pet insurance market means premiums are becoming competitive

- Peace of mind that the bulk of some unexpected bills will be covered

- Affordable premiums, in the early years

- Extra services such as VetAssist and GapOnly payment options

- Option to claim on well-being services such as vaccines and dental

- Lifetime cover

- They have a pet insurance info hub with heaps of helpful articles

- Winner of Canstar’s Outstanding value awards

Disadvantages of Woolworths Pet Insurance

- Premiums get more expensive the older your pet gets, and when they are likely to need it most

- Premiums go up every year and if you make a claim, they can become expensive

CHOICE have an interesting article on the Pros and Cons of Pet Insurance which you can read HERE3.

Does Captain Fi have pet insurance?

No. I have never had any pet insurance for any of my dogs, I prefer to build up a juicy Emergency Fund and use that in the case of any vet bills or unexpected expenses. You can read my article HERE on 11 ways to waste your money. Just to clarify, I’m not suggesting that pet insurance is a way to waste your money, but if you had a juicy Emergency fund, is there really a need for any pet insurance? Your emergency fund can be considered ‘self-insurance’. It’s up to you to decide if it’s worth it for you or not.

FAQs about Woolworths pet insurance:

How do you make a claim?

Woolworths Pet Insurance offers four options for making a claim:

- GapOnly claim option allows you to pay the gap, then the vet claims the rest direct from the insurer. The gap payment is the difference between the amount of the bill, and the amount the insurer will pay

- eClaim option allows you to pay the bill, and then have the vet submit your claim in the clinic for a faster refund

- Claim online by uploading the invoice via the MyPet portal

- Submit your claim by snail mail by filling out the Everyday Pet Insurance paper claim form

What should I look for when buying a pet insurance policy?

Pet insurance can help keep a healthy pet and a healthy bank balance in the face of unexpected vet bills. When considering pet insurance, it is worth looking for the following:

- Cover for ongoing expenses such as vaccinations and dental checks

- Accident cover

- Illness cover

When thinking about pet insurance, it’s also worth considering:

- Exclusions

- Excess payments

- How much you get back if you make a claim

- Annual premium increases

For further reading on What to look for in a pet insurance policy, you can read this article by Compare the Market.4

“The first year of your puppy or kitten’s life can be expensive: things like desexing, microchipping and council registration are usually one-off fees that add up pretty quickly. And that’s before you add in routine care vaccinations and worm and flea treatments. Routine care cover is an optional add-on that can take some of the sting out of paying all these costs at once. “

choice.com.au/money/insurance/pet3

Does pet insurance go up if you make a claim?

There are a number of reasons that your Woolworths Pet Insurance premium will go up, and making claims is one of them. So is the increasing age of your pet, inflation, and the ever increasing cost of medical care.

Does Woolworths pet insurance cover existing conditions?

Woolworths pet Insurance does not cover existing conditions. An existing condition is described as a condition that existed before the insurance cover started, whether it was diagnosed or not. There is a provision to have the pre-existing condition reviewed, if you disagree that it existed before taking out the insurance

Is Woolworths Pet Insurance worth it?

For pet owners on a budget who want to protect against bill shock from unexpected vet bills, then Woolworths Pet Insurance can be worth it for the peace of mind it offers. Let’s face it, that can be said about any insurance product. Insurance helps guard against what might happen.

However, Woolworths Pet Insurance has affordable insurance premiums in the early years and offers well-being benefits in some of the options, as well as illness and accident insurance. With the added bonus of a GapOnly pay option and 24/7 VetAssist, Woolworths Pet Insurance is a competitive option for your pet insurance.

“With VetAssist you can have a video call or online chat consultation with a licensed Australian Vet. It’s perfect for those times when you’re unsure if a trip to the Vet is required and you need some advice.”

insurance.everyday.com.au/pet-insurance1

For some, Woolworths Pet Insurance will be worth it, but for others, it might offer the same peace of mind to put the equivalent of the premiums in a bank account each year, that way it’s there if you need it when your pet gets older, but you get to keep it if you don’t.

ABC News weighs up whether pet insurance is worth it or not in their article HERE5.

Conclusion

Woolworths Pet Insurance offers a number of pet insurance options under Woolworth’s Everyday Insurance brand. A quick look on comparison sites shows there are many pet insurance providers in the market, increasing competition for your business.

Pet insurance helps give you peace of mind about what might happen when it comes to the health and well-being of your furry, four-legged family member. Having insurance to help guard against unexpected vet expenses can help protect your finances, but so can boosting up that Emergency fund!

Woolworths Pet Insurance offers affordable premiums, particularly in the early years of your pet’s life. Teamed with the GapOnly feature and access to VetAssist, Woolworths Pet Insurance is worth considering if choosing a pet insurer.

Captain FI is a Retired Pilot who lives in Adelaide, South Australia. He is passionate about Financial Independence and writes about Personal Finance and his journey to reach FI at 29, allowing him to retire at 30.