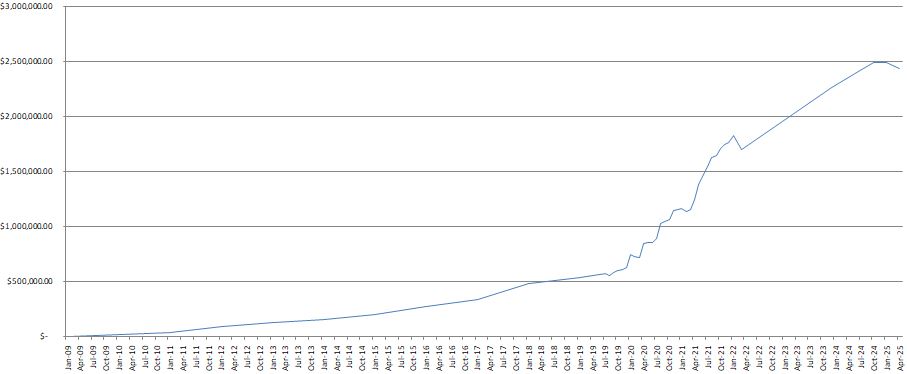

On the journey to FIRE, each month I collated all of my financial statements and investments to produce the CaptainFI net worth blog update. Check out links below to see how my investments have grown over time, what I had invested / devested in, what has been happening in my life and how this has shaped my financial health on my journey to Financial Independence.

This graph includes the total value from my;

- FIRE ETF share portfolio (SOLD in DEC 2023 to fund my dream hobby farm acquisition)

- PPR Hobby farm

- Investment property equity

- Crypto portfolio

- Content websites business

- Superannuation

- Angel investing

I began tracking my net wealth officially in 2018, so the data you see for the years 2009-2018 were ‘reconstructed’ using historical data such as my old bank accounts, pay slips, super statements, tax returns and investments. Whilst it isn’t perfect, it was a good start. It shows the somewhat slow progress in growing Net Wealth due to my lack of prioritisation of investing directly in assets – what I WAS doing however in those early years was mainly investing in myself – my education and vocational training as a pilot (over $350,000!).

I began university in 2009 after earning a scholarship for engineering. Tuition was fully paid for – so I had no HECS debt to battle, and I was even paid whilst I studied. This gave me an INSANE financial head start, and made achieving FIRE (something I didn’t even know about at the time) in my late 20’s a real possibility.

Immediately I began using this income for flying lessons, and later in the year earned my Private Pilots Licence (PPL). In 2011 I graduated with my (free) engineering degree, in 2012 I earned my commercial pilots licence (CPL), and in 2013 earned my Airline Transport Pilots Licence (ATPL). I worked various full time roles during this period, and once I had my CPL I also began picking up sporadic flying work when I could – including becoming a flying instructor, flying random charters and taking thrill seekers up in old warbirds on aerobatic adventure flights.

It was not until 2016 that I landed my first full time flying position, and in the second half of 2017 I was training as a Cargo pilot on a large jet. In 2018 I was fully qualified, flying cargo and passenger operations all over the world.

I took advantage of employer education schemes to earn a Masters Degree part time, which I completed in 2020 amidst the mandated lockdowns and reduced flights.

At the start of 2022, for a combination of reasons (spurred by major family health issues) I decided that I finally had enough assets and passive income that I had reached ‘FIRE’ and I published my last ‘monthly’ net wealth update for March 2022, which felt like the end of an era for the accumulation phase.

I finished taking leave in May 2022, and since then have stopped flying professionally. I needed a long overdue break from being a pilot, so I could focus on family as well as my own mental and physical health. Being a pilot is a job you absolutely can not half arse – it can become very dangerous if you do. I take a lot of pride in my professionalism as an aviator, and my judgement in making the decision to not fly during this incredibly difficult time for me.

I moved back to Adelaide and became a full time carer for my mother. I met an amazing woman (who is now my wife) who was incredibly supportive of me and my family situation. It was lovely to have time to reconnect with my family and live slower, just pottering part time with my website business and podcasting. Unfortunately, my dear mother passed away later in the year. This hit me pretty hard, and I took a year out from really doing much as I was pretty depressed.

After a year, I decided it was time to get the dream house, and I sold the ‘FIRE portfolio’ of ETFs in order to fund the acquisition of my hobby farm (a couple acres in SEQ hinterland). Since then, we have welcomed a baby, and life is good. I work part time with my content marketing websites and farm jobs, and I love it.

I have since decided to put out Quarterly post-FIRE updates, a short update about how the investments are tracking, any investment decisions I have made, and a short update on life post-Financial Independence – somewhat of an update from Early Retirement.

How do I still manage my investments?

I am using Pearler to invest using the auto invest feature, which ensures that my net worth continues to smoothly rise as I effectively dollar cost average into my split of ETFs in accordance with my investment strategy. I personally use Sharesight for my investment reporting since its totally free if you have under ten shares (making it perfect for ETF holders) and it generates a complete tax statement for all of my share purchases, sales and dividends I receive. Sharesight can be configured to automatically import your data from Pearler with the click of a button. You can check out the comprehensive review I did on Sharesight Here, where I even got to chat to their content manager and ask him a bunch of curly questions.

All CaptainFI Net Worth updates

2025- Monday, July 28 | Captain FI Net wealth Update Q3 2025

- Sunday, May 4 | Captain FI Net wealth Update Q2 2025

- Sunday, January 12 | Captain FI Net wealth Update Q1 2025

2024- Thursday, October 31 | Captain FI Net wealth Update Q3 2024

- Wednesday, July 3 | Captain FI Net wealth Update Q2 2024

2023- Thursday, October 5 | Captain FI: Net Wealth Update and Captains Log: Q3, 2023

- Thursday, July 27 | Captain FI Net Wealth Update: Q2, 2023

- Thursday, May 4 | Captain FI Net Wealth Update: Q1, 2023 – One year of Semi Retirement!

2022- Wednesday, October 12 | Captain FI’s FIRE Update: Q3, 2022 – Six months of Early Retirement!

- Friday, April 8 | Mar 22 Update: $1,701,410 (-$55,799)

- Wednesday, March 2 | Feb 22 Update: $1,757,210 (-$69,422)

- Friday, February 4 | Jan 22 Update: $1,826,633 (+$62,117)

2021- Friday, December 31 | Dec 21 Update: $1,764,516 (+$25,372)

- Tuesday, December 7 | Nov 21 Update: $1,739,144.23 (+$33,236)

- Monday, November 8 | Oct 21 Update: $1,705,907 (+$65,243)

- Sunday, October 17 | Sep 21 Update: $1,640,663.85 (+$16,547)

- Tuesday, September 7 | Aug 21 Update: $1,624,116 (+$70,156)

- Tuesday, August 10 | July 21 Update: $1,543,959 (+$74,732)

- Monday, July 5 | June 21 Update: $1,469,989 (+$89,757)

- Monday, May 31 | May 21 Update: $1,379,469 (+$137,248)

- Monday, May 3 | Apr 21 Update: $1,237,220 (+$81,726)

- Thursday, April 1 | Mar 21 Update: $1,155,594 (+$20,322)

- Monday, March 1 | Feb 21 Update: $1,135,272 (-$30,406)

- Friday, February 5 | Jan 21 Update: $1,165,678 (+$12,757)

- Wednesday, January 6 | Dec 20 Update: $1,152,920 (+$9,487)

2020- Monday, November 30 | Nov 20 Update: $1,143,433 (+$80,394)

- Monday, November 2 | Oct 20 Update: $1,064,399 (+$18,913)

- Thursday, October 1 | Sep 20 Update: $1,045,486 (+$16,193)

- Thursday, September 24 | Captain FI becomes a Millionaire

- Monday, August 31 | Aug 20 Update | $1,029,293 | +$141,075

- Monday, July 27 | Jul 20 Update: $888,218 +$29,568

- Wednesday, July 1 | Jun 20 Update: $858,650 +$791

- Saturday, May 30 | May 20 Update: $857,869 +$10,836

- Thursday, April 30 | Apr 20 Update: $847,023

- Tuesday, March 31 | Mar 20 Update: $819,354

- Wednesday, March 4 | Feb 20 update: $851,802.

- Friday, January 31 | Jan 20 Net Worth update: $864,602.

- Monday, January 6 | December 2019 Net worth update

2019- Saturday, November 30 | November 2019 Net Worth FI Update

- Monday, November 4 | October 2019 Net Worth FI update

- Tuesday, October 1 | September 2019 Net Worth update

- Monday, July 28 | Captain FI Net wealth Update Q3 2025

- Sunday, May 4 | Captain FI Net wealth Update Q2 2025

- Sunday, January 12 | Captain FI Net wealth Update Q1 2025

- Thursday, October 31 | Captain FI Net wealth Update Q3 2024

- Wednesday, July 3 | Captain FI Net wealth Update Q2 2024

- Thursday, October 5 | Captain FI: Net Wealth Update and Captains Log: Q3, 2023

- Thursday, July 27 | Captain FI Net Wealth Update: Q2, 2023

- Thursday, May 4 | Captain FI Net Wealth Update: Q1, 2023 – One year of Semi Retirement!

- Wednesday, October 12 | Captain FI’s FIRE Update: Q3, 2022 – Six months of Early Retirement!

- Friday, April 8 | Mar 22 Update: $1,701,410 (-$55,799)

- Wednesday, March 2 | Feb 22 Update: $1,757,210 (-$69,422)

- Friday, February 4 | Jan 22 Update: $1,826,633 (+$62,117)

- Friday, December 31 | Dec 21 Update: $1,764,516 (+$25,372)

- Tuesday, December 7 | Nov 21 Update: $1,739,144.23 (+$33,236)

- Monday, November 8 | Oct 21 Update: $1,705,907 (+$65,243)

- Sunday, October 17 | Sep 21 Update: $1,640,663.85 (+$16,547)

- Tuesday, September 7 | Aug 21 Update: $1,624,116 (+$70,156)

- Tuesday, August 10 | July 21 Update: $1,543,959 (+$74,732)

- Monday, July 5 | June 21 Update: $1,469,989 (+$89,757)

- Monday, May 31 | May 21 Update: $1,379,469 (+$137,248)

- Monday, May 3 | Apr 21 Update: $1,237,220 (+$81,726)

- Thursday, April 1 | Mar 21 Update: $1,155,594 (+$20,322)

- Monday, March 1 | Feb 21 Update: $1,135,272 (-$30,406)

- Friday, February 5 | Jan 21 Update: $1,165,678 (+$12,757)

- Wednesday, January 6 | Dec 20 Update: $1,152,920 (+$9,487)

- Monday, November 30 | Nov 20 Update: $1,143,433 (+$80,394)

- Monday, November 2 | Oct 20 Update: $1,064,399 (+$18,913)

- Thursday, October 1 | Sep 20 Update: $1,045,486 (+$16,193)

- Thursday, September 24 | Captain FI becomes a Millionaire

- Monday, August 31 | Aug 20 Update | $1,029,293 | +$141,075

- Monday, July 27 | Jul 20 Update: $888,218 +$29,568

- Wednesday, July 1 | Jun 20 Update: $858,650 +$791

- Saturday, May 30 | May 20 Update: $857,869 +$10,836

- Thursday, April 30 | Apr 20 Update: $847,023

- Tuesday, March 31 | Mar 20 Update: $819,354

- Wednesday, March 4 | Feb 20 update: $851,802.

- Friday, January 31 | Jan 20 Net Worth update: $864,602.

- Monday, January 6 | December 2019 Net worth update

- Saturday, November 30 | November 2019 Net Worth FI Update

- Monday, November 4 | October 2019 Net Worth FI update

- Tuesday, October 1 | September 2019 Net Worth update