Captain FI is a personal finance, investing and lifestyle educational blog aimed at helping you achieve Financial Independence.

Financial Independence occurs when your investments generate passive income that exceeds your cost of living.

Financial Independence, Retire… Eventually?

Financial Independence gives you the choice to direct your time and energy into the things that you truly value, rather than the things that don’t (like working that 9 to 5 grind…). It’s about working out what you value the most, and empowering you to have the freedom of choice. This uses the core principles of mindfulness, efficiency and minimalism.

The Why of Financial Independence

You might have heard that money can’t buy you happiness and to some extent that is true. Whilst money can’t buy happiness per se, money can help you avoid a lot of things you find unpleasant (which might be working long hours or living away from your family).

I personally believe happiness is a result of Good Health, Good relationships and Good Wealth. This means having your needs fulfilled in accordance with Maslow’s Hierarchy of needs – first the essentials like shelter and food are taken care of, then relationships and finally self actualisation through creative endeavours and passion projects.

Reaching FI means you have more time and are statistically more likely to take the risk of starting these highly rewarding and satisfying creative endeavours and passion projects. Check out how I am achieving happiness through financial independence.

Achieving Financial Independence is a goal for many. FIRE has traditionally stood for Financial Independence Retire Early, but for the ever growing FIRE community this term has also come to encompass:

- Financial Independence: Reduced Effort

- Financial Independence: Redirect Employment

- Financial Independence: Recreation Enjoyment

- Financial Independence: Retire… Eventually

Financial Independence Reduced Effort

Being financially independent means you don’t need to work, but many professionals and career minded individuals may still want to work. Having financial independence will allow you greater flexibility to work the hours that suit you, when it suits you. Some people choose to have a 5 day weekend – and if your boss doesn’t like it, well…. There is a reason it is almost universally referred to as ‘F U money’!

Financial Independence Redirect Employment

Being financially independent means you have options to branch out into a new career field, commence a course of study or start a business without the worry or time constraint of having to earn a wage.

For many, the opportunity to redirect their energy into new forms of employment is incredibly satisfying, and has led to the creation of many successful businesses. Businesses which in turn, produce more income and which can eventually be put on autopilot.

Financial Independence Recreation Enjoyment

Who doesn’t like holidays? Well being financially independent means you can go on holiday… forever! After getting FIRE’d, many individuals, couples and families have taken extended vacations, travelling very cheaply by taking advantage of Travel Hacks (such as credit card sign up bonus frequent flyer miles) and leveraging ‘Geographic Arbitrage’ to stretch their dollars further.

Geographic Arbitrage means taking your investment income from a strong economy into a weaker economy so that you can get more value; for example many Americans and Australians choose to retire in South East Asia, where the cost of living is very low and they can have a higher standard of living.

But financial Independence doesn’t mean you have to pack up and go; many of those who reach FIRE choose to spend their time in their community, with their friends and family, playing sport, volunteering with local organisations and exploring new ways to have fun.

Financial Independence Retire Eventually

Quitting your job is not for everyone. But the numbers don’t lie, and when your passive income from investing exceeds your cost of living expenses, you don’t need to work anymore. You have reached FI. It’s a huge jump, and not something everyone is ready to go for straight away. If this sounds like you, financial independence will give you the option to retire eventually, when you are ready.

As a side bonus, the longer you work when you are already Financially Independent, the larger your portfolio will grow. This gives you a greater cushion, reducing your risk and giving you more passive income. This can be a very insidious goal, raising the question “when is enough, enough?” and lead to analysis paralysis, delay and hesitation.

How can I reach Financial Independence?

Smart investors are able to reach FI by investing in profitable assets such as a stock market ETFs and LICs, REITs and real estate such as residential and commercial properties, and profitable business. You can own these directly, or through your government retirement account (superannuation, 401K, IRA etc)

Warren Buffet champions the power of a stock market ETF, to its market index strategy, simplicity and the powerful impact of compounding over time.

Check out my articles on Financial independence, and follow through our simple process for creating wealth.

The very first place to start though is an introspection – make some time to quietly reflect on your journey so far, and plan time to work through these steps;

- Spark your FIRE – Review your knowledge, values and goals. What motivates you? Why are you embarking on this financial independence journey? If you don’t know or don’t understand motivation, it’s going to be a lot harder on your FI journey.

- Make a budget – Track your expenses against your needs, goals and wants to establish your cash flow requirements. Budgeting and expense tracking apps, such as the We Money app, are great at this, but nothing beats opening up an excel spreadsheet for the first time. As you get more proficient, you will rely less on the budget and more on simply tracking your expenses. I recommend categorising your expenses into one of three areas: Survive (essential), Thrive (to live comfortably) and Indulge (Luxury), and to note the emotion that is attached to that expense.

As an example with my grocery budget, my Survive (essential) balance is $30 per week which covers a basic whole food plant based diet. My Thrive (to live comfortably) is $50 per week where I add a lot more fruits and fresh vegetables, and my Indulge (Luxury) is $100 per week where I add unnecessary things like juice (for making smoothies), cheese and other animal products, and some processed convenience foods like dumplings or take-out.

Other Survive expenses include my baseline car spending for driving to work, medical and hygiene products like toothpaste and Panadol. Thrive expenses for me include snacks like nuts, seeds, dark chocolate and chewing gum, home brewed booze, home gym equipment and petrol I use on road trips to visit friends and family. Other luxury expenses for me include my Spotify premium membership at $10 per month, living in a new apartment, gifts for people, as well as any take-out food or alcohol. - Create a buffer – Save an emergency buffer or emergency fund! This is critical in dealing with life’s ups and downs, and you should aim for at least a $2000 balance before even considering spending on any non essentials, paying down debt or investing! Try decluttering your home and selling items on Gumtree, eBay or Facebook Marketplace. Picking up a side hustle is a great way to make extra cash – things like dog walking, baby sitting, tutoring, Upwork, freelancing, completing surveys or even handyman work like mowing lawns or cleaning! Seriously, do anything you can to get your hands on and stash that cash, and then set it aside in a good, fee-free bank account somewhere you can’t easily access. This is your emergency fund to prevent you going into (more) debt.

- Cover your Ass – Make sure you have enough Insurance to protect you and your family. This includes Income Protection Insurance, Total or Permanent Impairment, Life (death) insurance, Health insurance, Professional indemnity / Liability insurance, Home and contents insurance, Auto insurance. If you have foolishly overstretched your mortgage, you may also need to consider things like mortgage insurance. Insurance can be expensive and it can be difficult to know the risks, what is appropriate and how much you need. As a rule of thumb, the higher your Net Worth and the lower your debt, the less insurance you need.

- Dip a toe – Become an investor and get some skin in the game! By investing a small amount you will learn valuable lessons and starting your snowball will be a powerful motivator. Microinvesting is a great way to start learning the ropes, and you can do so with as little as a few dollars. I personally reckon it’s best to take the plunge with $500 or so in a conventional brokerage account and look at something like a broad market index fund ETF or an old school LIC – I personally started my investing journey with a small investment in the Australian Foundation Investment Company.

- Reduce your expenses – Be mindful with your living expenses (but still have fun!). Try cutting them back by 5% every month until you reach your target budget. You can use all of the tips, tricks and strategies posted on this site to slash your cost of living – everything from plant based grocery shopping right through to negotiating a better deal on your phone plan or even your mortgage.

- Boost your income – Make more from your job by negotiating a higher salary or promotion, and think about doubling down on that side hustle!

- Pay off bad debt – If you have any debt other than a home loan or mortgage (eg a credit card, car or personal loan), consider a debt consolidation or debt consolidation loan to secure a lower interest rate to help you knock over your debt quicker. Use either the Debt Snowball or the Debt Avalanche techniques – the Debt snowball is great for beginners, and the debt Avalanche is great for more analytical people. Some people choose to pay off their home loan as well for peace of mind, but my preference is to use debt recycling to make that home loan tax deductible by using it for investing!

- Boost your Buffer – Boost your emergency fund. This is a very personal choice and depends on your personal circumstances such as family situation, cost of living, investment portfolio and security of employment. A Great start is 3-6 months of living costs, but it all depends on your personal risk appetite. This is your ‘FU’ money and gives you the confidence to know your worth – heck, it might even let you take a leap of faith into that higher paying job you have always dreamed about!

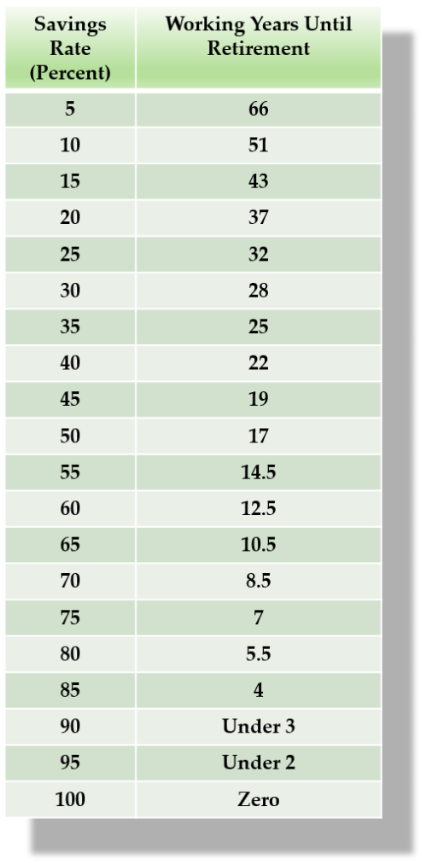

I personally don’t keep much cash at all, but this is only because I have very strong and diversified cash-flow across a large portfolio. - Get serious about Investing– Now that you are debt free, it’s time to get serious about investing so that you can get rich slowly! You can go as hard or as chilled as you like – for example with a 50% savings (investing rate) it will take you 17 years to reach Financial Independence, but by boosting this to a 75% savings rate you can slash a decade from your working career and become financially independent in only 7 short years! Of course, you can go even harder than this but you will need to engage some serious frugality muscles!

Many agonize over whether they should pay down their mortgage first or invest, and then argue about stocks vs property, but honestly all are awesome options and how you do it will depend on your personal risk appetite. Personally, I have an interest only mortgage on an investment property which I keep at 80% LVR, and I invest aggressively in shares, but when I buy my PPOR I will plan to pay that sucker off as quickly as possible (and to use debt recycling to help do this quicker too).

You will need to ‘Regularly add more ‘fuel to your FIRE’ as per your ongoing investment strategy. I personally add to my investments every single time I get paid – I make sure to pay myself first! Find the strategy that works best for you, but time and time again we have seen that a regular investment strategy is the smartest thing to do – it’s not about timing the market, it’s about time in the market! - Further your Education – Consume as much information as possible and seek as many critiques of your investment and wealth strategy as possible. This might sound overwhelming, but it should be fun. Start with this blog and the Captains reading list – slowly work your way through the books, and don’t forget to check out some of the other awesome personal finance and investing blogs around. Don’t forget to periodically go back to step 1 and work your way down the list again, looking for improvements each time!

Your Financial Independence number

Your FI number is simply the amount of investments you will need to produce an income that covers your cost of living. We will cover more on this later, but as a sneak peak this is found by multiplying your annual living expenses by 25. This is based on the internationally recognised ‘4% rule’, which gives a 95% chance (statistically over a 30 year period) that your portfolio will survive all economic downturns and continue to provide your passive retirement income, adjusted for inflation.

You don’t have to be investing purely in stock market ETFs, and a huge number of smart investors have been able to reach FI using investment strategies based either purely in property, or a combination of investing in property and stock market ETFs.

Having a large cash buffer (such as a year or more living expenses) is an important part of this. Extra sources of income such as active income from part time, contract work and side hustles, or passive income from alternative investments, projects and other businesses can be really helpful in managing your cash flow and keeping a healthy buffer. This ensures you keep your main investments topped up over the long term, maintain a good financial independence margin, and ideally even continue over time investing in more stock market ETFs.

In Australia, we have a unique two-stage retirement system thanks to Superannuation. Superannuation is our tax sheltered retirement investment accounts, similar to a 401K, Roth or IRA. You only pay 15% on money that goes into super, and its earnings are only taxed at 15% within the fund. It sounds great, but the catch is you can’t access it until you reach ‘preservation age’ which ranges from 55 to 60 depending on when you were born, and what type of job you’re employed to do.

Everyone chasing FI should consider tucking some extra cash into their retirement accounts (super, 401K, IRA) if they haven’t already. The Tax benefits and time it has to grow and compound means that by the time you reach preservation age, you should have a tidy investment ready to fund the rest of your retirement. In Australia, you can currently make a yearly concessional (pre-tax) contribution of up to $15,000 into your super without incurring any tax penalties.

That’s not to say you should neglect your FI portfolio, as you still need to live off something between when you retire early, and when you can access your retirement funds. The trick is to find the balance that gives you the best possible chance of success and earliest retirement.

Frequently Asked Questions

Have a read of some of my most Frequently Asked Questions. If you’re still not satisfied, why not ask the Captain? Leave a comment or get in touch and your question might be featured in the monthly ‘This is your Captain speaking’ Q&A sessions.

What is FIRE?

FIRE can stand for a couple of different things. The most commonly accepted is Financial Independence Retire Early. It is the process of achieving financial independence as soon as possible, with other explanations for FIRE being;

- Financial Independence, Retire Eventually

- Financial Independence, Recreation Early

- Financial Independence, Redirect Employment

What is passive and active income?

Passive income is income that you do not have to do anything to earn; so it is independent of your time. Passive income continues to be deposited into your account, 24 hours a day, 7 days a week, 52 weeks a year. This can come from various sources such as bank interest, dividends, royalties or even some businesses that you run. Strictly speaking no investment or income is truly passive; as everything will require some degree of management or oversight. I would say that an investment requiring one or two hours a year of admin meets my criteria of being passive income. In general, passive income is income earned that doesn’t require your time.

Active income is income that you earn by exchanging your time – money for time. This is like a standard job/career, or side hustle providing services such as dog walking or selling on eBay.

How long will it take for me to retire?

This is a very personal question. But the simple maths behind FIRE show that the more you are able to slash your cost of living and the more you are able to save, the earlier you are going to be able to retire.

Using the table below, if you are able to save and invest half of your salary, your working life will be about 17 years. If you are able to live well below your means and are able to save and invest 80% of your salary, you are looking at approximately 5 and a half working years until retirement. For the extreme cases of savings rates in the 90%s, due to your highly frugal lifestyle, you will be able to retire much sooner.

What is an Index fund

An index fund is a financial product which is designed to track a particular index. For example Vanguard Australian Shares (ASX:VAS) Exchange Traded Fund (ETF) is designed to mirror the ASX:300 index; that is, the performance of the top 300 Australian companies by market capital.

What is an ETF

An ETF is an Exchange Traded Fund. This is a parcel of shares that make up the index that the ETF is tracking. For example, the Vanguard Total US market ETF is a parcel of shares which seeks to track the performance of the US total market by providing exposure to over 3600 holdings. Buying one share of VTS gives you a slice of all of those holdings. ETFs have incredibly low fees, due to the automated nature of their portfolio management; if a company falls out of the index it is simply sold and replaced in the ETF by its replacement.

What is a LIC

A LIC is a listed investment Company. LICs are actively managed portfolios which can have both ultra low fees, or ultra high fees, depending on the company. I only like ultra low fee LICs like AFIC, Milton and Argo.

What is a MER

A MER is a Management Expense Ratio, or the annual fee you will pay on your investment product. Some modern ultra low fee ETFs have a MER ranging from .03% or 3 basis points (VTS) to .10% or 10 basis points (VAS).

A basis point is one hundredth of a percent, or .01%. This means, for every $10,000 you have invested, you will pay $1 per basis point. This makes VTS incredibly cheap at only $4 per $10,000 invested per year.

How can I reduce my expenses?

Even the biggest boat will eventually sink if there is enough holes in the hull. Your expenses, or more specifically, your unnecessary expenses are these tiny holes you need to plug. The best way is to start tracking your spending – pay for everything electronically if able, and keep a diary for cash transactions. Secondly start writing a list of all your major expenses (such as rent/mortgage, food, phone bills and insurance). After a month or two, start going through your electronic statement and cross checking – Work out where you are what you’re spending the most on. Once you have identified some problem areas – get to work! Solutions include downsizing where you live and your car, transitioning to a more plant based diet, and some common sense when it comes to phone plans and insurance. Check out the content on the site for how to save money on these specific areas!

What does a domiciled and cross listed fund mean?

Domiciling refers to the ‘home’ of the fund. For example, Vanguard Total US market (ASX:VTS) is a US domiciled fund, which is cross listed onto the Australian Stock Exchange. This means shareholders need to register with the US IRS to pay tax. Thankfully, Australia and the US have tax treaties which mean you won’t have to be taxed twice on your investments. This means you will need to fill out a W-8BEN-E tax treaty form.

What does market cap (capital mean)?

Market Cap or Capital is the capital value of a listed security or share. This is the sum of the share price multiplied by the number of shares, plus any additional assets. Market Cap is often used to describe sectors of the market or index, for example ‘Big caps’ like Microsoft and Commonwealth bank, versus ‘small caps’ like start ups or newer, lesser known companies.

How do I buy a share?

To buy a share you will need to go through a broker. The Broker is kind of like a car dealer; they didn’t make the car – in fact they probably have nothing to do with the manufacturer – but they can help arrange for you to purchase the car (the share) in your name. You will pay a small price for this transaction – $9.50 using SelfWealth, or you can get a free brokerage credit by signing up to Pearler, using the code CAPTAINFI. Once you have bought the share, it needs to be registered in your name (just like a car) – this process is automatic (and free!) and you can then manage the share through your share registry.

Still have questions?

Still have questions…? Why not ask the Captain! Leave a comment or get in touch for more information and for your chance to be featured in the monthly ‘This is your Captain speaking’ Q&A sessions.