CaptainFIs financial and personal update for Q3 2025

Captain FI Net Wealth update Summary

NW down again – third quarter in a row! Down by $33,000 to a total of just under $2.4M.

I have been enjoying time with family on the farm and raising our baby, and our mother in law has been living with us for six months now which is awesome. She has been a massive help with the baby, which has allowed my wife and I to have a break including hosting visiting family and friends.

I have hardly done any (paid) work at all, mostly household / dad / hobby farm stuff. Finally got our flock of chickens and getting lots of “free” eggs…

Bought some more upgrades for the farm (mower, tools etc), some more concrete and fencing stuff, paid the yearly rates, rego’s (cars, trailers, boat), insurances (home, cars, boat, landlord), tax bills, and a couple big electricity bills and massive grocery shops – somehow this all added up to be over $30K!.

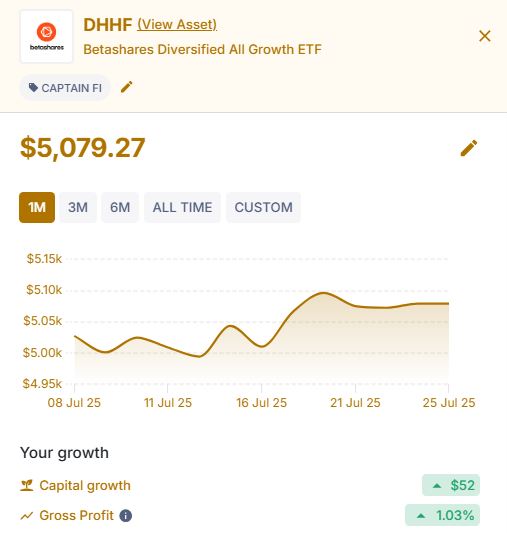

I made my first shares investment for years ($5K into the DHHF all in one fund). Property prices steady (farm + rental) – have switched back to monthly repayments to improve cash flow.

Considering selling the investment property to pay down home loan, simplify finances and improve cash flow… although looks like if I keep it for a few more years of solid growth I could potentially sell it and be totally debt free… For now I should probably just work more!

Captain FI is not a financial advisor, does not hold an AFSL and this article is not financial advice. This website is reader-supported, which means we may be paid when you visit links to partner or featured sites, or by advertising on the site. For more information please read my Privacy Policy, Terms of Use, and Financial Disclaimer

Captain FI’s personal update

In May my father passed away. He was sick for a long time in palliative care, and we had been estranged since my Mum passed a few years ago.

For those that don’t know, my parents separated when I was a toddler, and he was never really in the picture apart from going to visit him every couple of years or so. We did reconnect once I was an adult and he had moved back to Australia, but it was a difficult relationship and one sided (in terms of effort etc). After my Mum died and I discovered some awful letters he had written to her, I just couldn’t do it anymore. I decided to respect myself and put some boundaries in place.

Nevertheless, on the advise of a few good friends and some family members, I went back home to South Australia to visit him on his deathbed. I wasn’t sure what to expect, but deep down there was a little part of me that was hopeful for some kind of closure on our “relationship”. Unfortunately, and I guess expectantly, there wasn’t really any bedside revelations or meaningful engagement on that front.

We just reminisced about some of the good times we had together – bonfires, camping, footy. Small talk really, whilst I helped him sip on a can of beer and handed him some squares of chocolate (ironically the stuff that led him to palliative care in the first place).

Reading the situation I figured it wasn’t really appropriate to push into more emotional topics. I just wanted him to be comfortable and didn’t want to make his death about me, so kept it more of a surface level reunion. After a couple hours it was time to go, as he was exhausted and in pain, becoming a bit delirious and needed morphine to rest. I left feeling sad and a bit disappointed, but also glad that I had made the effort to visit.

He passed a couple of days later, when we had just returned home to Queensland.

Often I have thought to myself “Why wasn’t I good enough for him to stick around / not be a shit dad / be proud of me” or variations thereof, but I have slowly come to the realisation that unfortunately he was just a damaged man, unable to move on and heal from his own traumas, and his actions were in no way a reflection of me or my family.

We had a ‘Woofie’ down in the back paddock in his honour, and later on my uncle and I shared a special Scotch that my dad had given him as 50th birthday gift (nearly 20 years ago) that he had been saving.

Sadly, my Wife’s uncle also passed during this time. We were thankful we were able to visit him during our trip to Adelaide to say our goodbyes. It was very sad for my Wife because she lived with them when she first moved to Australia, and he and her Auntie had helped set her up her new life here – so understandably they were quite close.

We are often up very early for the morning feeds – it is quite peaceful once bub goes back to sleep in our arms to sit on the porch and watch the sun rise and quietly reflect with a cup of tea or coffee. There have been some spectacular sunrises recently.

We have also enjoyed the cooler and less humid weather to be getting out and exploring a bit more – waterfall hikes, doing a final bit of mud crabbing for the season, and getting stuck into projects at home like the chicken coop/run, fencing and revitalising / replanting out the veggie gardens. Now that Bub is older (and vaccinated!), and we are feeling a bit more on top of things, we have finally had a lot of friends and family from interstate come and visit which has been great.

I also finally caved, and upgraded our ride on mower to something with more grunt to make tackling the mowing much quicker. I hadn’t planned to buy it and didn’t really want to spend the money, but a friend was upgrading to a larger tractor himself and urgently needed to sell it so he made us an offer we couldn’t refuse!

I am sometimes feeling a bit overwhelmed with the sheer amount of work and jobs on the farm, but it is great to look back and see just how much we have done during our time here to far. It will be great to finish off a few of the half finished projects including the sheep fencing so we can get some spring lambs in which would hopefully keep the paddock mowed for us and save us a bit more time!

Captain FI podcasts

No new episodes for now. Check out the previous episodes of the Financial Independence Podcast on Spotify or now they have been uploaded to the CaptainFI YouTube channel!

Captain FI blog articles

I have been slowing down with the blogging while we adjust to life as parents – in case you may have missed it, my last net wealth update is below

Captain FI 2025 spending figures

As I have talked about in my last few updates, my spending has increased a lot since we bought acreage and started our family. For contex over the past few years, my total spending figures (cost of living) were roughly;

- 2021 – $43k – Renting city apartment (single)

- 2022 – $32k – Renting apartment 6 months, then moved back in with my Mum as her carer

- 2023 – $69k – Renting a small house with my fiancée (our combined total household spending figure inc holidays)

- 2024 – $144k – Moved onto acreage with my wife (large expenses furnishing house, farm projects etc)

The tally so far for the first half of 2025 is $78k, with about another $32k to spend this year (cost of living plus commitments to projects and travel) for an total projected 2025 spend of around $110k. There were some opportunistic deals which I couldn’t pass up (like the mower upgrade) and projects I wanted to do, and otherwise just some expensive unforseen bills to cover.

Currently, our baseline cost of living estimate is around $65k per year (mortgage, groceries, insurance, transport, health etc), and we seem to spend around $10k a year on holidays and recreation. This figure always changes around because it isn’t a budget and doesn’t dictate our spending – it’s just what we seem to spend around, and works for us. In addition to that I have been spending money on farm projects and upgrades, which I am considering ‘one off expenses’ (that should end up making us money in the long run) and I dont factor those projects into the cost of living.

Going forward I’m estimating around a $75k annual spending figure, which is good because it means I only really need to make around $7k a month income from my online business to cash-flow our baseline living costs. This means any surplus I can use to grow the business, and lets us reinvest all of our investment earnings, invest my wife’s income into her shares and super, and then any farm earnings we reinvest into upgrades (such as expanding the apiary, stock, fences, shedding and equipment).

Captain FI’s Investments

I don’t calculate a Net Wealth or Savings Rate Figure each month anymore, but I do try to keep a rough track of everything for these quarterly updates

My investments are split across the following areas;

The ‘FIRE’ Portfolio of Index ETFs(SOLD December 2023 to fund dream home).- Global shares – Betashares diversified high growth ETF (ASX:DHHF)

- Acreage – hobby farm in Queensland.

- Investment Property in New South Wales – Residential duplex

- My company – which runs a portfolio of content marketing websites

- Angel Investment in the investing platform Pearler

- Cash (Emergency Fund in the mortgage offset account)

NB – December 2023 I sold the ‘FIRE’ Portfolio (mix of Index ETFs) to fund my dream acreage purchase. In July 2025 I have started rebuying shares using the Betashares DHHF Diversified high growth ETF as the I believe the convenience of having an ‘all-in-one’ fund that is Australian domiciled for a incredibly small management fee of 0.19% is worth it for us.

My wife tracks her own investments separately and her investments include;

- Overseas property

- Global Shares – Betashares diversified high growth ETF (ASX:DHHF)

- Global shares index fund via her superannuation

- Cash (emergency fund)

- Shares of several family businesses including a hospital, aged care facility and school.

In July I started rebuying shares with a $5,000 purchase of DHHF. Whilst the priority at the moment is paying down the mortgage (to reduce our cost of living), I just wanted to get the snowball started, and we will potentially be debt recycling from the mortgage to build up the share portfolio again quicker.

The ‘FIRE’ Portfolio (Exchange Traded Index Funds)

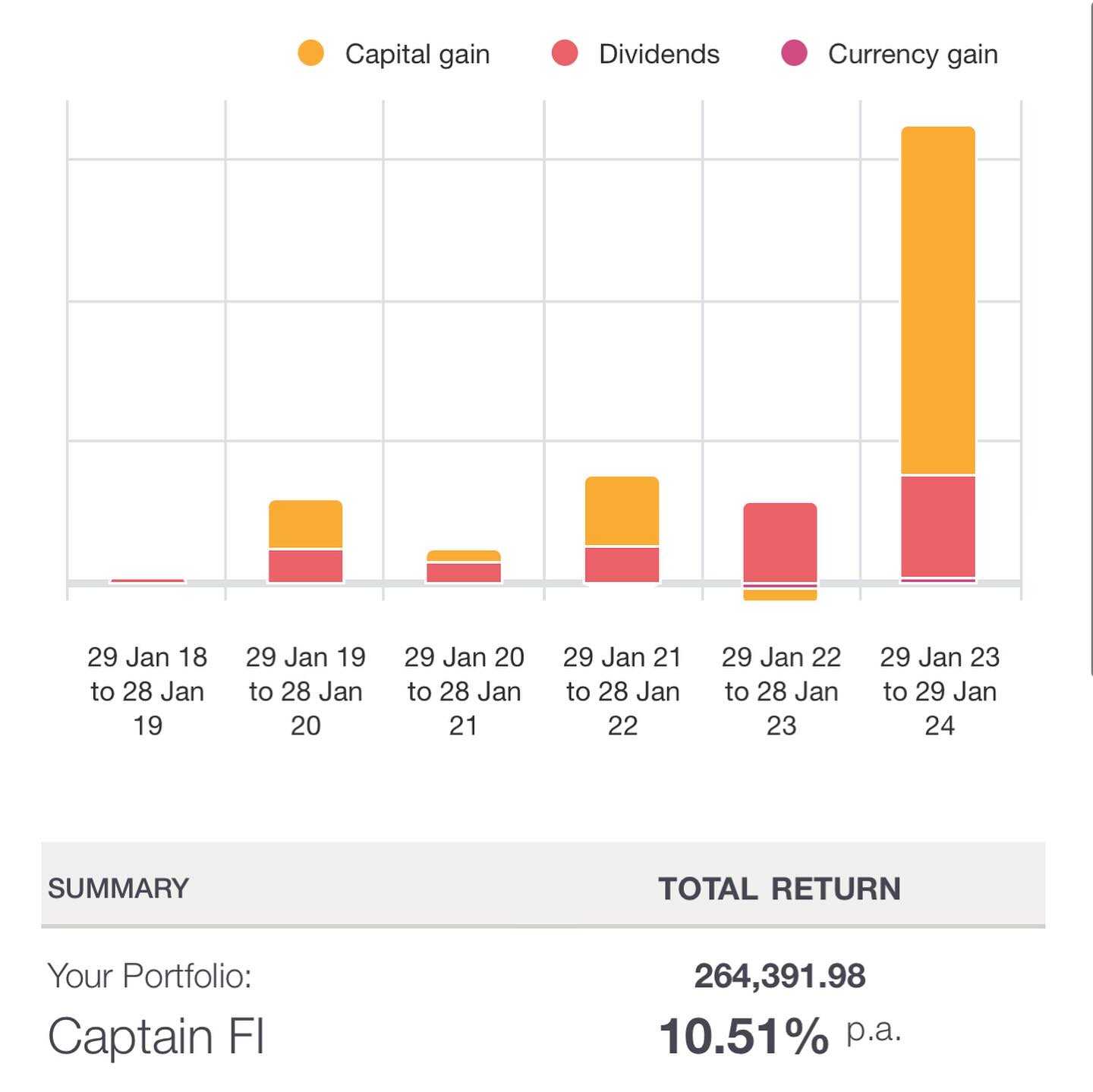

The ‘Financial Independence Retire Early’ or FIRE Portfolio was a simple, passive share portfolio started in January 2018 with the aim of growing wealth through both capital gains and tax efficient franked dividend income.

It was split between three parcels of incredibly low-fee, index-tracking Exchanged Traded Index Funds (ETFs) to achieve global share market diversification – A200 (15%), VTS (60%) and VEU (25%), and I tracked the share portfolio using Sharesight, which means my portfolio accounting and tax reports were all completely automated.

After six years of passive index fund investing where I bought shares every payday, I finally sold the entire portfolio in December 2023 so I could buy my forever home – a large luxury home on acreage in the SE QLD hinterland where I can hobby farm and raise my family in peace and quiet.

Cashing in the chips I sold approximately $1.7M of shares with a total annualised return of 10.51% – which was an incredible feeling. Whilst it was difficult to let go of that passive income stream and the market has continued to grow since I sold, I had achieved what I set out to do which was to become financially independent, retire early from the rat race, and buy my dream acreage to raise a family.

Captain FI’s Primary Place of Residence

The acreage is a lifestyle choice which provides a safe place to raise my family with plenty of space, fresh air and privacy, whilst also providing an opportunity to produce an income by house hacking and hobby farming.

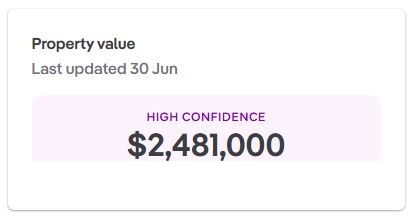

To keep things simple, I just check the property value using online valuation. The current PropTrack automated online valuation estimate is $2.481M, which is up $6,000 from the last time I checked it for the Q2 2025 net wealth update.

I owe $532K on the mortgage, with $10K in the mortgage offset account. The net mortgage position is $522K, of which I pay a $3100 monthly repayment.

I had previously been paying weekly and making extra repayments to get ahead on the mortgage a bit so I could get a better rate, and have now switched to monthly repayments to improve cash flow. Going forward the plan is to continue making the minimum repayments to rebuild the emergency fund up in the offset, and then once that is built up again to make a decision regarding debt recycling.

Debt recycling plans

I had plans to redraw equity from the mortgage to debt recycle into the Betashares DHHF ETF in order to build up the share portfolio and passive income faster. With the intent that this passive income stream could then not only cover the mortgage repayments (which would become tax deductible) but also eventually our cost of living.

You can play around on https://debtrecyclingcalculator.com to see what effect debt recycling might have on paying off your mortgage or building a share portfolio quicker, but you just have to be comfortable exposing yourself to market risk and the fact that you are essentially using equity in your family home as collateral.

When I ran the numbers, it showed if I maxed it out and then continued to debt recycle dividends and tax savings each year, I could pay my mortgage off in 11 years. However I would have to max out my redraw which would mean increasing the repayments, and therefore I would need to make more income as the dividends alone wouldn’t cover the loan costs, essentially meaning I would be negative gearing into shares using the home loan.

When I compared debt recycling to just not withdrawing from the loan, the ASIC moneysmart calculator showed that by just doing nothing and staying ahead on the mortgage would actually reduce the original mortgage term down to 12 years – only one year longer than the debt recycling option.

When I spoke to our financial advisor, they recommended that we just pay down our home loan over debt recycling. They offered a few reasons;

- Paying down the mortgage locks in an ‘”Equivalent grossed up (taxable) return of around 8% with zero risk”, when compared to the share markets ~10% long term average and high short term volatility.

- If we are ahead on the mortgage, we can just ask the bank to absorb the redraw (amount we are in advance) and recalculate a lower minimum monthly mortgage payment which increases our cash-flow.

- The dividend income from the debt recycled shares would not cover the cost of the loan – even when factoring the tax deduction for the loan interest, and the franking credits from the dividends. This makes it a ‘negatively geared’ strategy which would reduce our cashflow.

- Debt recycling is more attractive for high income earners who are claiming the tax deduction for loan interest at higher tax brackets – 45c, vs us in the 16c and 30c brackets.

- Debt recycling would increase our ‘adjusted annual taxable income’ and increase our asset pool, which both impacts our eligibility for certain family government benefits such as the child care subsidy and FTB (A+B), and reduces how much benefit we can receive. Adjustable Taxable Income is basically your total income with no deductions allowed – Check out the ATO website for the technical definition of Adjusted Taxable Income. As we have a young family with plans for more kids, we would like to make use of any entitlements we have – which means preferencing reducing our debt over increasing income.

Currently we have decided not to invest / debt recycle, and are just planning to pay down the mortgage for now. We will look into it again next year.

Captain FI’s Investment property

The goal of the Investment Property is to build wealth through capital growth, whilst also providing a growing source of income from the rent. I chose to use an investment property as it is independent from my other assets, I can use leverage, and I am bullish on property prices due to our current political and immigration policies and supply constraints.

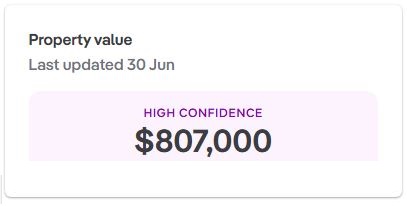

The current PropTrack automated online valuation estimate is $807K, which is down $4,000 from the last quarters estimate.

The property has a $530K mortgage, for an equity position of $277K and approx 66% LVR. I no longer use the offset account for the IP. Instead, I put all cashflow into my PPR offset and draw expenses for both properties from that (I then just record IP expenses to tally for tax time).

I pay a $3200 monthly repayment for the loan and collect $700 weekly in rent. Other costs (Building and landlord insurance—$1500, Council rates—$2000, water and sewage—$500, property management fee—5.5% ($2000), termite and fire alarm inspections -$300) add up to around a $8500 shortfall per year. In other words, this property costs me about $163 per week to hold, plus any maintenance issues that crop up along the way.

This means it is negatively geared (which is annoying for someone who is trying to be retired) but the interest and other costs are tax deductible, and that combined with the depreciation schedule does give me a couple of grand back at the end of the year – for a total ‘net’ loss of around $6000 per year.

Whilst it has cost me around $15K to hold over the past 2 and a bit years, the property valuation has gone up by $57K. Going forward, the property market is tipped to grow between 3% to 6% per annum – which given the 66%LVR means the projected ‘cash on equity’ return would be three times that or around 9 to 18% – which means holding the leveraged property should still be better than shares (10%) or paying off my home loan (8%).

Over time, rents increase and this means it will also become positively geared and provide us with a source of income – the current estimate is that the crossover point should be in 2027. Currently it is rented out $50 a week below market value, but this is a strategy I am using to try and establish a good rapport with the tenant and hopefully reduce maintenance costs (as they are encouraged to look after the place better) and also to reduce tenant turnover / vacancies.

If I sold the property now, with a 2-3% realtor commission, a few grand for staging and a conveyancing, and with the current valuation I should end up with about $780k. After paying out the remaining loan I would be left with $250K. With a cost base of around $500K to build and approx $20K claimed so far in deductions, I would have about $300K in taxable capital gains, which with the long term CGT discount would result in around $50K of actual capital gains tax payable. After paying the tax bill, I would be left with around $200k (which would most likely be used to pay the PPR mortgage).

I don’t think $200k after tax is really attractive enough at the moment to sell the property, as we are managing alright and its only currently ‘costing’ $6K a year in cashflow (and will become cash-flow positive within a few years). Currently I think its worth holding onto it for the growth in property price. Having said that, if I used it to pay down the home loan, it would save us almost $1300 a month in mortgage repayments!

Projecting forward, If I could sell it in 4 or 5 years for $1M, there would be about $460K remaining on the investment loan. With $30K in selling fees and $55K of deductions claimed, the cost base would be around $475K for a $525K capital gain, which with the CGT deduction would probably result in around $110K worth of capital gains tax payable – leaving me with about $400K – this number is very close to what the outstanding home loan mortgage would be, so it would definitely be very tempting to sell it and become totally debt free!

I have previously written a full separate article on the IP build if you want to know more about the process – CaptainFI’s residential property development investment.

Captain FI’s Online Business (website portfolio)

I have a small website portfolio of content and affiliate marketing sites. These make money semi-passively from display Advertising through managed ad networks such as Adsense and Mediavine, and affiliate programs such as Amazon Associates and other direct affiliate deals. The overheads are pretty low – just some software subscriptions, and I’m back to doing everything myself again to save on outsourcing costs – previously I used a bunch of virtual assistants and writers, but I’m avoiding this cost at the moment to maximise how much I can pay myself.

On one hand I want to be transparent with my investing and money, but when it comes to the websites I have to maintain privacy about SEO, traffic, contracts and cashflow as it is my business and I don’t really want to invite competitors to the space. So that’s why I don’t really publish my business income or valuations anymore. I’m thankful I have an awesome accountant who helps me through the specifics of business ownership including the nightmare that is BAS lodgements!

Anyway, about a year ago I decided to shift my strategy and just work on a couple of bigger sites rather than trying to spread myself too thin on a massive portfolio. Right now my personal focus is on making as much money with as little effort as possible, so I can spend my time on the farm with my family.

I’ve written a pretty detailed article here about how to make money online, and I recently published a few more articles about how to start making money online for beginners, as well as an ultimate list of blog income reports for anyone wanting a peek into the industry.

I still have a couple for sale if anyone is interested in giving this side hustle a go – price depending on how established and how much time, money and effort I have put into them. They range in age and have various backlink profiles, number of published articles, and traffic. You can check out this article on website operation if you are keen as I’ve listed all the details in there. Feel free to send me an email through the contact form or get in touch on social media if you are interested in getting started.

I originally learned these skills through the eBusiness institute over the past 5 years – I have done a pretty comprehensive review of the eBusiness institute as well as interviewed Matt and Liz Raad about this on the podcast a couple of times where we go over a huge list of frequently asked questions about online business if you want to learn more about this. They also provide some free introductory training for CaptainFI readers.

Check out these podcast episodes for more information

- Podcast | Q and A Session with Matt Raad – Part THREE

- Podcast | Q and A Session with Matt Raad – Part TWO

- Podcast | Q and A Session with Matt Raad – Part ONE

- Captain Fi Podcast | Online Business with Matt Raad

- Podcast | Digital Marketing with Richard

- Podcast | Entrepreneurship with Liz Raad

- Podcast | Digital entrepreneurs Matt and Liz Raad

I have also recently finished the Authority Hackers TASS (The Authority Site System) Course as well as the Making Sense of Affiliate Marketing course which has been a cool way to consolidate the skills I have learnt from the eBusiness Institute, and I have published a few comparison review articles such as Authority Hacker vs Making Sense of Affiliate Marketing and eBusiness Institute vs Authority Hacker which might help you choose between training providers.

Angel Investing

I made an ‘Angel Investment’ of $10,000 into the Fintech platform Pearler in 2021. Pearler was founded in 2018 and launched in 2020. Since then, Pearler has carved out a niche market in the financial independence community as one of the best investing platforms available. Since I made the investment the company has grown heaps, but there isn’t really a secondary market for these shares until Pearler either lists on the ASX or has a corporate buy out – so I can’t really get an updated official valuation.

Cash – Mojo Emergency fund

The cash emergency fund has taken a hit. I currently only have $10,000 cash in my emergency fund – down $50k from last quarter. This is WAY lower than I want, because I have been dipping into it for bills, renovations and projects and to be honest, it was almost ‘burning a hole in my pocket’. I will be aiming to build this back up to around six months expenses or around $30k in the offset account.

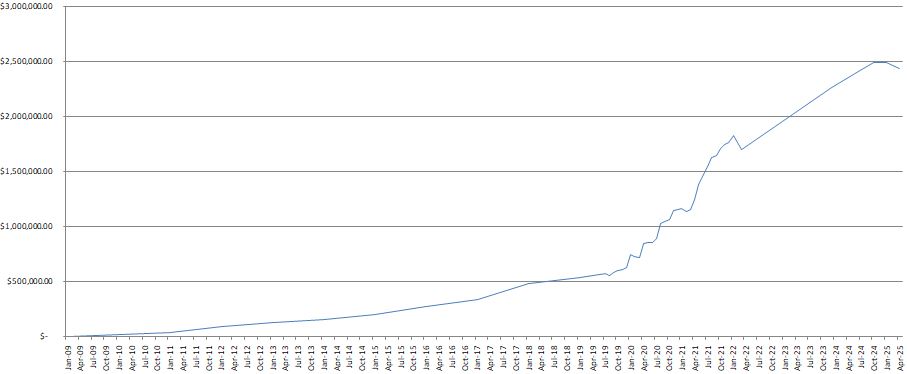

Captain FI’s Net Wealth progression

During my journey to FI I roughly documented my net wealth progression via monthly updates and a graph which was rather crudely constructed in Excel. It demonstrates the ‘somewhat exponential’ journey over my 14 year ‘working’ career. You can access the archives for my Net Worth updates here to see how it’s gone over time. Check out the graph and all the updates below to see how it has gone since the beginning.

When I FI/RE’d, I stopped putting out regular net worth updates and stopped calculating my net worth, and tried to just put out quarterly ‘updates’ but I was pretty slack. I am trying to keep up with quarterly tempo, and recently calculated my net worth after selling shares to buy my dream farm (hence the lack of data points on the graph below lately).

| Date | Net worth | Difference | Saving Rate | Notes | |

| Jan 09 | $5,000.00 | ? | Estimate NW based on historical Super, Bank statements and assets at the time | LINK | |

| Jan 10 | $24,000 | +$19,000 | ? | Estimate NW based on historical Super, Bank statements and assets at the time | LINK |

| Jan 11 | $40,000 | +$16,000 | ? | Estimate NW based on historical Super, Bank statements and assets at the time | LINK |

| Jan 12 | $92,000 | +$50,000 | ? | Estimate NW based on historical Super, Bank statements and assets at the time | LINK |

| Jan 13 | $130,000.00 | +$38,000 | ? | Estimate NWbased on historical Super, Bank statements and assets at the time | LINK |

| Jan 14 | $161,000.00 | +$31,000 | ? | Estimate NW based on historical Super, Bank statements and assets at the time | LINK |

| Jan 15 | $200,000.00 | +$39,000 | ? | Estimate NWbased on historical Super, Bank statements and assets at the time | LINK |

| Jan 16 | $281,000.00 | +$81,000 | ? | Estimate NWbased on historical Super, Bank statements and assets at the time | LINK |

| Jan 17 | $340,000.00 | +$59,000 | ? | Estimate NW based on historical Super, Bank statements and assets at the time | LINK |

| Jan 18 | $482,000.00 | +$142,000 | ? | Estimate NWbased on historical Super, Bank statements and assets at the time | LINK |

| Jan 19 | $542,000.00 | +$60,000 | ? | Estimate NWbased on historical Super, Bank statements and assets at the time | LINK |

| Jul 19 | $578,900.00 | +$36,900 | 84% | Finally began tracking NW this like a proper adult. | |

| Aug 19 | $560,100.00 | -$18,800.00 (-3.2%) | 78% | Share market slight correction, Ok savings. | |

| Sep 19 | $584,744.88 | $24,644.88 | 72% | Share market rebound, savings rate not so good. | LINK |

| Oct 19 | $600,386.00 | $15,641.12 | 84% | Good saving this month. Normal salary, plus allowances, dividends from index funds, tax refund, eBay selling and was working abroad in asia where things are cheap. | LINK |

| Nov 19 | $612,917.21 | $12,531.21 | 76% | Falling short of my savings goal of 80%. Mostly domestic legs this month with higher costs. Also invested in hydroponics. | LINK |

| Dec 19 | $625,350.00 | $12,432.79 | 76% | Good savings of cash (for development) and investment, however higher spending due to Christmas period (Travel and Gifting). | LINK |

| Jan 20 | $865,212.00 | $239,862.00 | 55% | Super settlement was a HUGE boost to NW. $9K growth from stock market. Expensive month lots with lots of unexpected bills – weddings, travel, Booking flights, fines etc. | LINK |

| Feb 20 | $851,802.0 | -$16,592 (-1.9%) | 52% | Large increase in spending on myself this month, still managed to tuck away $5K to put into shares and property. Corona Virus market scare resulted in a correction and gave NW a small negative trend. Time in the market not Timing the market! Became Single again. | LINK |

| Mar 20 | $819, 354.6 | -$31,806.95 (-3.7%) | 80% | Another small step backwards in the NW due to the ‘corona crash’ in full swing. FIRE Portfolio of ETF/LICs down about 15% this month, however due to high savings rate and structure of my superannuation annuity the NW is only down 3.7%. Savings rate good at 80%, higher than usual income (with some slightly higher spending, too). Picking up shares on discount – this is the best outcome for someone in the accumulation phase with good income! | LINK |

| Apr 20 | $847,023 | +$27,668 | 85% | $11,000 in rebound of stock market capital prices alone (up 6%), plus first quarter dividends paid (heavily reduced due to banks withholding dividends). Great savings rate due to COVID-19 lock-down = no spend. Increased entrepreneurial efforts and selling down of physical possessions provided side hustle income. Two standard paychecks from flying activity; domestic day trips only so no allowances. All cash unfortunately had to go into the property development due to contract timing, I am chomping at the bit to buy some more index funds before they go back up in price too much – hence why I am selling most of my toys! | LINK |

| May 20 | $857,859 | +$10,836 | 92% | Some Great sales as I let go of my Super Sport Motorcycle, Some gym gear, expensive flying equipment and a few other various bits and bobs and invested this money. Flying still reduced, but increasing from April. The share market grew as I continued to make my fortnightly investments. I also wrote down the ‘value’ of some of my possessions (liabilities) such as my car, tools and furniture by around $10K to align them to market price (“tell him hes dreaming…!”). | LINK |

| June 20 | $858,650 | +$791 | 90% | Small Net Worth gain as I continue to declutter and simplify my life, despite being off work due to a family emergency. Share market not doing much. | LINK |

| July 20 | $888,218 | +$29,568 | 68% | Majority gain due to share market going back up, low spending due to being on the family farm and at home because of lock down. | LINK |

| Aug 20 | $1,029,293 | +$141,075 | 74% | Became a millionaire. Achieved this massive milestone I set out for myself in Dec 2019. Included unrealised gains in my property development as well as website business. Good savings rate due to not much spending, invested in Aus and total world shares. Investing in my web business. Starting to shift focus away from $$$ and more into looking after my mental health. | LINK |

| Sep 20 | S1,045,486 | +$16,193 | 60% | Officially took time off work for the rest of the year to be close and look after family during major operations. Continued to sell down physical possessions and work on digital business while at home. NW gain mainly due to valuation of websites. | LINK |

| Oct 20 | $1,064,399 | +$18,913 | 80% | Base income (retainer) and leave loading, dividend and websites provided income, as well as raiding my P2P lending capital. Significant bill for property due to design not meeting standards which effectively lowers my equity position, as well as fence being stolen. | LINK |

| Nov 20 | $1,143,433 | +$80,394 | 82% | Big gains came from share market growth (influencing both the Financial Independence share portfolio and Invested superannuation), Business gains (due to increased earnings) and a $30K boost to my annuity thanks to me logging in and checking the fine-print on the accumulation stats. I only invested around $7K. Insane that in one month, I accumulated nearly more net worth than I did in four years from 2009-2012 | LINK |

| Dec 20 | $1,152,920 | + $9,487.32 | 84% | Share market slight drop, Earnings from Business, Contract work, Selling possessions. No share market investments this month (oops! I forgot and money was tight). Invested a lot into the website business this month (way more than planned) and it is still running at a decent loss (plans to turn it cash flow positive in 3 months). | LINK |

| Jan 21 | $1,165,678 | +$12,757 | 79% | Great returns from the share market. Earnings from Business, Dividends, Flying wage, flipping items on consignment. Regular share contribution, investing in micro investing platforms, P2P lending, Investment property and big reinvestment into the business (still running at a loss) | LINK |

| Feb 21 | $1,135,272 | -$30,406 | 76% | Significant write down on property development due to council DA rejection and redesign requiring more money and creating less equity. Offset by small increase to Business value and investments. Simplified my investments and switched over to Pearler. | LINK |

| Mar 21 | $1,155,594 | +$20,322 | 71% | Continued investment into the portfolio as well as growth of investments and business. Gave my notice at work and looking for part time job at home for ‘Barista FI’ | LINK |

| Apr 21 | $1,242,220 | +$86,727 | 74% | Property development back on track | LINK |

| May 21 | $1,379,469 | +$137,248 | 72% | Massive gains in the website portfolio due to revaluation based on recent business income, big growth of superannuation due to annuity increasing (salary increment) and shares generally went up. Crypto went down by about 40% or so. | LINK |

| June 21 | $1,469,989 | +$89,757 | 41% | Quit flying role and moved to Adelaide. Great month for investments, websites producing serious income so accordingly they are valued higher. Spent a lot on furnishing the new apartment and on enjoying some more luxuries. Seeing a therapist to help deal with anxiety from leaving work. | LINK |

| July 21 | $1,543,959 | +$74,732 | N.A. | Set myself up in Adelaide. Did basically nothing for the whole month except spent time with family, relax, sleep and go to doctors appointments. Massive boost to website portfolio AdSense and affiliate incomes, as well as general share market performance. | LINK |

| Aug 21 | $1,624,116 | +$70,156 | N.A. | Relaxed again, focused on mental and physical health, and spending time with family and my partner. Big increases to spending (too afraid to calculate a ‘savings rate’) but also big increases to NW through website portfolio income growth. Finally got the slab poured on the investment property (foundation). | LINK |

| Sep 21 | 1,640,663.85 | +$16,547 | N.A. | Stocks, super etc went down, but business income from websites increased, plus business valuation increased. Property build. got to frame stage, and I also got a dog! Expenses for vet surgery well worth it. Moved into a nicer apartment | LINK |

| Oct 21 | $1,705,907 | +$65,243 | 30% | Big boost from website valuation due to securing new affiliate contracts for recurring income, shares went up nicely. No massive changes to this month. Calculated a savings rate and found myself pretty low due to spending a lot on my garden and going out quite a lot – I don’t think I will calculate this savings rate figure any more. | LINK |

| Nov 21 | $1,739,144.23 | +$33,236 | – | Great month. Relaxing (somewhat). Spent a lot of money doing ‘fun’ things like winery tours, a fine dining experience and self education. Shares moved sideways (well slightly down) but everything else went up. Building got to enclosed stage (roof, walls, windows and doors) but have had some issues with build quality and weather / covid delays. Put a $1000 deposit on the puppy. Stopped tracking Savings Rate. | LINK |

| Dec 21 | $1,764,516 | +25,372 | – | Spent nearly the whole month with family, did some work on the website portfolio. Traffic recovered from google algorithm changes. Invested $10K into Stockspot and Sixpark, $1K into ACDC, $100 into Comsec pocket and $100 into Bamboo, $260 into BTC, $4K into ETFs through pearler. Paid the $3000 balance for the puppy. | LINK |

| Jan 22 | $1,826,633 | +$62,117 | – | Stock market slightly down, Massive boost to website traffic (overall its more than doubled). Invested $10K VTS, 2K VEU through pearler, Paid for Angels cancer surgery, bought more BTC and ETH, bought a parcel of ETHI on commsec pocket. | LINK |

| Feb 22 | $1,757,210.57 | -$69,422.93 | – | Stock market down, Website business revenues down and additional spending on content and staff for business, Additional property development bills, some unexpected expenses, Wrote down the value of some of my personal property (and gave stuff away). | LINK |

| Mar 22 | $1,701,410 | – $55,799 | – | My last ‘regular’ monthly Net wealth update as I give notice at work and finish up my non-flying job. | LINK |

| Q3, 2022 | Over $2M | N.A | – | Six months of Early Retirement in Rest mode! I stopped tracking my net wealth post-FI, my dog passed away, I gave away most of my physical stuff and moved to become my mums live-in carer, met a lovely girl, bought a puppy. Had some incredible months with semi-passive website income but overall neglected the business and regular (stable) revenues decreased. | LINK |

| Q1, 2023 | Over $2M | N.A | – | One year of Early Retirement! A lot of (sad) changes, the passing of my mother and family feuding resulting in temporary homelessness, selling my ‘nursery’ of plants, and traveling overseas for a few months. Finding a new home to settle, couple of domestic trips flying to Tasmania and Queensland a couple of times, and plenty of camping and road trips within SA. Did not work much on the business at all and lost a few more contracts and had to cut staff. | LINK |

| Q2, 2023 | Over $2M | N.A | – | Getting back on top of things with podcasting and blogging more regularly. Focusing on building our ‘rich life’ and deliberately increasing spending in areas such as food, travel and convenience. Did a few interviews and went on a few podcasts. | LINK: CaptainFI Q2, 2023 Net Wealth Update |

| Q3, 2023 | Over $2M | N.A | – | Big focus on health and fitness, fixing diet and losing excess weight. Continue to sell a few websites from portfolio and focus on largest ones. Attended some FIRE events and lots of road trips | LINK: Captain FI’s Q3, 2023 Net Wealth Update |

| December 2023 | $2.26M | N.A | +$260K (21 months since last calculated) | Interim calculation due to share sales prior to purchasing property – no update published | No update published |

| Q2, 2024 | $2,417,426 | 12% – Calculated to see where we sat | +$157,426 (6 months since last calculated) | Mid year 2024 Net Wealth update. Sold shares, crypto and 5 websites, Purchased the farm in Queensland, received $250K inheritance, significant cost in setting up the property. | LINK: Captain FI’s Q2, 2024 Net wealth update |

| Q3, 2024 | $2,485,000.00 | N.A | +$67,574.00 (3 months since last calculated) | Q3 2024 update. Lots of spending on wedding and bought a boat, preparing to debt recycle. Properties saw great paper gains. | LINK: Captain FI’s Q3, 2024 Net wealth update |

| Q1, 2025 | $2,482,000.00 | N.A | -$3,000 | Q1, 2025 update. Write down of business valuation due to reducing income. PPR valuation estimate down, IP up. Slowly paying off debt. Farm life is great! | LINK: Captain FI’s Q1 2025 Net wealth update |

| Q2, 2025 | $ 2,431,487.00 | N.A. | -$ 50,513.00 | Q2, 2025 update. Property prices up, continued to pay down debt, some big spending: household help, fencing, retaining walls and chicken enclosure projects, bought second car, paid for international trip and 3 x domestic trips. | LINK: Captain FI’s Q2 2025 Net wealth update |

| Q3, 2025 | $ 2,398,487.00 | N.A | -$ 33,000.00 | NW down again! third quarter in row… My father passed away. I have been spending time with family on the farm and raising our baby, our mother in law has been staying with us for six months. I have hardly done any (paid) work at all, mostly household / dad / hobby farm stuff. Got our flock of chickens and getting lots of “free” eggs… Made first shares investment for years (DHHF all in one fund). Property prices steady – switched back to monthly repayments to improve cash flow, bought some more upgrades for the farm. Paid the rates, rego (cars, trailers, boat), insurance, tax bills, and some BIG electricity bills ($$$!). Considering selling the investment property to pay down home loan and simplify finances. Probably should work more… |

Captain FI is a Retired Pilot who lives in Adelaide, South Australia. He is passionate about Financial Independence and writes about Personal Finance and his journey to reach FI at 29, allowing him to retire at 30.