RSPCA pet insurance is one of the most popular insurers in Australia, but are they the best? Here’s my full RSPCA Pet Insurance review to take a closer look at their policies, coverage, and costs so you can make an informed decision.

The Good

- Comprehensive coverage tailored to your individual needs

- No waiting period for accidental injuries

- A portion of profits goes to RSPCA Australia’s animal shelter

- No excess to pay on claims

- Additional features such as third-party liability cover, veterinary fees cover, holiday cancellation cover, and more

- Owners can get back up to 80% of their vet bills

- Comes with an annual maximum claim limit of $20,000, slightly higher than most other pet insurance companies

- Promotions offered now and then (sometimes one free month of insurance with new policies purchased)

- Winner of many awards

The Bad

- Cruciate ligament conditions have a 6-month waiting period

- Prices can be higher than other pet insurance providers

- Annual premiums may increase if the policyholder makes a claim

- Not all ages or breeds of pets are eligible for coverage

- Don’t cover pre-existing conditions1

Verdict: If you want to opt for pet insurance, RSPCA has many benefits and is a popular option in Australia, but I prefer having a juicy Emergency Fund.

Introduction

Pets are awesome, I love having pets but they can get really expensive at times. You have to think about vet bills, accidents, and illnesses, which can really add up. Personally, I choose to self-insure by having a large emergency fund, as part of my Barefoot Buckets strategy, but many pet owners do like the peace of mind of having pet insurance.

One option that’s becoming more popular among pet owners is RSPCA pet insurance. They have a wide range of policies and varied costs, and are certainly a well known name and brand in Australia, but are they the best? Let’s look closer..

What Does RSPCA Pet Insurance Cover?

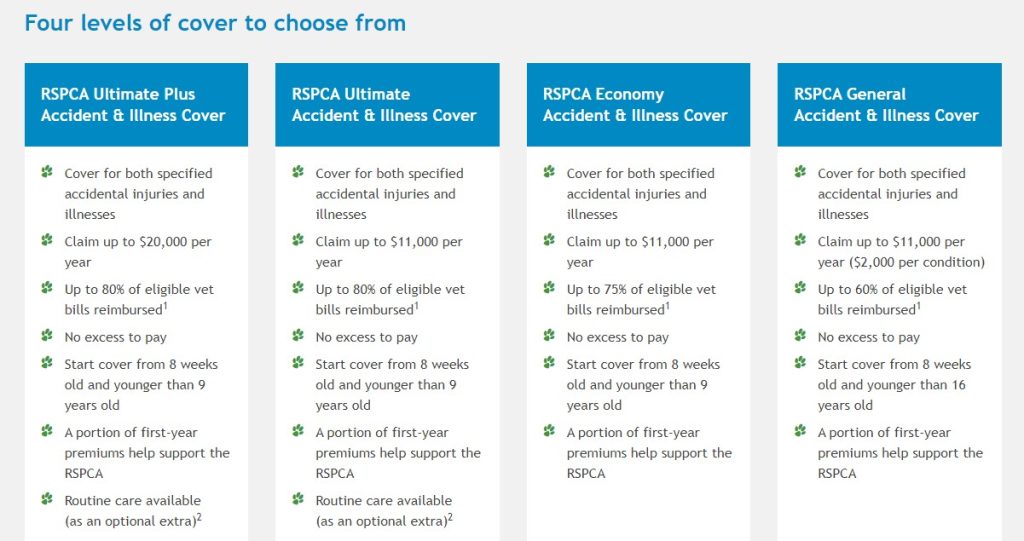

RSPCA Pet Insurance2 offers cover for cats and dogs against a range of specified illnesses and accidental injuries.

Depending on the chosen pet insurance cover level, owners can get back a portion of the eligible vet bills they pay out in cases such as bee stings, skin allergies, broken bones, and even major conditions like diabetes.

However, it does not cover any pre-existing condition your pet might have had before the policy was taken out, nor does it cover routine treatments (such as yearly vaccinations) or dental procedures. This is something to keep in mind when shopping around for an insurance policy.

RSPCA also offers other additional options, such as routine care coverage, which covers the cost of vaccinations, worming treatments, flea treatments, and other preventative measures. This is a great way to save on monthly vet bills, and it can also be used in tandem with general accident & illness cover for maximum protection.

Who Is the Underwriter for RSPCA Pet Insurance?

The RSPCA Pet Insurance is underwritten by The Hollard Insurance Company3, a member of the international Hollard Insurance Group.

Established in 1999, Hollard Insurance company has become one of Australia’s top five insurers and operates in both Australia and New Zealand. It is an independent, privately owned company that specializes in providing a wide range of insurance services to customers.

How Much Is RSPCA Pet Insurance?

The cost of RSPCA Pet Insurance2 varies depending on a few factors, such as the breed and age of your pet, as well as the cover level you select. Prices are provided on a quote basis, so you will need to contact them directly to get an accurate quote for your pet.

However, we gathered some sample quotes to give an indication of how much coverage might cost.

For example, coverage for a 1-year-old Maltese Cross can cost around $801.10 per year, while coverage for a 5-year-old Maltese Cross might be around $1,046.98.

Similarly, coverage for a 1-year-old Labrador could cost up to $1,239.54 per year, and a 5-year-old Labrador could cost around $1,624.31 per year.

Ultimately, the best way to get an accurate quote is to contact RSPCA Pet Insurance directly and discuss your individual needs and requirements. Depending on the cover level you select, your premiums could be significantly lower or higher than these examples.

Is There a Waiting Period With RSPCA Pet Insurance?

When it comes to pet insurance, one of the most important things to consider is the waiting period. This is the amount of time between when a policy is taken out and when a claim can be made on it.

RSPCA Pet Insurance has a waiting period for both accidental injuries and illnesses. For accidental injuries, there is no waiting period – meaning that you can make a claim as soon as your policy starts. However, for illnesses, there is a 30-day waiting period before any claims can be made.

For cruciate ligament conditions, there is an even longer waiting period of 6 months before you can make a claim on your pet insurance policy. This helps ensure that only genuine claims are made, not those from pre-existing conditions or weak ligaments that may have been present before taking out the policy.

“RSPCA Pet Insurance is flexible and provides peace of mind for pet owners across all of Australia. Our pet insurance plans cover up to 80% of the cost of eligible vet bills, with no excess to pay, when your dog or cat becomes sick or injured. You also have the freedom to submit and track claims, update your details and easily manage your policy online. Plus, a portion of first-year premiums go to support the great work of the RSPCA, helping them protect other Australian animals in need.”

rspcapetinsurance.org.au2

Where Are They Based?

RSPCA Pet Insurance is based in Canberra, Australia.

Advantages of RSPCA Pet Insurance

RSPCA Pet Insurance has established itself as one of the leading pet insurance providers in Australia.

Here are some of the advantages of using RSPCA Pet Insurance:

- Comprehensive coverage tailored to your individual needs

- No waiting period for accidental injuries

- A portion of profits goes to RSPCA Australia’s animal shelter4

- No excess to pay on claims

- Additional features such as third-party liability cover, veterinary fees cover, holiday cancellation cover, and more

- Owners can get back up to 80% of their vet bills

- Comes with an annual maximum claim limit of $20,000, slightly higher than most other pet insurance companies

- Promotions offered now and then (sometimes one free month of insurance with new policies purchased)

- Winner of many awards

Disadvantages of RSPCA Pet Insurance

Some drawbacks may include:

- Cruciate ligament conditions5 have a 6-month waiting period

- Prices can be higher than other pet insurance providers

- Annual premiums may increase if the policyholder makes a claim

- Not all ages or breeds of pets are eligible for coverage

- Don’t cover pre-existing conditions1

FAQS About RSPCA Pet Insurance

How Do You Make a Claim?

Making a claim with RSPCA Pet Insurance is simple and straightforward. Pet owners can make a claim easily via their online portal6 or by post.

To make a claim via the online portal, pet owners must log in to their accounts and upload copies of itemized invoices, vet history, and consultation notes. For the first claim, pet owners will also need to provide their pet’s full medical history.

To make a claim by post, pet owners must print and fill out the claim form, take it to the vet and ask them to fill out Section 2 and sign it. They then need to attach itemized invoices, payment receipts, and consultation notes and post them to: RSPCA Pet Insurance, Locked Bag 9021, Castle Hill NSW, 1765.

If your vet has Gap Only7 enabled, you can make a claim on the spot, at your vet, and then simply pay the gap (the amount left to pay after your vet processes the claim and takes payment from your insurer). It’s best to check first to see if your vet offers Gap Only. If not, you’ll need to make a claim online or by post.

Does RSPCA Pet Insurance Have an Excess?

No, RSPCA Pet Insurance does not have an excess. This means that pet owners do not need to pay anything upfront when making a claim on their policy.

Does RSPCA Pet Insurance Cover Dental?

No, RSPCA Pet Insurance does not cover dental procedure costs.

Is RSPCA Pet Insurance Worth It?

This depends. And it’s like any kind of insurance; insurers are counting on people living in fear of a huge unexpected bill. I like to self-insure and keep a large emergency fund in case of any unexpected bills, including vet bills, but if you haven’t built up a large emergency fund, or you prefer to have the peace of mind of pet insurance, RSPCA is a good option. It’s important to do your own research though and shop around for offers, policy options and promotions. You can also read my Woolworths pet insurance review and my article on the Cost of Owning a dog HERE.

RSPCA Pet Insurance comes with a range of additional features2 and offers up to 80% reimbursement on vet bills. With no excess to pay, and several policy options, they are definitely a top contender.

“Pet insurance can take care of the unexpected expenses that come with the unpredictable lives of cats and dogs. Thankfully, there are a range of different insurance options, from basic policies to comprehensive coverage.”

rspcapetinsurance.org.au2

Conclusion

RSPCA Pet Insurance is a great choice for pet owners who want comprehensive, affordable coverage for their furry friends. With no waiting period for accidental injuries, your pet will be protected right away. Additionally, the 30-day waiting period for illnesses is quite reasonable compared to some other providers.

Are they the best? In my opinion, they look like one of the best, but it’s up to you to shop around and do your own research. It’s worth comparing them to other top pet insurance providers such as Woolworths pet insurance, Coles pet insurance, Bow Wow, Knose, PIA and Trupanion. Websites such as Finder and Choice can compare many of these companies side by side as you can see HERE on Finder8 and HERE on Choice9.

All in all, if you’re looking for a trusted and reliable provider of pet insurance that offers complete coverage, RSPCA Pet Insurance is worth considering.

Do you have pet insurance? Who do you insure through and why? Let me know in the comments, it would be interesting to start a discussion on this.

Reference List:

- ‘Pet Insurance That Covers Pre-Existing Conditions’, Ashley Kilroy, Forbes. Published (updated): Feb 7, 2023. Accessed online at https://www.forbes.com/advisor/ca/pet-insurance/pet-pre-existing-conditions/ on April 12, 2023.

- https://www.rspcapetinsurance.org.au/

- https://www.hollard.com.au/

- https://www.rspca.org.au/

- ‘CRUCIATE LIGAMENT INJURY’, Sydney Animal Hospitals. Accessed online at https://sydneyanimalhospitals.com.au/cruciate-ligamentinjury/#:~:text=Cruciate%20ligament%20injuries%20may%20lead%20to%3A&text=inflammation.,the%20joint%20may%20also%20tear on April 12, 2023.

- https://petportal.rspcapetinsurance.com.au/signin?ReturnUrl=%2f

- https://gaponly.com.au/

- Compare pet insurance in Australia, Finder. Accessed online at https://www.finder.com.au/pet-insurance on April 12, 2023.

- Pet insurance comparison, Choice. Updated: Feb 3, 2023. Accessed online at https://www.choice.com.au/money/insurance/pet/review-and-compare/pet-insurance on April 12, 2023.

Captain FI is a Retired Pilot who lives in Adelaide, South Australia. He is passionate about Financial Independence and writes about Personal Finance and his journey to reach FI at 29, allowing him to retire at 30.